- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

There is no such thing as a tax return filed as an extension. You file the 2020 completed tax return and verify that the payment made with the extension request is included on your 2020 federal tax return, Form 1040.

If you used the TurboTax Easy Extension to electronically file the extension request, Form 4868, and make the tax payment with the request, the payment should already entered on your tax return. Provided you used the same user ID for the 2020 online tax return as was used for the Easy Extension. You can check to see if the amount is on your tax return by clicking on Tax Tools on the left side of the screen. Then click on Tools. Click on View Tax Summary. Then click on Preview my 1040.

The federal extension payment will be shown on Schedule 3 Line 9. The amount from Schedule 3 Part II Line 13 flows to Form 1040 Line 31

To enter, change or delete a payment made with an extension request (Federal, State, Local) -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Deductions and Credits

- Click on I'll choose what I work on (if shown)

- Scroll down to Estimates and Other Taxes Paid

- On Income Taxes Paid, click on the start or update button

On the next screen select the type of extension payment made and click on the start or update button

Or enter federal extension payment in the Search box located in the upper right of the program screen. Click on Jump to federal extension payment

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled "Transmit my returns now".

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

Thank so much for the information. I did not use the TurboTax Easy Extension. Ugh. I completed my return on TurboTax. Used the tax due figures and manually completed a form 4868 and sent the taxes due. I had to wait for a K1 which I now have and have entered in the same return as "Amended Return". It decreased my tax due. Now I'm not sure what to do. Do I file an amended return? Thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

@tom163 wrote:

Thank so much for the information. I did not use the TurboTax Easy Extension. Ugh. I completed my return on TurboTax. Used the tax due figures and manually completed a form 4868 and sent the taxes due. I had to wait for a K1 which I now have and have entered in the same return as "Amended Return". It decreased my tax due. Now I'm not sure what to do. Do I file an amended return? Thanks for the help!

Did you actually file the 2020 tax return or not?

If you did not file the 2020 tax return then you do NOT amend the return. You would only need to add the information form the Schedule K-1 you received to the tax return go through the Review procedure and then complete the File section to either e-file or print and mail the tax return,

If you started to amend the 2020 tax return and it was never filed, then click on Cancel Amend on the left side of the online program screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

The 4868 extension is not your tax return. The payment just goes to your final tax due or you can get a refund. You probably need to enter the extension payment into your real 1040 tax return to get credit for it.

If your extension payment did not automatically show up on 1040 you need to enter it. So make sure it's not already there before you enter it!

For 2020 Federal Extension payments should be on schedule 3 line 9. And go to 1040 line 31.

You can type estimates paid in the search box at the top of your return and click Find and it will give you a link to Jump To the screen where you enter Extension Payments.

To enter the amount you paid with an extension (including state extension) go to

Federal Taxes (or Personal for desktop H&B version)

Deductions and Credits

Then scroll way down to Estimates and Other Taxes Paid

Other Income Taxes - Click the Start or Update button

Next page second section Payments with Extension

Either Visit All or Click Start or Update by the extension you paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

I know it sounds dumb, but I actually don't remember if I "filed". I've got a medical condition from a previous stroke that screws with my memory. My notes don't tell me if I "filed". My notes say I paid the federal and state taxes due along with form 4868 which I derived from completing the TurboTax return. Based on this fact, I don't believe I have filed my return yet. Thanks for your patience, I really appreciate it. Obviously, I will take better notes next year! Again, right now, I'm not sure what to do. I'm presuming I file the return with the correct K1 info (which I've done) and update the taxes paid to reflect the amount I paid with form 4868. Right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

@tom163 wrote:

I know it sounds dumb, but I actually don't remember if I "filed". I've got a medical condition from a previous stroke that screws with my memory. My notes don't tell me if I "filed". My notes say I paid the federal and state taxes due along with form 4868 which I derived from completing the TurboTax return. Based on this fact, I don't believe I have filed my return yet. Thanks for your patience, I really appreciate it. Obviously, I will take better notes next year! Again, right now, I'm not sure what to do. I'm presuming I file the return with the correct K1 info (which I've done) and update the taxes paid to reflect the amount I paid with form 4868. Right?

Correct make sure the amount paid with the extension is entered on your tax return. Once everything has been entered then go through Review and then File.

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled "Transmit my returns now".

If you have already e-filed this 2020 tax return using TurboTax there will be a rejection message that a return has already been filed.

If you have Not already filed this 2020 tax return then you will get a message acknowledging the transmission of the tax return.

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

Thank you for taking the time to deal with this rookie! I really appreciate it. I understand your directions. Take care.

Tom L.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

You can check if you efiled your return here,

https://turbotax.intuit.com/tax-tools/efile-status-lookup

When you efile you get back 2 emails. The first email only confirms the transmission. The second email says if the IRS (or state) Accepted or Rejected your efile. Check your spam or Junk folder.

When you log into your account you should also see the status and if it was Accepted or Rejected, Started, Printed, Ready to Mail, etc. What does it say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

It says "Ready to Mail".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

@tom163 wrote:

It says "Ready to Mail".

Then the 2020 tax return was never e-filed. If you did not print, sign, date and mail the tax return to the IRS then the return has not been filed at all.

See this TurboTax support FAQ for changing from mail to e-file - https://ttlc.intuit.com/community/e-file/help/how-do-i-change-from-mail-to-e-file-in-turbotax-online...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

Thanks for this info. I am using the online version - TurboTax Premier. I cannot access the return to change it except by using the "amend" feature. Is that the only way to get the correct information entered and to file? (Sorry for the disjointed communication. I saw your message late. I was working with another person who was trying to help me.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

@tom163 wrote:

Thanks for this info. I am using the online version - TurboTax Premier. I cannot access the return to change it except by using the "amend" feature. Is that the only way to get the correct information entered and to file? (Sorry for the disjointed communication. I saw your message late. I was working with another person who was trying to help me.)

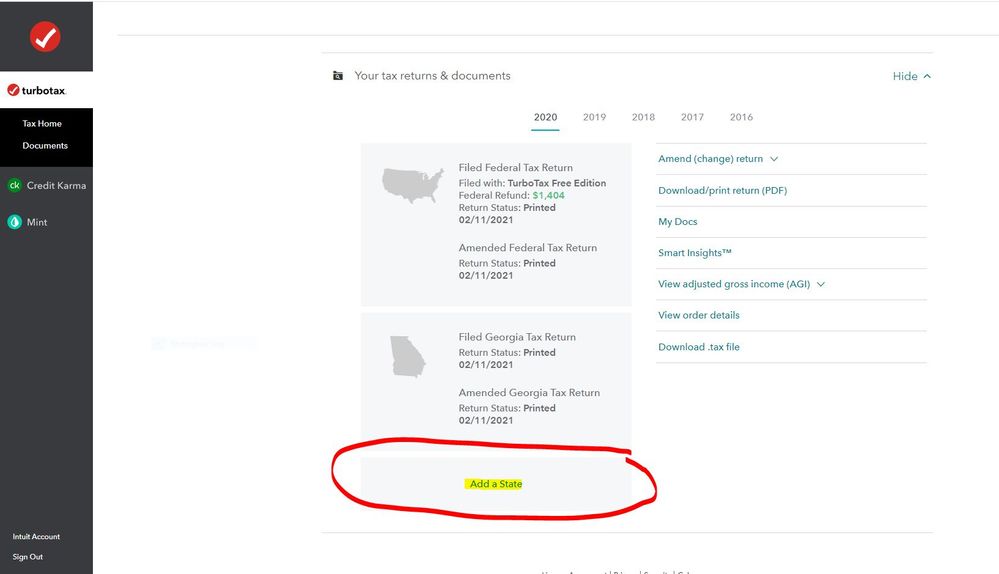

You click on Add a State to get back to the 2020 tax return without needing to amend. Do you see the Add a State link on the Tax Home webpage as shown in this screenshot?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

I did that. My tax payment made with the extension is showing there. I don't see how to get to the federal return to verify the extension payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed an extension May 17, 2021. Paid the taxes due. I used TurboTax to determine my taxes due. How do I file my return for 10/15/21 deadline?

@tom163 wrote:

I did that. My tax payment made with the extension is showing there. I don't see how to get to the federal return to verify the extension payment.

If you clicked on Add a State, that takes you back to your federal tax return where you can verify your extension payment is included on the federal return as I described in a previous message.

Once you know the payment is on the return, click on Review at the top of the online program screen. When finished with Review the program will take you to the File section. Complete the File section to e-file your tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

katrivedi02

Returning Member

kinjals6592

New Member

sales25

New Member

steelbrebar

New Member

bdsenterprises55

New Member