- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turb...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

Hi Everyone,

This is a dumb question or I'm totally blinded. I did not receive a 1099-NEC from my employer for a 4 months contract job. I kept all my payment invoices. How can I file self-employed income in turbo tax? I don't see any the option to report the income. Maybe, I'm blind. Thank you in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

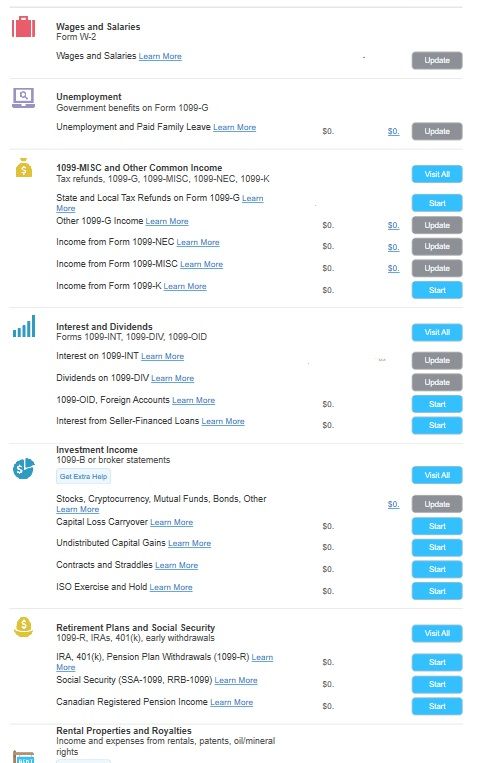

When you enter your income in TurboTax, in the Wages and Income section, you will see an option to enter self-employment income. Choose that option and later you will see an option to enter income not reported on a Form 1099-NEC:

You can enter any expenses that you had that are ordinary and necessary to generate the income that you earned.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

Thank you so much! @ThomasM125

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

And Actually I would just enter your total income as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099Misc or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

@VolvoGirl Thank you! I'm currently using TurboTax Premier, but I'm having trouble finding the self-employment option. I only see the option for Form W2. I don't see anything like @ThomasM125 screenshot. I assumed the Premier is different. I worked as an independent contractor for four months before transitioning to full-time employment, and I left the company last month. It seems like the self-employment option might be hidden somewhere. I cannot find the self-employment section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

I have the Home & Business version so the lower versions are different and I don't know them very well. What's below Rental Properties? Isn't there Business Items?

You can just type Schedule C into the search bar at the top of your return and it should give you a JUMP TO link to go directly to it.

Or try going to Federal

Wages and Income,

Then scroll way down to Business Items

Business Income and Expenses - Click the Start or Update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

Oh nobody mentioned it but self employment is Business Income.

A 1099NEC is for self employment income. Yes you are the owner of your own self employment business. You are in business for yourself. Use your own info. The people or company that pays you is your customer or client. You need to fill out schedule C for self employment business income. You are considered to have your own business for it. YOU are the business.

To report your self employment income you will fill out schedule C in your personal 1040 tax return and pay SE self employment Tax. Here's a Schedule C https://www.irs.gov/pub/irs-pdf/f1040sc.pdf

And you need to pay self employment tax on it. Self Employment tax (Scheduled SE) is automatically generated if a person has $400 or more of net profit from self-employment. You pay 15.3% SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. So you get social security credit for it when you retire.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

Open form Schedule C and you should be able to report the Income and expenses here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get a 1099-nec from the employer for a contract job. How to I fill my income in turbo tax

@plettieri @VolvoGirl Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

balld386

New Member

Svoboda

New Member

Alex012

Level 1

lee31evans

New Member

jon higuchi

New Member