- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

Depends on if the whole property is affected or just part. If the whole property is affected reduce the basis....if only a part is affected the gain is the difference between the payment the partnership got and the basis of the part of the property affected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

To enter your 1099-S into TurboTax, follow these instructions:

- While in your TurboTax account,

- Select Search from the top right side of your screen,

- Enter 1099-S,

- Select Jump to 1099-S,

- Follow the on-screen prompts to complete this section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

there's no link to a 1099S....entering 1099S in the box is useless.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

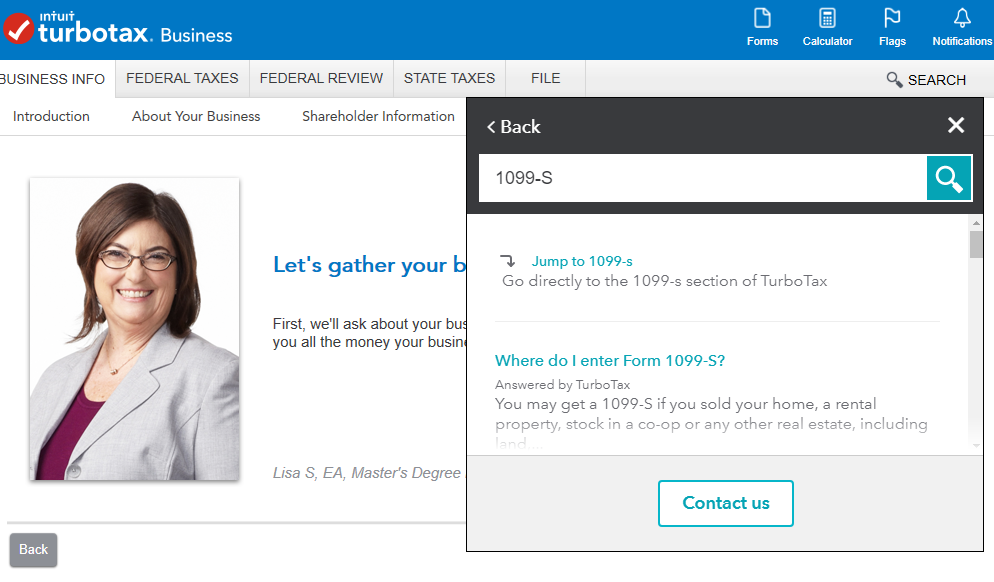

When you enter "1099-S" in the search box, you should see a "jump to" option that will bring up this screen:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Turbotax Business (used for a partnership), how do I account for a 1099-S received for monies paid for a pipeline easement?

Thanks everyone! I appreciate the help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gtbyrd

Level 2

gtbyrd

Level 2

wjschermer

Level 2

Mitzy20

Level 4

wallacee

Level 1