- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The Form 8615 issue has been fixed.

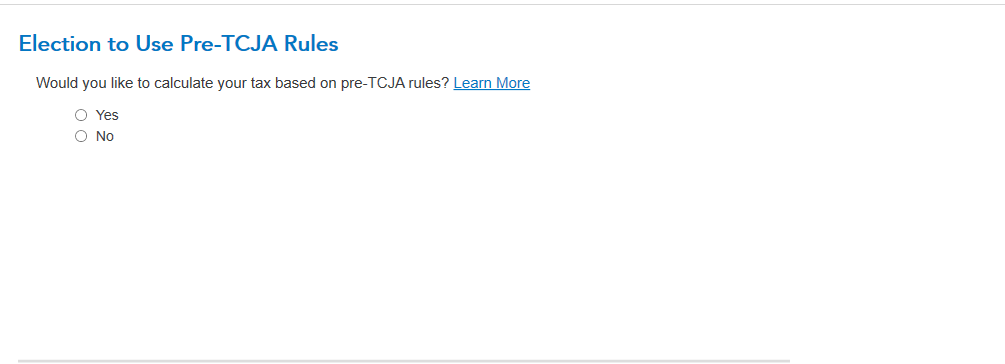

1. If you want to select the Pre-TCJA rate (use the parent's marginal tax rate), you have to check the box for the Pre-TCJA rate on the screen. Make sure to return to double-check to make sure that the "Yes" option remains being checked. See the image below. If the Pre-TCJA box is not checked, you are telling the program to use the Estate and Trust rate which some of the information from the Qualified dividends and Net Capital Gain worksheet are irrelevant in the calculation thus do not show on the forms or worksheets.

2. If you choose the Pre-TCJA rate, which is the parent's rate, you need to complete that information from the parent's return. If parents do not have that information, enter zeros. If you want it to be calculated by the TCJA rate ( Estate and Trust's rate), parent's information would be irrelevant.

**Mark the post that answers your question by clicking on "Mark as Best Answer"