- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Imported 1099B with multiple accounts from same institution, but unable to differentiate them

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

TT automatically imported tax information from Wells Fargo for all of my accounts (four in total). Unfortunately this year TT does not identify which is which, nor provide any means to otherwise identify them. I have not had this problem in previous years.

Forms 1099-DIV and 1099-INT were straightforward and I was able to figure out based on the amounts. Unfortunately for 1099-B all that is shown is Gain or Loss, with a number. There is absolutely no other information, no indication of type (short term/long term/etc) nor is there any identification of where that number came from. Trying to reconcile the provided numbers with the printed forms has proven to be extremely challenging, as there is nothing that appears to correlate.

Further, clicking on 'Review' asks questions about the 1099-B which can't possibly be answered without knowing which account is being reviewed, and still doesn't provide any additional detail.

This is almost useless and I have spent hours trying to correlate which of the four accounts goes with which numbers to no avail. Please do not ask me to delete the imported forms and enter manually, as (a) this defeats the purpose here and (b) there is a lot of information that needs to be entered, which TT already has from the import.

I've been using TT for several years and have never had so much trouble. Am I just missing something obvious, or is there really no way to differentiate 1099-B from multiple accounts from a single institution?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

I know nothing about WF, so all i can do is offer a suggestion that may not work

import the 1099-Bs one account at a time

If WF uses a master account number for all 4 accounts this likely will not work since the import contains the a/c number and the imported data is buried somewhere in the Turbotax file that is inaccessible.

FYI when you import the Turbotax form has an account number

you'll ned to remove previous 1099-B import to avoid doubling up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

Unfortunately I can't import a single account at a time, and never have been able to do so. When I import the any single account, TT previously would give me a message that it found other accounts and would import them at the same time. This year there was no such message, and all of the accounts were imported at the same time with no message.

In the past I could always find detail to be able to differentiate the different accounts for the multiple 1099-B. This year literally there is only a 'Gain' or 'Loss' and a number, four times (one for each account). There is no further detail, no expansion nor popout to see more information. Nothing. If I click on 'Review' I immediately get asked questions but still am not provided with any other detail.

I really feel like I am missing something here and it is really frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

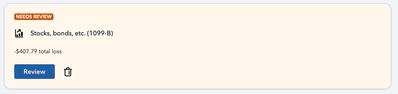

This is what I see in TT (online) for one of the 1099-B, but similar is seen for all four accounts (I see multiple boxes like this). One is inherited, so I can't answer that question when I click on 'Review'. The values presented do not match any combination of what I can find from the summary boxes (A,B,D,E).

What am I missing to be able to identify which account is which? There really is no detail I can find but I can't be the only one that is facing this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

I guess I am the only one that has seen this?

I ended up making a guess on the questions, which was wrong, simply to get to the next page with the rest of the values listed. From that I was able to compare with my printed forms and noted which was which. Unfortunately there was no option for me to change the details related to the questions (such as purchase vs inherited) anywhere I could find, so I cleared my return, cleared browser cache and cookies, restarted the browser, and began the process over from scratch.

Importing my 1099s (B, INT, DIV) does show the account numbers with the value in box 1 at import time. That is of absolutely no help, since box 1 is not referenced later when you actually review those.

I am at a loss to understand how something so basic that should have been so simple was made so difficult on the part of TT. This is not resolved but I took a very time-consuming (wasting) alternative to guess then restart from scratch to get past this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

I tried TT for the first time this year after receiving my completed returns from my tax attorney, to see how TT results compared with my professional preparer, and then use it for next year and use my advisor to review the TT generated returns. I encountered a very similar dealbreaker situation, as I have multiple accounts at one financial institution. I was able to successfully import all of them at once, but my problem was that following import, there were multiple items to review (missing cost basis, etc.) and there was no way to associate any of these review items with one of the specific accounts. I called TT support and first and second level support were both unable to supply a solution. There was no way to move past this verification step, so at that point, I deleted all of my information and will wait until TT provides this very basic capability before trying it again if at all. It's AMAZING to me that after all these years in business, something as basic as maintaining individual account information seems impossible in TT...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

I have this issue with TT 2024. Seemed to work last year for me. How can I import multiple accounts from the same broker and keep them separate?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

Try downloading your account detail to your computer and then upload each account PDF separately. The import will take all accounts as one, but the detail can be uploaded, form by form, for each account. Skip the import and choose upload from my computer instead. @rlaz

How do I fix errors on my Form 1099-B that I imported into TurboTax?

What if I can't import my 1099?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

How do I import from a PDF? This is not one of the options. Only TXF and quicken files are allowed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

In TurboTax Desktop, you are able to upload IRS form 1099-B information from your broker by reporting summary information.

Your brokerage statements should include a summary of your transactions, grouped by sales category, for example, Box A short-term covered or Box D long-term covered.

You will enter the summary info instead of each individual transaction. Follow these steps.

- Select Federal Taxes across the top of the screen.

- Select Wages & Income across the top of the screen.

- Select I'll choose what I work on.

- Scroll down to Investment Income.

- Click to the right of Stocks, Mutual Funds, Bonds, Other.

- At the screen Let’s finish pulling in your investment income, select Add investments.

- At the screen Let Us Enter Your Bank and Brokerage Tax Documents, select Skip Import.

- At the screen OK, let’s start with one investment type, select Stocks, Bonds, Mutual Funds and select Continue.

- At the screen Which bank or brokerage sent you this form, enter the information. Continue.

- Do these sales include any employee stock, enter No.

- Do you have more than three sales, enter Yes.

- Do these sales include any other types of investments, enter No.

- Did you buy every investment listed, enter Yes. Continue.

- On the screen Now, choose how to enter your sales, select Sales section totals. Select Continue.

- On the screen Look for your sales on your 1099-B, select Continue.

- At the screen Now, enter one sales total, enter the information. Continue.

- Select Add another sales total as necessary. Continue.

- You will mail a paper copy of the IRS form 1099-B to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

At Schwab, I can individually select any one of my 4 accounts. I tried to select 1 of the 4, import the data directly from Schwab, and then rename the entries in TT, 1099-INT, 1099-DIV, 1099-B. Now, I repeat the process for another account. Unfortunately, this second import overwrites the first import even though I changed the names of the first entries. How can I rename or otherwise differentiate the import of my different accounts? I would like to avoid manual entry of the information, especially the 1099-B info. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

I think the point is missed here by trying to work around a problem that was introduced this year.

From my return last year, I can see each account 1099-DIV or 1099-INT form with the account number from each institution. This way I can check and recheck if I have imported or entered each account. This year however, even if I tried to import to the named 1099 (last year's tag for each account no/institution), it creates another 1099 entry and there is no way I can tag it. This is the problem that TT has introduced in 2024, in my opinion, unless I am missing how to do it. That's why I came here in the first place!

V

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

Yes. This seems like a bug introduced this year (2024). I hope that TT fixes this issue or the product is not worth the cost?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Imported 1099B with multiple accounts from same institution, but unable to differentiate them

I found a way around it.

Right after importing a form, you can edit the title of the form and add the account number, for example, in the title. To the best of my recollection, this was automatic in the previous years. I don't know if the title is part of the form reported to the IRS, but even in that case an account number should not cause any harm. (IRS already knows everything about us 😉 )

I hope this helps.

V

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

foreigntaxexplorer

Returning Member

jwilda

New Member

mysert

Level 1

jtoler5

New Member

mikethemartian

New Member