- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: In Turbotax Business (used for a partnership), how do I account for a 1099-S received for mon...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

Depends on if the whole property is affected or just part. If the whole property is affected reduce the basis....if only a part is affected the gain is the difference between the payment the partnership got and the basis of the part of the property affected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

To enter your 1099-S into TurboTax, follow these instructions:

- While in your TurboTax account,

- Select Search from the top right side of your screen,

- Enter 1099-S,

- Select Jump to 1099-S,

- Follow the on-screen prompts to complete this section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

there's no link to a 1099S....entering 1099S in the box is useless.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

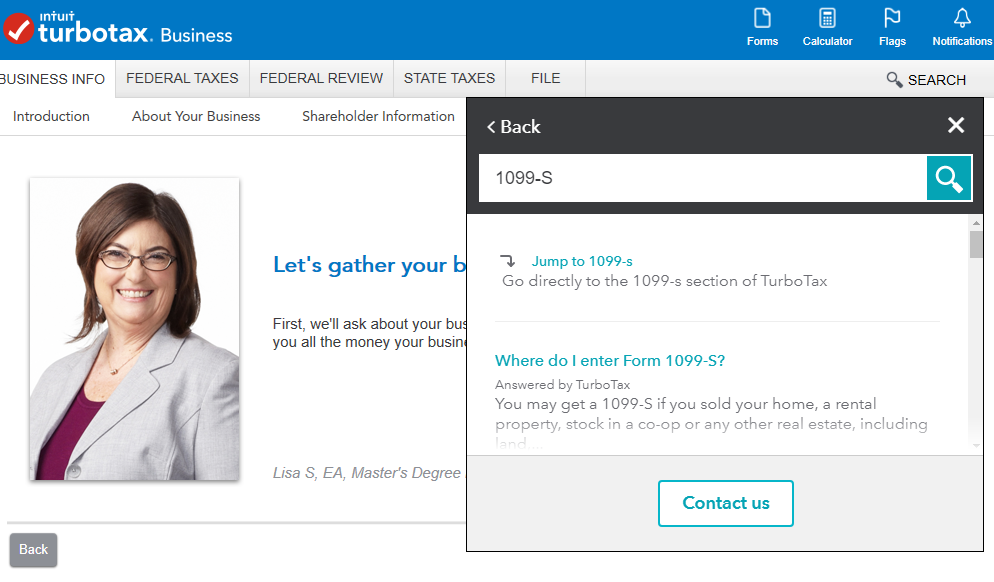

When you enter "1099-S" in the search box, you should see a "jump to" option that will bring up this screen:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

Thanks everyone! I appreciate the help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pivotresidential

New Member

ilenearg

Level 2

Newby1116

Returning Member

VAer

Level 4

RyanK

Level 2