- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I got a 1099-MISC for my hobby of reviewing products on Amazon. Do I have to put it in small business or can I put this in "uncommon income" as the hobby it is?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099-MISC for my hobby of reviewing products on Amazon. Do I have to put it in small business or can I put this in "uncommon income" as the hobby it is?

The threshold you are referring to all depends on your other income.

I am also a Vine reviewer. I keep an Excel spreadsheet with all my orders, and I have a running year-to-date total at the top of the sheet, so I always know how much I have ordered. Since Amazon is not withholding any taxes, I have to be mindful of our total annual income, and how much tax we have withheld from other income sources.

If you order Vine items throughout the year, it is important to keep track of the ETV. It can add up fast! It could even put you into a higher tax bracket.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099-MISC for my hobby of reviewing products on Amazon. Do I have to put it in small business or can I put this in "uncommon income" as the hobby it is?

Yes, you can enter the 1099-MISC in "Uncommon income." Here are the steps. (The last screen says do not enter 1099-MISC, but ignore that.)

- Open TurboTax.

- "Pick up where I left off."

- Federal > Wages & Income > " Less Common Income" > Miscellaneous Income, 1099-A 1099-C > Start or Revisit.

- "Other reportable income" > Revisit.

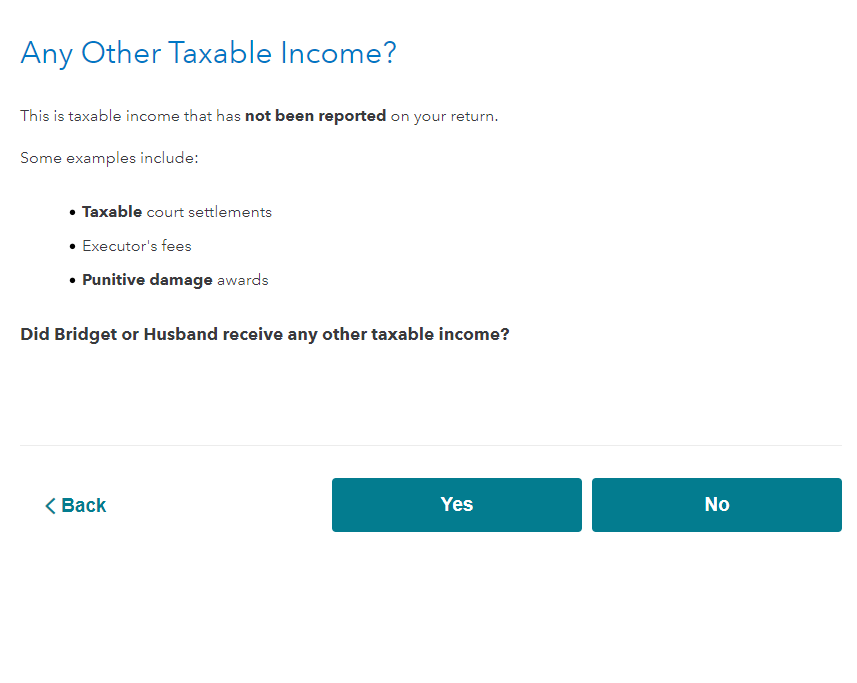

- On the screen below, select "Yes."

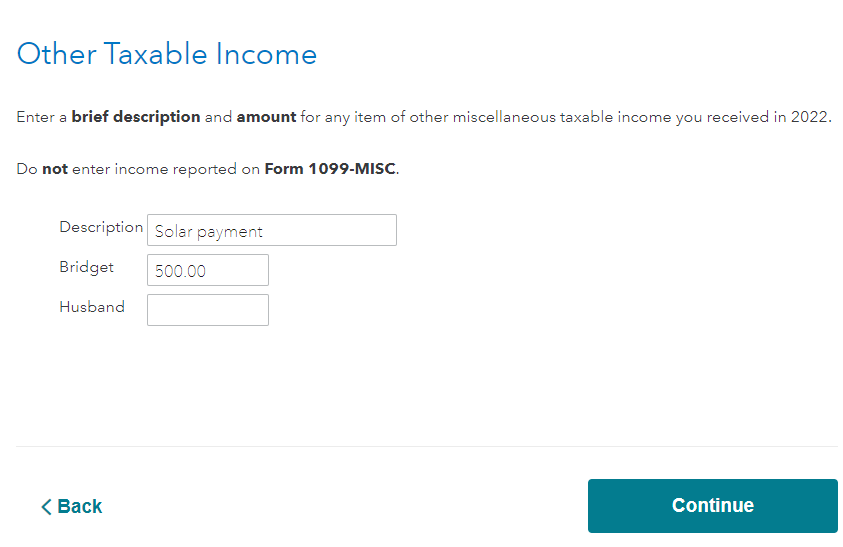

6. On the screen below, enter the description and amount.

7. Continue > Done.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099-MISC for my hobby of reviewing products on Amazon. Do I have to put it in small business or can I put this in "uncommon income" as the hobby it is?

So the total value of items received for review is considered income?

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

roxy420girl83

New Member

user17627469163

Level 1

fastboymazen

New Member

Click

Level 5

petepenn

New Member