- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

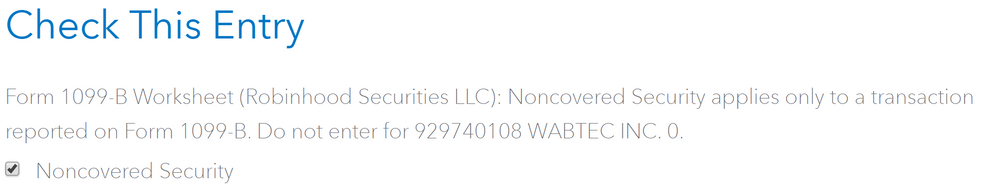

I do not know how to fix this error. I keep getting this message for my federal:

| Form 1099-B Worksheet (Robinhood Securities LLC): Noncovered Security applies only to a transaction reported on Form 1099-B. Do not enter for 247RGT012 DMPI RIGHTS 1. |

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Same issue uploaded form through Robinhood. Have you found a fix? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

If you have any cryptocurrency, it should reported in a different section.

If this is the case, I suggest deleting the Robinhood import and splitting out any portion that is cryptocurrency.

If you had cryptocurrency, click to read more in this short video and article about entering cryptocurrency details.

Delmar had a 1 for 10 reverse stock split mid 2019 which may require a basis adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

same issue here, seems strange that Robinhood (a division of turbo tax) would have this glitch. Still haven't figured out the fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Issue resolved:

Robinhood imports all of the information on your 1099-B, including the information that doesn't get reported to the IRS; information that doesn't get reported such as gains or losses less than a specified amount by the IRS. You can find this info on your PDF with the following statement"This section of your tax information statement provides proceeds transactions that are not reported to the IRS, but may have a tax impact"

basically, the irs has bigger fish to fry and these amounts are neither worth your time or theirs.

You can resolve this error by going into your incomes > stocks > click on the brokerage that held this investment (in our case Robinhood) > click through till you get to the itemized list of investments > delete the ones that are on the list of investments not reported to the IRS.

In my case, I needed to remove my WABTEC investment from TurboTax, since it doesn't actually need to be reported.

Hope this helps someone. I did call turbotax but was told i would need to pay upgrades in order to speak to a CPA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Thanks for the fix. How did you go about deleting WABTEC from your PDF? Or did you do something on the TurboTax website end of things?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Here in community, we do not do anything on our website end of things? We don't have the ability of deleting WABTEC either. These must have disappeared mysteriously.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

You saved me $80. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

just deleted all entries that gave me an error and worked, thanks!!!! (some of them had like 0 shares which was really weird....)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Very helpful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Thank you! This worked for me. I went back to the federal section and found the wages section. Then under the stocks section, I deleted the items based off of the 1099-B sheet, which say they are not reported the IRS. After I deleted the two items I was able to submit my return without any errors.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Thank you. Unfortunately, I didn't see this post and paid for the CPA help. Great help, they quickly found this post. We fixed it like the others here, by editing 'Robinhood Securities LLC', going to the end of the list of trades to find and delete WABTEC, then trying the review again.

The thing is, I don't remember buying WABTEC at all. So, I think this is a problem directly from Robinhood.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Of course they told you to pay. That is what this error is all about. They want more money. Thanks turbotax for stealing our hard earned money!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

Where does it say it’s not reported

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting Check This Entry Form 1099-B Worksheet (Robinhood Securities LLC):

For example, box 12 has a check box if the cost basis is not reported to IRS, so you will enter it in your return so you will correctly report the gain/loss on the transaction.

In the top of each coded section, it will state what type of code is applicable. In that same section, certain codes tell you that certain items are not reported to IRS.

Form 1099-B is available on irs.gov. Generally, most brokerage houses provide a "substitute 1099-B" to their customers. It looks different but still contains all the same information.

For additional information, there is instructions for how to use each box of Form 1099-B on the back of the copies of the IRS Form 1099-B at the following link:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

simstn1

Level 1

wttm2003

New Member

jim-chandler

New Member

sandys17

New Member

jojobeans

New Member