- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I received a 1099-MISC from robinhood for some type of investing activity. The options that t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

It depends on specifically why you received the 1099-MISC from Robinhood. I suggest reporting in the Less Common Income area so that it does not trigger self-employment obligations.

If the broker provided ONLY Form 1099-MISC, and you received it for free:

This can be handled in the Less Common Situations. To enter in TurboTax, follow these steps:

- From the left menu, select Federal

- Wages & Income scroll all the way down to Less Common Income and click Show More

- Select the last listed option for Miscellaneous Income 1099-A, 1099-C, click Start

- Next, select the last listed option Other Reportable Income

- Did you receive any other taxable income, click yes

- Other Taxable Income: Enter your description and the amount and click Continue and Done. Disregard the comment "Do not enter income from Form 1099-MISC here" because this is meant to guide taxpayers reporting typical 1099-MISC income. Your case is less common and this is how you can report it in TurboTax.

If the broker..

- gave you stock

- that you subsequently sold

- but Robinhood reported it to you on Form 1099-MISC and

- if you had basis in it, meaning you paid Robinhood something in exchange for this stock

then follow the link to read what TurboTax Expert DavidS127 advised.

When you receive shares of stock, not cash, then it should be reported as a stock transaction, even though you received Form 1099-MISC.

Secondly, in this scenario, to be in compliance with the IRS and report the Form 1099-MISC you received, you need to report it as "an in and out." Do this:

- Follow Steps 1-6; for the description write: Robinhood Form 1099-MISC as received

- Repeat Steps 1-6 and enter the income amount as a negative

- For the second description write: Robinhood Form 1099-MISC reported on Schedule D

If this is your scenario, the instructions above will...

- get the proceeds to Schedule D where they belong,

- prevent the proceeds from being considered self-employment,

- prevent the proceeds from being double taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

Hey,

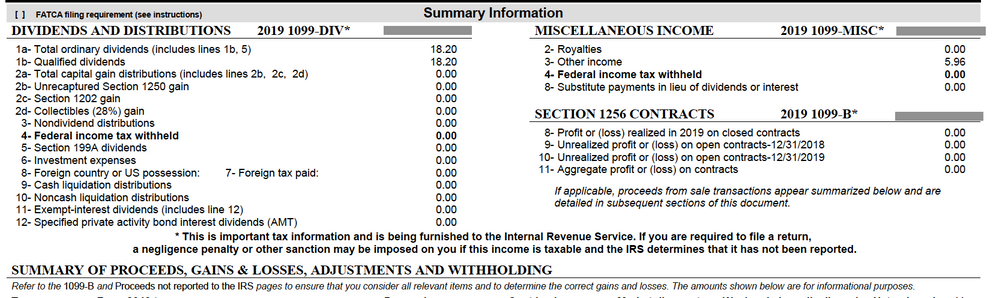

I also received the-MISC from Robinhood for the free stock i received in 2019 but sold it in 2020.

Can i file it under Miscellaneous Income 1099-A, 1099-C.

Or to be in compliance with the IRS do i need to report the Form 1099-MISC i received, report it as an in and out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

Follow these steps if you have a 1099-MISC:

- Under the Federal menu, click on Wages & Income

- Expand the menu for Other Common Income

- Click Start/Revisit next to Form 1099-MISC

- Enter the information as shown on your document

Be sure to indicate that this is NOT related to your main work. Robinhood income is not considered self-employment or a trade or business. You should not be generating a Schedule C. The income should be reported on line 8 of Schedule 1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

Hello,

just quick questions can i sell and buy crypto in robinhood and collect unemployment at the same time is that okey or it's considered as fraud ?

thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

Unemployment has nothing to do with investing income. Investing is not employment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

So when it asks Describe the reason for this 1099-MISC, what should I put? other income from stocks?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

Yes, you can enter Other income from stocks. If you are not sure exactly why this was issued that is a good description of the income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-MISC from robinhood for some type of investing activity. The options that turbotax gives for the income dont apply. what should I do?

Simple answer for this Robinhood 1099-misc situation ... when you joined Robinhood they "gift" you a share of a stock and the cost of the stock is reported as other income which you need to report as other income (Sch 1) but then that amount becomes the cost basis of that stock for when you sell it in the future.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shimib

New Member

alexherrera00

New Member

chaturanan_mishra

New Member

aaronkdean

New Member

webperson04

Level 1