- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I received a settlement from lawsuit as a class member, but it was confirmed the settlement i...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

Hi,

Why I trying to prepare Federal return, it said" Check This Entry"-"Qualified Business Income Component wkst"-"Aggregation changes stmt must be entered"-"Aggregation changes stmt", What does this mean? And what should I input here?

Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

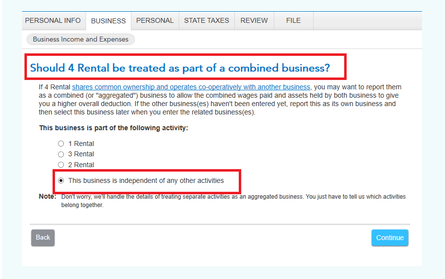

Aggregation refers to an option you would have taken to treat multiple businesses as one for purposes of the qualified business income (QBI) deduction.

To de-select the 'aggregation' option, go back through the interview for each business or rental property you entered. If you see a screen asking if your taxable income might exceed $160,700 (or $321,400 if married filing a joint return), answer Yes (even if that is not the case). Answer No to the specified services trade or business question (unless it applies to your business).

You should then encounter the screen "Should [name] be treated as part of a combined business?". That screen will give you the option to combine the business or rental into another or indicate that the "business" is independent of any other activities.

If you do want to 'aggregate' your businesses, here's what an Aggregation Statement would include:

- A description of each trade or business or property.

- The name and EIN of each entity in which a trade or business or property is operated.

- Information identifying any trade or business that was formed, ceased operations, was acquired, or was disposed of during the taxable year.

- Information identifying any aggregated trade or business or property of an RPE in which the RPE holds an ownership interest.

- Such other information as the Commissioner may require in forms, instructions, or other published guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

Hi,

I already deleted the dividends entry, but when I run check, "Form 8939, Dividends I must be entered", actually I dont need to report dividend, and don't need to show where to report, form and line, schedule and line. How should I fix this issue, thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

You can Delete Form 8938 from your return.

In the left menu pane, choose Tax Tools > Tools, then 'Delete a Form' from the pop-up menu.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

There are a few exceptions to taxation on settlements.

If this was in connection with a personal injury lawsuit (car accident, slip and fall, etc.), it is not reported or taxable, whether lump sum or periodic payments. This isn't the forum to publicly share the reason for your settlement, but anything 1099-reportable would be with the wording of the settlement agreement. Hopefully, you have a copy, and there likely is law firm contact info in it which could expedite an answer.

Otherwise, though, the guidance from others about taxability is correct. And unless you have it in writing that it's not, I'd be wary of not reporting it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

Hi,

After I deleted, can I still add it back, because even I didn't need to add dividend, but I still need to add interest.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

Here's How to Report Interest (whether or not you have a 1099-INT, it is reported the same way).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

TurboTax asks for an EIN Number of the party that paid the settlement. If the payor has not provided that, and no 1099, how do you proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

What income are you reporting that was not reported on a 1099 form? What is the nature of the settlement? Was this a class-action lawsuit?

Some large class-action lawsuits will maintain websites to report their side of the lawsuit. An EIN may be found there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

This was a Class Action Securities Litigation settlement distribution.

TurboTax does not allow e-filing the return without an EIN for the payor. The payor has decided not to provide a 1099 form for this purpose, hence the catch 22.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a settlement from lawsuit as a class member, but it was confirmed the settlement it's not 1099 reportable payment, not W2 reportable payment, should I file that payment?

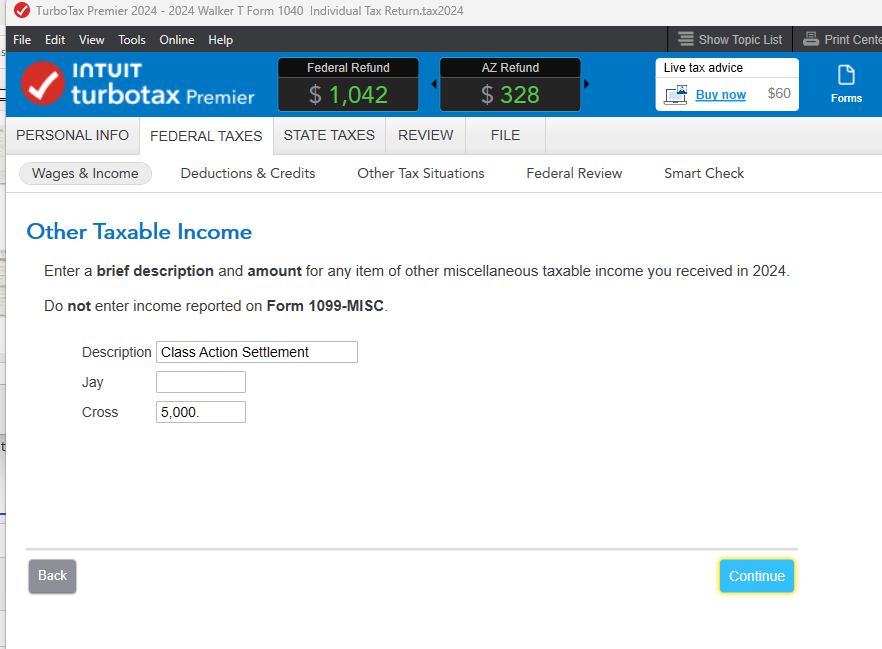

To report income from a Class Action Settlement, go to

On the Income Topics page, scroll all the way down to Miscellaneous Income, 1099-C, 1099-A, Start

On the next page, scroll all the way down to Other Reportable Income, Start

Then you'll be able to enter a Description/Amount.

The income will show on Schedule 1, Line 12.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aowens6972

New Member

Naren_Realtor

New Member

abicom

Returning Member

CGaspar6055

New Member

candycrush88

New Member