- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Aggregation refers to an option you would have taken to treat multiple businesses as one for purposes of the qualified business income (QBI) deduction.

To de-select the 'aggregation' option, go back through the interview for each business or rental property you entered. If you see a screen asking if your taxable income might exceed $160,700 (or $321,400 if married filing a joint return), answer Yes (even if that is not the case). Answer No to the specified services trade or business question (unless it applies to your business).

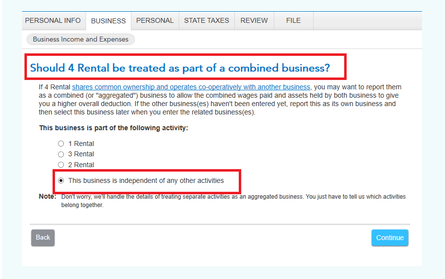

You should then encounter the screen "Should [name] be treated as part of a combined business?". That screen will give you the option to combine the business or rental into another or indicate that the "business" is independent of any other activities.

If you do want to 'aggregate' your businesses, here's what an Aggregation Statement would include:

- A description of each trade or business or property.

- The name and EIN of each entity in which a trade or business or property is operated.

- Information identifying any trade or business that was formed, ceased operations, was acquired, or was disposed of during the taxable year.

- Information identifying any aggregated trade or business or property of an RPE in which the RPE holds an ownership interest.

- Such other information as the Commissioner may require in forms, instructions, or other published guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"