- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed o...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

I used TurboTax Deluxe ONLINE as well, and I received the same message from the IRS. I went to the IRS website and printed out each form related to the Form 8615 for me (2019 Form 8615, 2019 Line 7 Tax Computation Worksheet, and 2019 Qualified Dividends and Capital Gain Tax Worksheet) as well as the instructions for each form. I calculated everything by hand, following the IRS instructions for 2019 from their website. I got the same exact answers as TurboTax. I'm not sure why the IRS is rejecting the return when I get the same thing manually as TurboTax, using the IRS current forms and instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

Do you have Turbo Tax for Mac or Windows? The 3/20 update did NOT fix it for my Mac version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

It may have fixed it for Windows version, but it did not fix it for the Mac version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

If you have TurboTax Online you can clear your cache and delete cookies. Also, try refreshing your browser or try using a different browser.

Here are two articles below that will show you how to clear your cache and delete cookies.

How to clear your cache - Community

How do I delete cookies? - Community

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

Has this now been fixed for the Mac version?

I too am having this problem with my Federal tax form being rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

It appears the Mac version issue has been fixed. I resubmitted for the 3rd time today, 3/23, and without making any changes to file (or cache), my Mac version return was ACCEPTED. Hallelujah!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

Congratulations! Thank you for your patience!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

How can I delete a return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

Did you want to completely clear the return & start over?

You do have the option Clear and Start Over your return. To choose this option:

- Click Tax Tools

- Click Clear & Start Over

- Confirm

While this will require you to redo the return in its entirety, it will also delete any and all forms associated with the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

HI, WHY AM I GETTING THIS REJECTION FROM THE IRS? TURBO TAX DID IT RIGHT. CAN YOU HELP ME?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

My son, a full-time college student during the school year, received the same error 2 times when using the online version of TurboTax (once after the 3/20 update)

I want to make sure we are checking the correct boxes before we do this again.

In his case he had a summer job working a large number of hours, requiring him to file taxes for the 1st time

He has a form 1099-Div (invested money from small inheritance after death of grandparent) with cap gains over the minimum level in the calc sheet

He is still being claimed as a dependent on our (parents) taxes, which have been filed using TurboTax Deluxe and accepted by the IRS.

Question #1 He Did not have the pre TCJA box checked in his prior filings (Is that the reason for the error?)

Question #2 The online worksheet asked for information from our (parents) schedule D (which was not required - No box checked on Qualified Dividends and Capital Gain Tax Worksheet) and from form 4952 (which we do not have either). Note the first time the software asked for info from line 9b (which made no sense) - the second time it asked for info from line 3a (the qualified dividends and capital gain worksheet only has a line 3)

Before I have my son go through the process again to resubmit online, what should he do differently so that it is correct this time?

Note: I tried to call the IRS twice this week and could not even get into the queue to ask a question.

A frustrated parent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

The Form 8615 issue has been fixed.

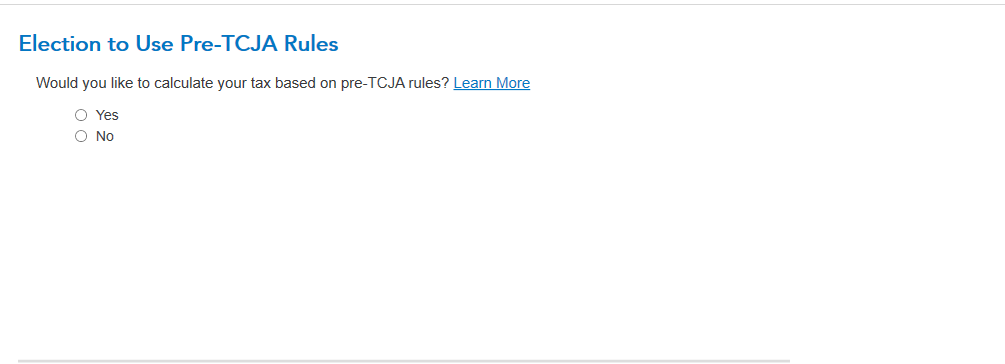

1. If you want to select the Pre-TCJA rate (use the parent's marginal tax rate), you have to check the box for the Pre-TCJA rate on the screen. Make sure to return to double-check to make sure that the "Yes" option remains being checked. See the image below. If the Pre-TCJA box is not checked, you are telling the program to use the Estate and Trust rate which some of the information from the Qualified dividends and Net Capital Gain worksheet are irrelevant in the calculation thus do not show on the forms or worksheets.

2. If you choose the Pre-TCJA rate, which is the parent's rate, you need to complete that information from the parent's return. If parents do not have that information, enter zeros. If you want it to be calculated by the TCJA rate ( Estate and Trust's rate), parent's information would be irrelevant.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I just received federal rejection for : FDI_8615Line7Box_ErrorHold - This return was placed on hold due to calculation issues found in Form 8615. can't find way to fix

Two weeks ago I received the rejection from the IRS for Form 8615 Box 7 error. I have waited until today to refile. Every time I would try to revisit the form on TurboTax, nothing changed. I took the forms from the IRS website and calculated everything by hand, getting the same answer as TurboTax. Today I decided to delete the 1099 Income information regarding the stock sales and then re-enter it in TurboTax. This 1099 stock sale info is what generated the Form 8615 in the first place. The same exact figures appeared on the tax forms with the same amount of tax due. I refiled the return with the IRS, and the IRS has accepted it. I had previously input the 1099 stock info before TurboTax did an update on 3/19/20 to Form 8615. Hope this helps someone else.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jbclerie

New Member

Efreemanfee

New Member

user17601299497

New Member

adeleon672

New Member

gerzro33

New Member