- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Since the CARES Act is still working its way through Congress and has not been signed into law, there are some questions that can't be answered definitively at this time. Please check for updates here TurboTax Corona Virus Update Center and here IRS Corona Virus Update Center. As a point of interest tax returns with only $1 of income are automatically flagged as potential fraud due to ID Theft.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Since the CARES Act is still working its way through Congress and has not been signed into law, there are some questions that can't be answered definitively at this time. Please check for updates here TurboTax Corona Virus Update Center and here IRS Corona Virus Update Center. As a point of interest tax returns with only $1 of income are automatically flagged as potential fraud due to ID Theft.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Just report $1.00 in capital gains on a 1099-DIV form. For pay or write “In order to efile “.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

@LeonardS Can you site a source that the IRS will automatically flag returns with a $1.00 AGI? VITA/Taxaide has been doing that for many years to enable efiling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Filing with $1 capital gains on form 1099-DIV is completely legal. Stay safe and healthy out there everybody, I love you all!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

@TaxingExpert So, just file $1 capital gains on form 1099-DIV and do not claim $1 income and/or $1 as AGI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

According to the IRS, People who typically do not file a tax return will need to file a simple tax return to receive an economic impact payment. Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax. IRS Economic Impact Payment

You do not have to put fake $ on your return. If you truly received no income, then file a zero income return with the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Reporting the $1.00 in capital gain will show up as that amount in income and will allow you to efile. If you want to report zero income you can print your return and mail it. Most programs will not allow you to efile with zero AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Will this option produce a different result?

"... make a $1 entry for Interest Income.

To do this go to:

Income

Interest and Dividend Income

Interest or Dividend Income

Interest Income Form 1099-INT > enter your name in the Payer's Name box and enter $1 in the Interest Income box 1 entry space.

This will have no bearing on the return however it will allow the IRS computer to read an entry on one of the required lines and therefore be able to process the return for you."

Source:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Adding a dollar of interest will have the same result as adding a dollar of capital gain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Out of professional curiosity,, why would VITA/Taxaide or anyone else want to enable someone to "e-file" for no apparent reason? Remember a $1 anywhere, if it is fictitious, is still fictitious. There are no filing requirements due to the Standard Deduction for $1 wage earners. Thus, "enabling someone to be able to e-file", just to e-file doesn't make sense. IMO. [Usually I don't partake in these discussions, but I would really like to know a reason for enabling those who don't need to be enabled.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

If your income is under $12,200 you don't have to file a tax return.

You can always file a tax return, even if you are not required to file a tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

I've been filing my parent's zero-tax-due return for fifteen years.

It comes in handy at times like these.

It also simplifies your NJ homestead rebate application.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

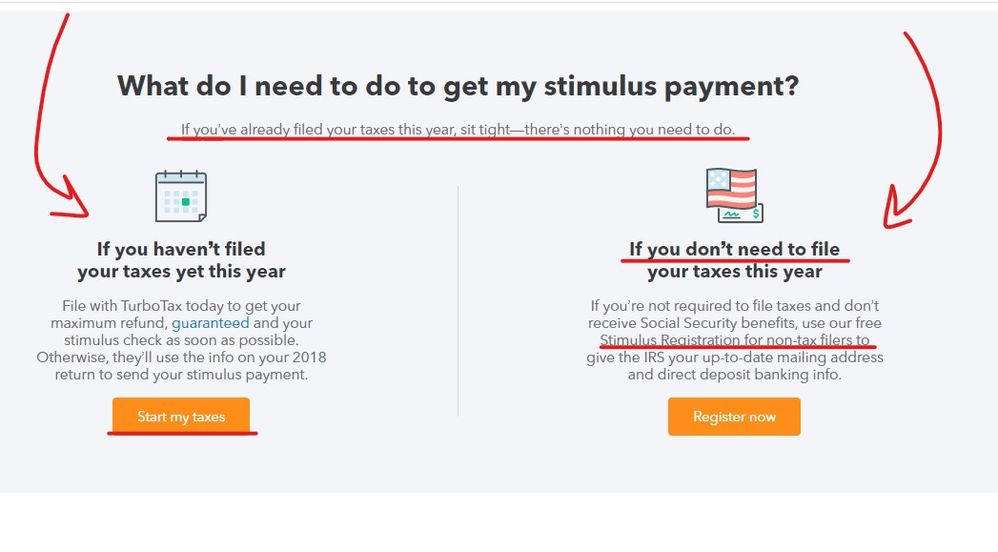

TurboTax has partnered with the IRS to allow taxpayers who DO NOT NEED TO FILE a return to report the base minimum info to get a stimulus check. This system must ONLY be used for those who do not need to file ... those who are required to file a return CAN NOT use this option. Other tax programs are also working on this option to file a "simple" return that only has the taxpayer(s) name(s), address, dependents if any and the DD info if they have it. https://turbotax.intuit.com/stimulus-check/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told I should file a tax return claiming $1 income and $1 agi for 2019 so that I am in the IRS system since I have been unemployed since 2016, how do I do that?

Normally filing a zero income return is not allowed ... but for this stimulus check many need to efile one to get a check now. Also entering DD info on a return where there is no refund is not usually allowed. So the IRS is making an exception ... by using a program set up for this situation you will be allowed to efile with no income and no refund. TT already has a working option ... other companies will follow soon. Even my professional program says one is on the way.

More taxpayers that can efile for the stimulus check will help the IRS immensely. It is estimated that paper checks will still be being issued into September because they are limited in how many paper checks the current antiquated system can handle. https://www.usatoday.com/story/news/politics/2020/04/04/coronavirus-stimulus-outdated-technology-cou...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HNKDZ

Returning Member

kac42

Level 1

bees_knees254

New Member

berniek1

Returning Member

RyanK

Level 2