- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: If all your shares were held long term, or short term, th...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Hi nextchap,

Does CODI or 'cancellation of debt income" from a MLP in a IRA trigger a tax return to get filed by the custodian? I am aware they will file a tax return for UBTI over $1000, but will CODI also trigger a filing, or is this on the owner of the IRA account. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@GoodShip -- sorry, but I don't know enough about the IRA issues with MLPs. Best to start a new post.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Rizziello66 - Thanks for the explanation, but in trying to follow it, I have some questions.

My situation: In a Bypass Trust (a complex trust for which you use TurboTax Business), I sold all shares of a MLP. Some were short term and some long.

I've taken the K-1 sent to me by the MLP and divided their 2019 Sales Schedule into the short and long. They tell me 94% of my sales were long, which is correct.

1. But when I allocate the "Cumulative Adjustment to Cost (their column #5) into the short and long shares, and then add this to the actual cost (as listed on my 1099B, which is correct), the total cost basis is a negative. TT will not accept a cost less than zero. What do I do about this?

2. You say to "Use the K-1 interview for the 'ordinary gain' portion of the MLP sale, but not the capital gain/loss". If you mean I should go to the K-1 interview under "Income: Business Investment and Estate/Trust Income", there is no place to report a sale of the MLP. This is reported under "Investment Income, Form 1099-B".

3. I tried to go into Form 8949 and override the blank info in column (f) and (g), but TT will not allow me to enter anything in these columns.

In short, I have made up an Excel spreadsheet with all the info for the MLP's K-1 2019 sales schedule but I can't figure out how to get this info into TurboTax.

I will appreciate any help you can provide and would be happy to give you my telephone number if you would like to talk. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@kidoncorner -- I can give a little help, but probably not enough:

1) Cost basis going negative is where I tell folks to get help from a tax preparer who's familiar with partnerships. The issue is that the rules about how to handle suspended losses, and any cash distributions from the MLP, change as soon as your capital account hits 0. And how they change depends on any liabilities (recourse or nonrecourse) allocated to you. And since this may affect your prior year returns (depending on when you went negative), amending may be required. I'd bring in an expert is recommended.

2) I'm not familiar with the way TurboTax business sets up the interview, so can't help.

3) Try to do the over-ride on the 1099-B itself. In Premier/Deluxe, the results of the 1099-Bs flow to the 8949.

Sorry I can't be more help.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

nexchap: have you any advice for handling a PTP-MLP sale situation in which sold half of my interest in the PTP-MLP as a short-term sale in April 2019, and then the PTP was liquidated a few weeks later [May 2019] in a non-taxable transaction which ended the PTP and I got a K-1 which says Final K-1 [received shares in the newco -- same amt of shares as before the liquidation so this seems to be why this latter transaction is not a taxable event]. Are all the passive losses on the K-1 still not deductible this year? but somehow impact Cost Basis of newco shares, which i still am holding? -- thanks for any help you can share!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@dj1016 -- you've got two different, but still common, events:

- You made a partial disposition. So you'd enter that just like this thread discusses. In the TT interview, you'd check off the "Disposed of a portion..." option, which will allow you to enter the sale info. Some of your suspended losses will be released.

- You'll also check the "This partnership ended in 2019" box, but on the next screen, you'd check "Disposition was not via a sale". This will address the non-taxable exchange for shares of newco.

When you've done this, the only loose end will be the suspended losses that need to transfer to newco. Your TT return will still show them on the defunct MLP (oldco), even though its gone. I've found that the easiest way to deal with that is to wait until next year. When you're filling out your 2020 return, and entering the newco K-1, you'll get to the screen where TT asks you about suspended losses and carry-over from 2019. It will grab the 2019 newco info by default, but you can modify that screen to add in the additional suspended losses from oldco. Then you're done. All suspended losses are accounted for.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

nexchap: Many THANKS for the help! one thing i forgot to mention is that the newco is a C-Corp, so would i adjust the basis of those shares somehow using the suspended carry-over losses? or are those carry-overs 'just lost'?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@dj1016 -- That's an important caveat. What I've described will still get you through TT, but next year 'oldco', and its suspended losses, should just be deleted. As for what basis you should give your shares in 'newco', I'd look to them for guidance. There are a number of ways these deals get structured, and I'm not sure what the formula for figuring your basis should be. If 'newco' can't help, then I'd look to an actual tax preparer to give you a defensible position for the basis you choose.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

nexchap: thank you for your help on this -- much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

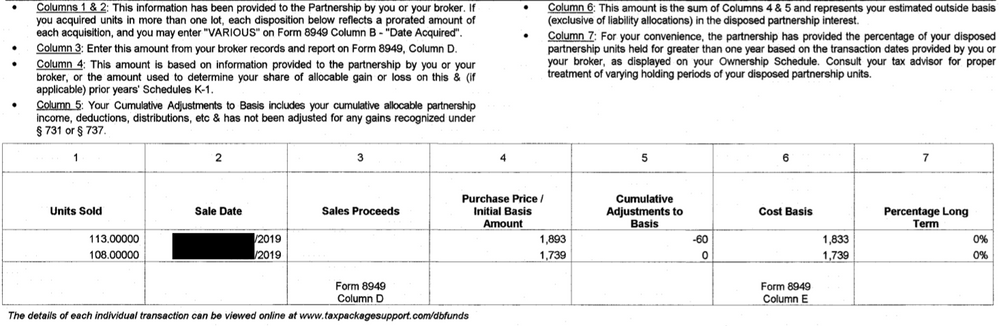

I have number of Sales Schedules that came with PTP ETF K-1s that do not include the Ordinary Gain/Loss (Subject to Recapture as Ordinary Income) or AMT Gain/Loss Adjustment. They only include Purchase Price / Initial Basis Amount, Cumulative Adjustments to Basis, Cost Basis, and Percentage Long Term.

Do I have to calculate the Ordinary Gain/Loss and AMT Gain/Loss Adjustments somehow? If so, how do I go about doing this?

Great post. Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@TheHeurist-- I don't think I can help. If I understand the question, you bought shares in an ETF (exchange traded fund) that is distributing K-1s? And individual sales schedules for the underlying holdings? I haven't run into that before, so don't know if they made the Ordinary Gain disappear somehow, or are simply leaving it up to you. And if they are leaving it up to you, I don't know how you'd calculate it on your own, since that's not generally possible with MLPs. Sorry I can't be more help.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

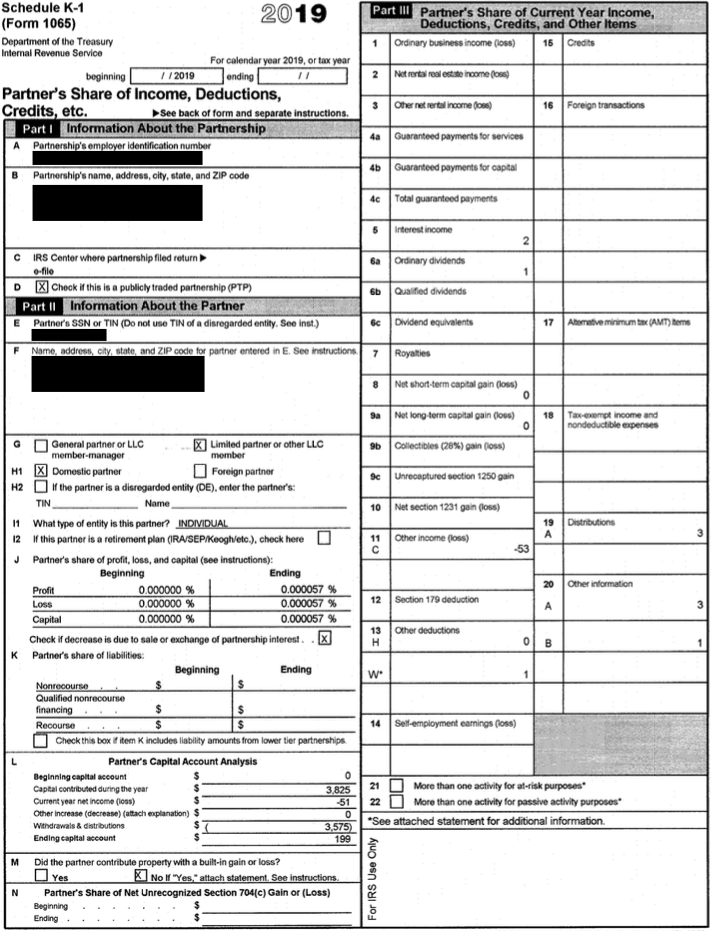

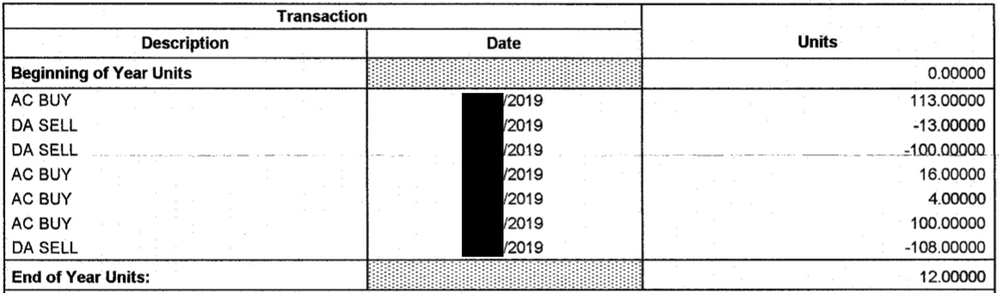

@nexchap Thanks for getting back to me so quickly.

Yes, in addition to K-1s issued by MLPs, I am also dealing with several K-1s issued by commodity related ETFs. The Sales Schedules that came with the MLP K-1s all included columns for Ordinary Gain/Loss (Subject to Recapture as Ordinary Income) and AMT Gain/Loss Adjustment. However, the Sales Schedules for all of the ETF K-1s I'm dealing with did not include these columns. I have posted a redacted example below (K-1, Ownership Schedule, and Sales Schedule).

I feel like I'm missing something simple here.

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@TheHeurist-- In that case, I can hazard a guess. And to be emphasize: its a guess. I haven't dealt with commodity partnerships, so take this as if a stranger 3 bar stools away was just yelling stuff at the TV. You may want to post a separate question to try to get a less guessy answer.

But the reason Ordinary Gain is such a large part of MLP calculations is that they have these massive pipelines that have huge amounts of depreciation, and those depreciation calculations drive both the "Business Income" line (box 1) and the "Ordinary Gain" line on sale. Your commodity ETF likely doesn't appear to have any "Business Income", probably doesn't have any depreciation or inventory, and so probably doesn't have anything going on that would generate Ordinary Gain. So its not showing anything on the Sales Schedule because it is actually $0.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap-- Thank you. I believe you are correct that the Ordinary Gain is actually $0 in this case.

I have another question regarding the sale of this commodity ETF. It appears that my broker did report the cost basis for the first sale (07/31/2019) on the 1099-B I received, i.e. it was classified as a covered security (Box A was check on Form 8949, Part I).

For this sale, the adjustment to basis = -60 and the ordinary gain = 0. Can I still adjust the basis on my 1099-B, or should I enter the adjustment in the K-1 interview somehow (to avoid contradicting what my broker reported)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

I do notice that there is a check box in the 1099-B Sale form called "The cost basis is incorrect or missing on my 1099-B". If I check that and click continue I am prompted with option "I know my cost basis and need to make an adjustment" where I can enter the "Actual cost basis". I am considering entering the the adjusted cost basis here. Let me know what you think. Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

v8899

Returning Member

macey.karr

New Member

scatkins

Level 2

user17550205713

Returning Member