- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: K-3 for EPD and ET - how to file it during extension?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-3 for EPD and ET - how to file it during extension?

I received K-3 on both K-1 box 21 foreign taxes paid is empty, do I need box 16 checked?

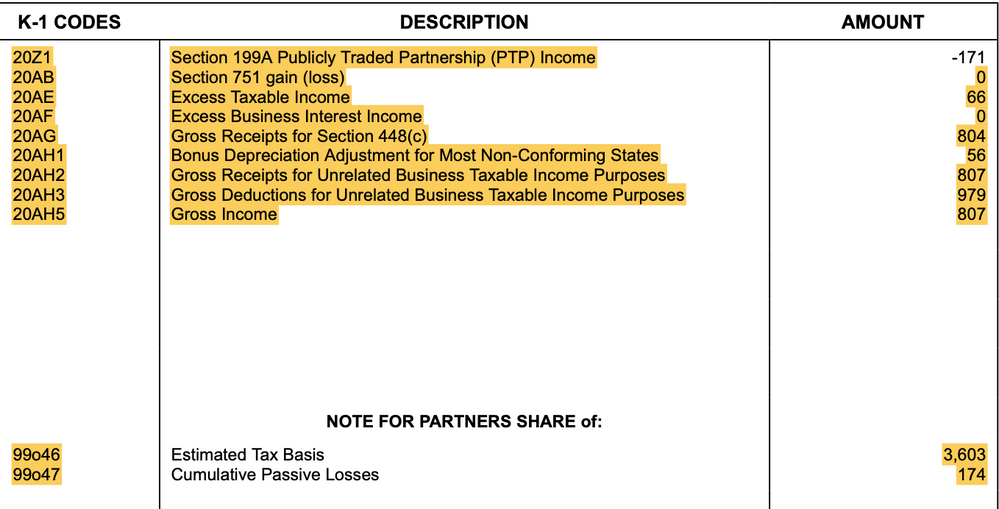

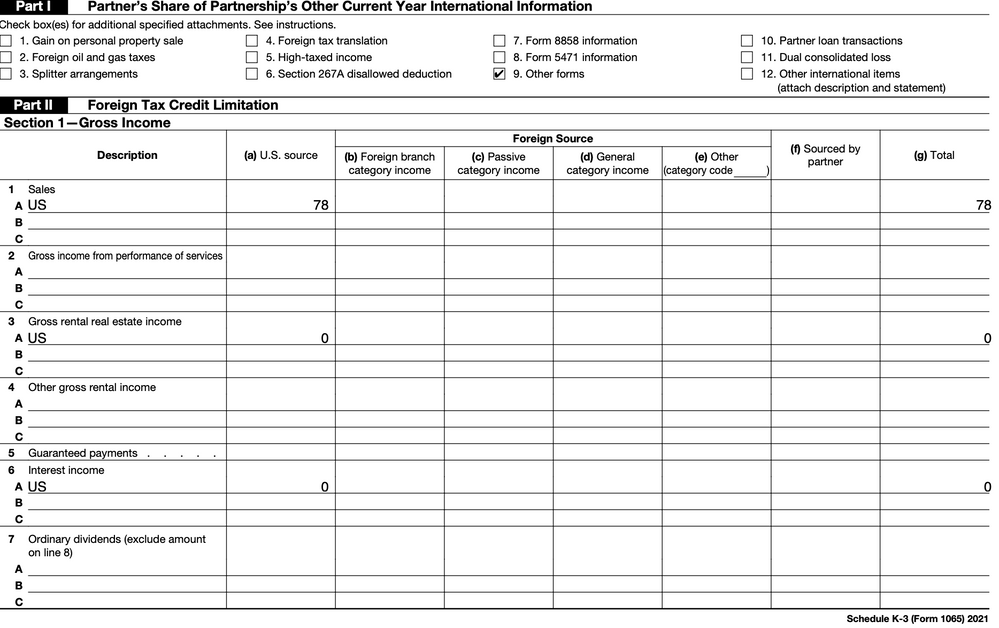

1) For EDP I have this on my K-1

k-3 for EPD

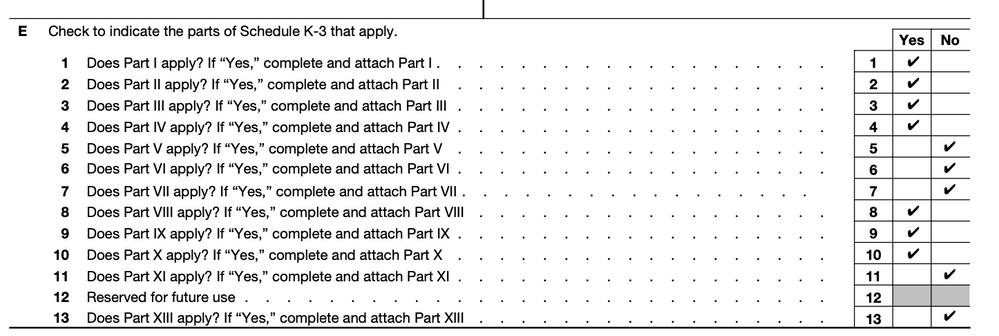

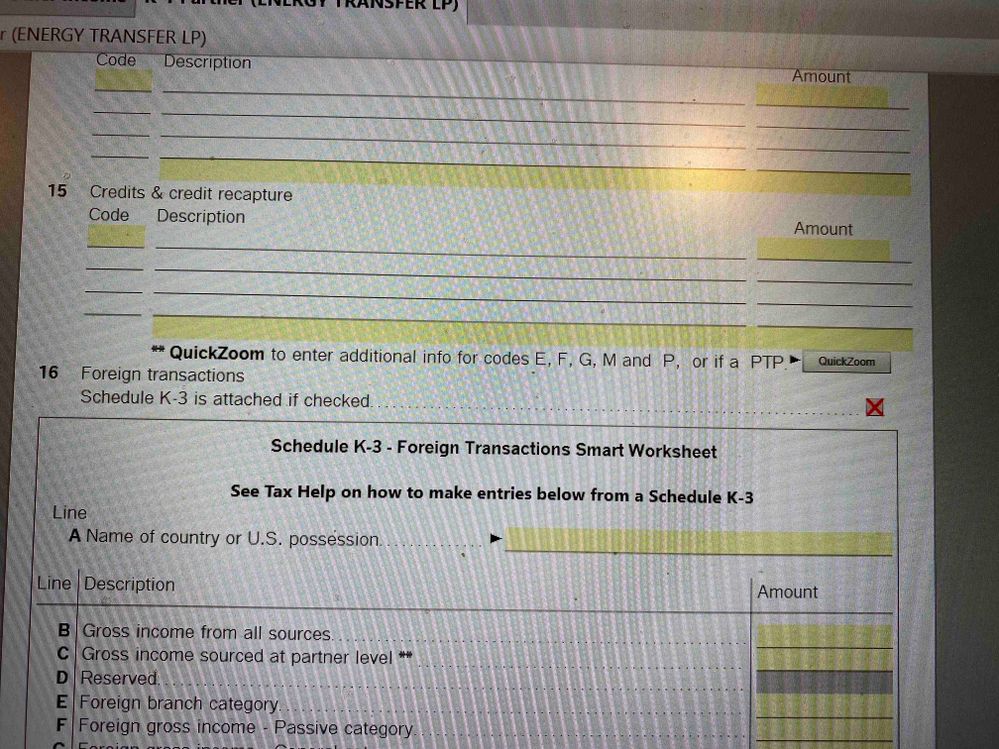

2) for ET

what do I put into turbotax, example below is for ET

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-3 for EPD and ET - how to file it during extension?

@Mike9241 might be able to help with this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-3 for EPD and ET - how to file it during extension?

all of the following assumes you are a US citizen

you mention ET

the K-3 has the following sections checked 1,2,3,4,9,10

PART:

1) other forms but they are not specified

2) all US income so there's nothing to report for form 1116

3) this is for apportionment and allocation of research and experimentation expenses for foreign tax limitation purposes but ET reports no FTC so this section is irrelevant

4) for preparation of form 8993 to determine section 250 deduction. but this only applies to domestic corporations and US individual shareholders of controlled foreign corporations making a section 962 election. IRC 962 election is an election to be taxed as a Corporation. And, most taxpayers would not want to elect to be treated as a corporation and then become double taxed.

9 and 10 ) appear to be for foreign partners.

so to sum it up it would seem the k-3 for ET is totally irrelvant for your US taxes. (by the way, Turbotax can't handle most of this info only section 2 when needed). if other sections apply to a taxpayer they would have to enter the numbers directly on whatever form or schedule they apply to and many of these forms are not covered in any version of Turbotax..

now for EPD

all that supplemental info on the k-1is irrelevant except for

20Z1 - you should get to a question about 199A income/ QBI asyou go through entering the k-1 info.

20AH state depreciation adjustment - if needed you can get a state k-1 From EPD

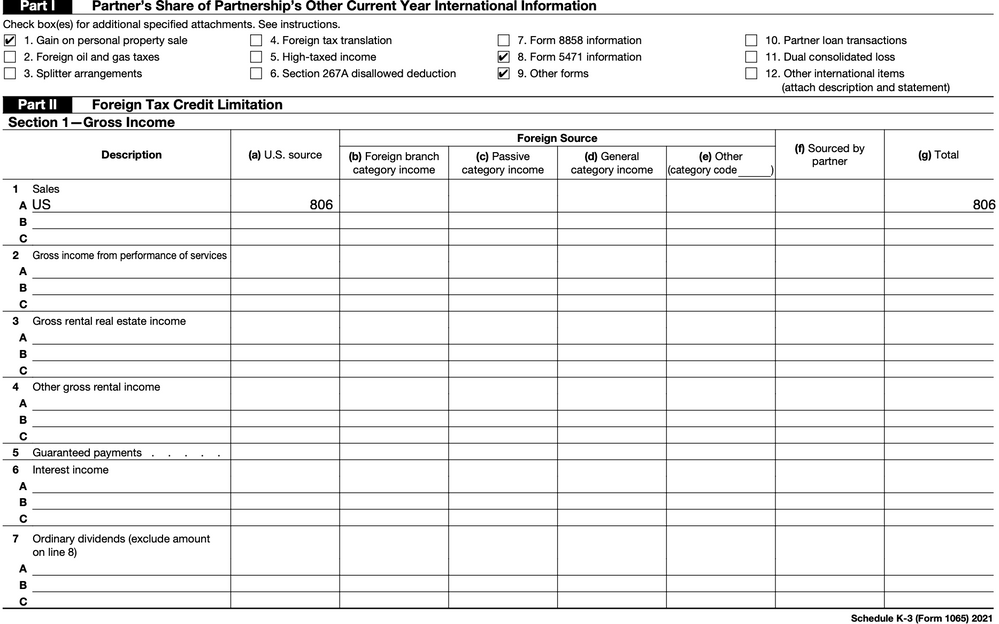

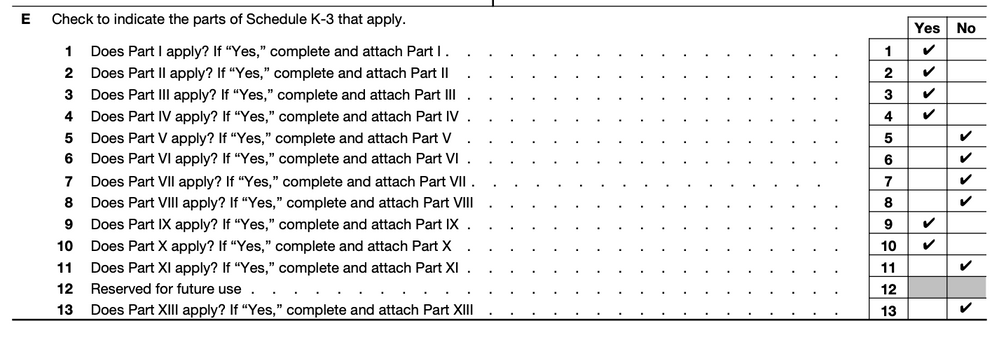

now for K-3

same as for ET with the following differences

Part

1) form 5471 is checked

5471 is for those US individuals who hold a 10% or more stake in a foreign corporation or who are an officer or director of a foreign corporation.

the 5471 info would come from K-2 - you didn't get one, and K-3, part 5 which is not applicable for EPD

😎 (59(a) not handled by Turbotax. this information is relevant for partners completing Form 8991. This Part VIII of Schedules K-2 and K-3 must be completed for corporate partners who are determining if they are subject to the Base Erosion and Anti-Abuse Tax (BEAT),

so here to there's really nothing to enter for the K-3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-3 for EPD and ET - how to file it during extension?

Thank you for your answer, yes this applies to citizen. When you say K-3 is irrelevant to ET or EPD in my case and turbotax cant handle it, what should I fill out in the fields they are asking me? Btw I dont have 10% of stake nor am I director.

Do I understand this correct if I say that if I dont want to claim any tax credit K-3 can be disregarded? Can box 16 be unchecked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-3 for EPD and ET - how to file it during extension?

Is there an option to include K-3 pdf during e-file in turbotax? if yes, how?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

edstowe1

Returning Member

ajw204

New Member

jackkgan

Level 5

Sotokatrina2

New Member

nisa004

New Member