- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

K1 Line 20, code Z with amount.

When doing tax review, it keep giving error Code z select Ln20, but no Section 199A income has been entered on Statement A however, it does show same amount input in Line 20. Please help resolve this problem

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

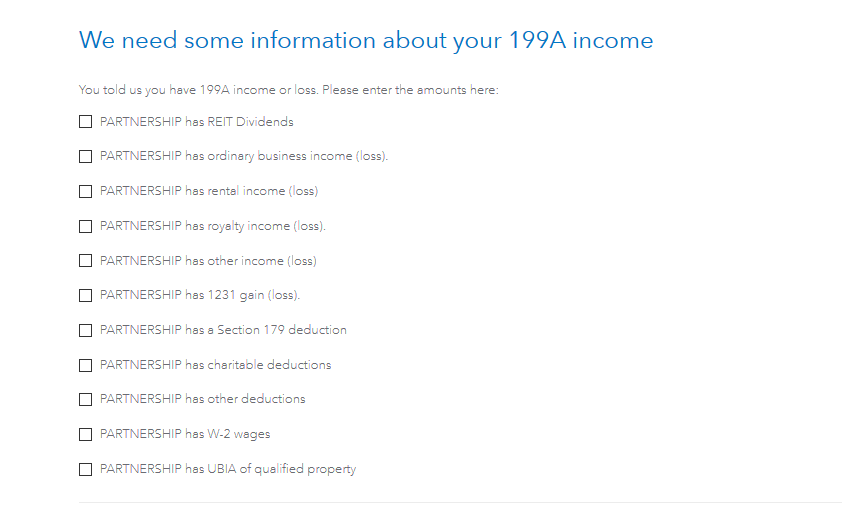

You need to continue and look for the screen below- the entries here will create the Statement A to clear the error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

I"m also having an issue with my K1s. Error says "Box 20 Code Z has been selected but no section 199A income has been entered on Statement A." I did put in numbers. I tried leaving the interview section blank and enter later, but it still says there an error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

Code Z is referencing your qualified business income (QBI). That is normally the income listed on lines 1 to 4 on your K-1 schedule, but it can vary.

If the income is not listed on the face of your k-1 schedule, in box 20, it should be listed on a statement attached to your K-1 schedule. You need to enter the QBI income amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

I cannot find this 199A screen--how do I get to it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

Yay, I found it. You have to enter a dollar amount in the first box to get it to open up a 199A detail screen a few clicks later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

Right you are.

Use the statement you received with the K-1 if applicable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

How do I clear this error? It appears on all of my K-1 reports.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

We need specific information about the error that you are receiving. Here is one solution below. If this does not help, please let us know the exact error that you are receiving so that we can answer your question.

To properly enter your partnership K-1 box 20 code Z amounts into TurboTax, you must Continue through the K-1 interview after you have entered your code Z for box 20. Enter the code Z when you enter the K-1, but you don't need to enter an amount. Continue on, and there is a screen near the end of the interview titled "We need some more information about your 199A income or loss". This screen must be completed in order for your box 20 code Z information to be correctly input into TurboTax.

Note that the instructions are the same if you have a box 17 code V for an S Corp Form 1120S K-1, or a box 14 code I (as in India) for a trust Form 1041 K-1.

Here is a screenshot of that "We need some more information about your 199A income or loss" screen you need:

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Per@avidS127

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

@ThomasM125So I should get the information from PART III Section 1 for ordinary business income and so on (Section 5 Interest Income will be other income, Section 11 Other Income will also be other income).

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

@timoooshy Line 1 may qualify for qualified business income (QBI) as referenced by line 20, code Z, the other income amounts you mention would not be considered QBI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

This is so very frustrating. I've been at this for several hours trying to clear this error code. I've entered information for K-1, Line 20, Code z and then taken it out. Ive gone all the way through the interview just like it says. I just want to file. Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Line 20, code Z with amount, when doing tax review, it keep giving me error

in step-by-step mode after entering 20Z there should be questions about 199A this is what box 20 Z refers to if you're using the desktop version of Turbotax in forms mode there's a Quickzoom link to enter the 199A info in the Qualified Business Income (QBI) Deduction section which Turbotax does use. forms mode is not available in any of the online versions.

probably you entered 20 Z but did not enter the QBI info which creates a mismatch

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

mulleryi

Level 2

mulleryi

Level 2

meenakshimishra

Level 2

tcondon21

Returning Member