- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: IRS8915F FEMA Disaster Declaration Number rejection

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

Please try the following steps to fix the rejection:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen I selected the blank entry and click "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and continue.

Please let me know if this works for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

This did not work for me - neither did deleting the forms and re-adding them. The COVID-19 is still on line C of the form 8915F.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

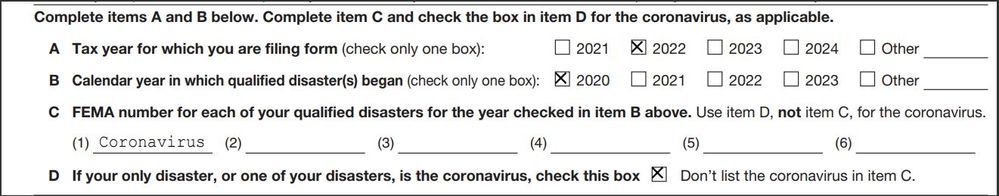

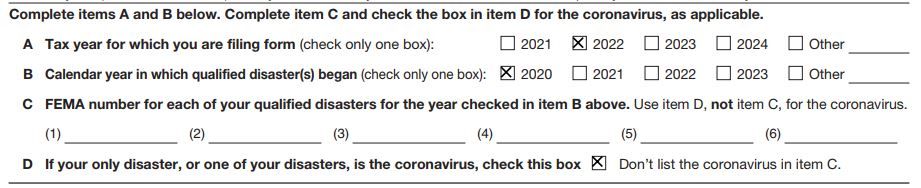

If you using TurboTax Desktop, go to Forms at the upper right and Open Form 8915. Delete Coronavirus on Line C.

before:

after:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

How do I access forms? I'm on the desktop version and there's nowhere to access a specific form and edit it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

If you are using the desktop software, you can click on Forms in the upper right corner. Then find form 8915F in the list. If you are filing a joint return, you will see either ''-T'' or ''-S'' added to the form names, which stands for taxpayer or spouse. Once you delete the word ''coronavirus'' from Line C and check the box on Line D, you can resubmit your tax return for e-filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

No. I am using the website and logging in. Don't tell me I have to buy the software after paying for max benefits! How can I do this from the website application?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

The initial workaround provided in the first comment of this thread did not work for me. I am using the online version and am also getting a rejection when filing. When I go view the 8915-F form, I see this:

I suspect the issue is because TurboTax is inserting "none" for item C and it should be completely blank. How can I correct this using the online version of TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS8915F FEMA Disaster Declaration Number rejection

Another option is to delete both "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information.

For TurboTax Online:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

If you are using TurboTax Desktop then switch to Form mode and select the "8915E wks" and then click delete on the bottom.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mzmudallal

New Member

ryan-j-delahanty

New Member

rockingma21

New Member

rockingma21

New Member

jhvanden

New Member