- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software (Home and Business)

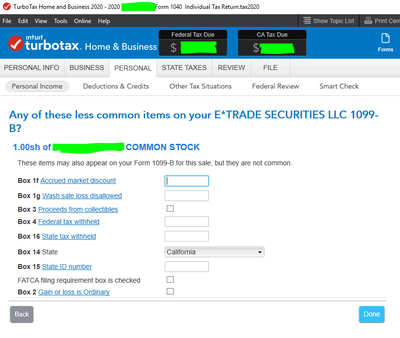

I don't see "Corrected Cost Basis" box while adding extra info to the stock proceedings imported from 1099-B. Using this box is the suggested way of entering adjusted cost basis on other posts like this:

However, I don't see all the boxes mentioned in that post on my desktop SW, instead this is what I see:

I tried updating software but nothing is fixed. Could anyone suggest to help with reporting adjusted cost basis another way or fixing this software issue? Thanks a lot in advance

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software (Home and Business)

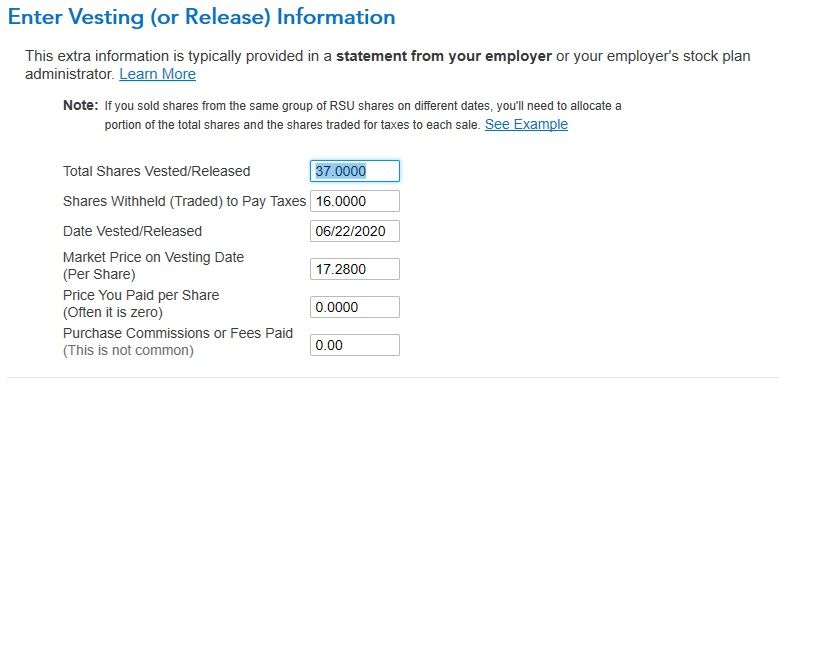

The adjustment screen is a few screens past that. Click on Done, and then you will see "Was this a sale of employee stock?" Since it was RSUs, if they value was properly reported on your W-2 when issued, and you know the correct stock basis, you can answer no, and on the next screen you can indicate that "The cost basis on my statement is incorrect". Checking that will cause the program to reveal a "Corrected cost basis" box where you can enter your correct stock basis. (See screenshot below.) Or you can indicate it's employee stock and the program will walk you through the entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software (Home and Business)

Thanks a lot @DavidD66, I can see that box when I select "No" for "Was this a sale of employee stock?". But wouldn't that be a wrong statement while those RSUs are acquired through employee stock program?

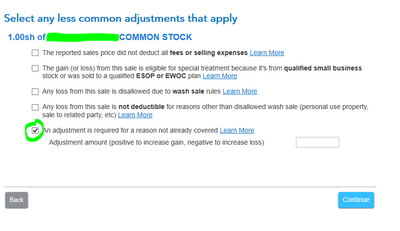

I just noticed that when I select "Yes", there is still an option to correct cost basis at the end as below, would that be a more proper way of doing it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software (Home and Business)

Yes, technically it would be an incorrect statement to say it wasn't employer stock, but there is no penalty for making an incorrect statement to TurboTax in order to skip a lot of unnecessary questions and entries. You can do it either way, the result will be the same.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software (Home and Business)

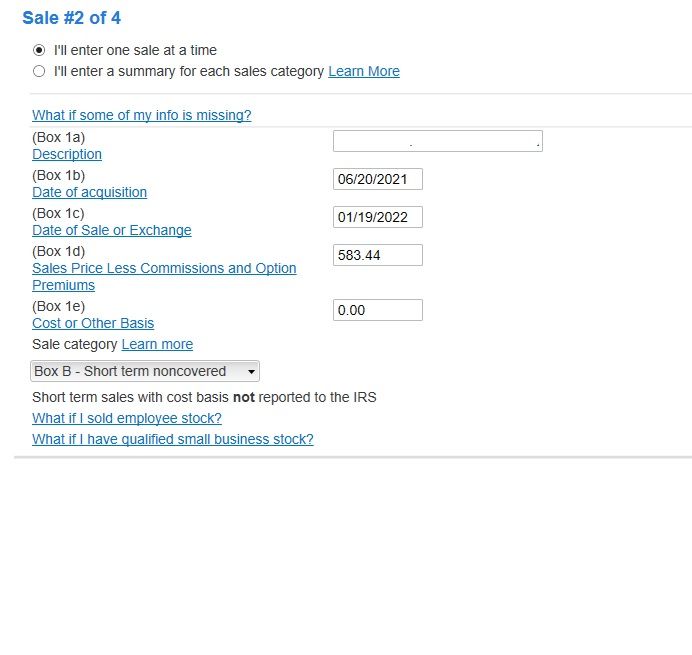

This adjustment cost basis is very confusing.

Shares Sold: 22

Total Proceeds: 583.44

Adjust Cost Basis and Adjustment Amount (ordinary Income): $416.02

I entered the following:

When I checked the box "An adjustment is required for a reason already covered and enter $416.02. The amount I owe increased from $104 to $253. Do I have to check this box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software (Home and Business)

You do need to check the box so your investment sale income is properly reported. Your 1099-B form indicates that your cost basis is $0 whereas it should be $416.12. If you leave it as $0, more of your income is being treated as capital gain income rather than ordinary income, so the tax is lower. But if the actual cost basis is $416.12, you need to report it as such on your tax return. @skylinegtr2022

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Corrected Cost Basis" box while reporting RSU sales on TT 2020 Desktop Software (Home and Business)

@ThomasM125 Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jamesfalk

New Member

altheaf

Level 1

athanplace

New Member

jrlm59

New Member

acnorwood

New Member