- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I have a 2023 Fed & state overpayment that I applied to 2024. The estimate Tax section said n...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 2023 Fed & state overpayment that I applied to 2024. The estimate Tax section said not to enter it there, but I can't find where to enter the overpayments

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 2023 Fed & state overpayment that I applied to 2024. The estimate Tax section said not to enter it there, but I can't find where to enter the overpayments

If it didn't transfer over from last year then enter a refund from last year that you applied to this year here. BUT first make sure it's not already there. You don't want to apply it twice.

To enter last year's refund you applied to this year.

Federal (Personal for Home & Business)

Deductions and Credits

Then scroll way down to Estimates and Other Taxes Paid

Other Income Taxes - Click the Start or Revisit

Next page scroll down to 2023 Refund Applied to 2024

Click Start or Update by the tax you applied

Then for state, you need to click on the state tab and go through state again for it to update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 2023 Fed & state overpayment that I applied to 2024. The estimate Tax section said not to enter it there, but I can't find where to enter the overpayments

The amount from your 2023 tax refund that you applied to go toward your 2024 tax liability should have transferred to your 2024 return as a credit. It'll show up under Other Income Taxes Paid in the Deductions and Credits Section.

To edit or add an entry that you made for 2023 Refund Applied to 2024 taxes, follow the steps below:

- Open TurboTax

- Select Federal Taxes and then Deductions & Credits

- Select I'll choose what I work on

- Scroll down to Estimates & Other Income Taxes Paid

- Select Start/Update by Other Taxes Paid

- Select Start by 2023 Refund Applied to 2024 federal taxes (or state)

- The next screen you will verify the amount that transferred or enter it.

The payment will appear (or be included if you made other estimated tax payments) on line 26 of your 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 2023 Fed & state overpayment that I applied to 2024. The estimate Tax section said not to enter it there, but I can't find where to enter the overpayments

What if an overpayment is from 2021 state taxes. The state notified me of my overpayment in November 2024, and stated it would be applied to my estimated account for 2024.

Where do I put that credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 2023 Fed & state overpayment that I applied to 2024. The estimate Tax section said not to enter it there, but I can't find where to enter the overpayments

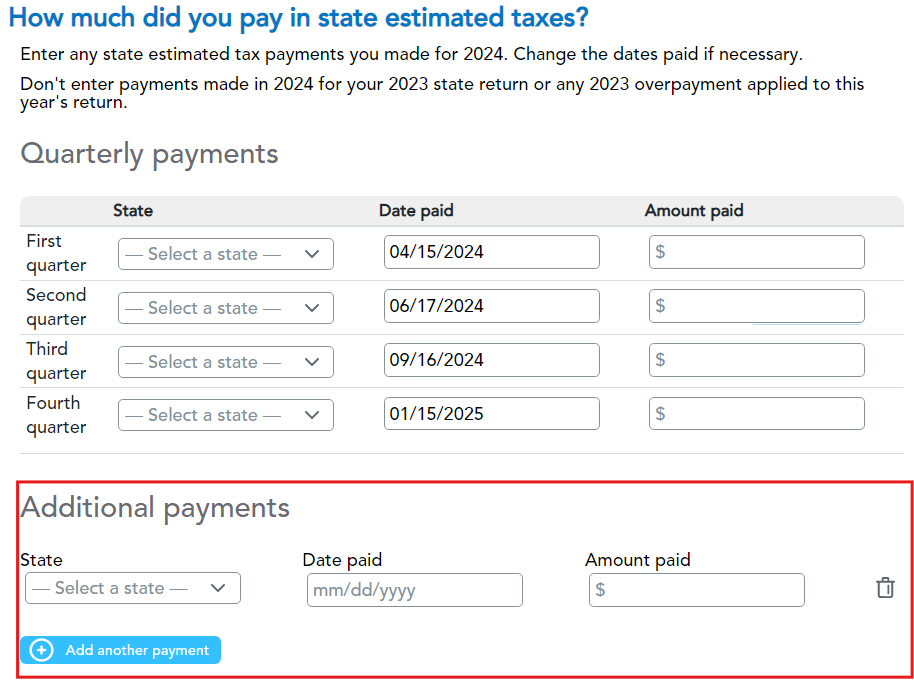

You can enter that amount under the estimated payments as an additional payment.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sjonsson1985

New Member

caryoak

New Member

taxgirlmo

Returning Member

ncrental2012

Level 2

DonNielson

New Member