- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I am working on my schedule f, specifically my listing of assets. I purchased a used tractor ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my schedule f, specifically my listing of assets. I purchased a used tractor this year, and I believe I should be able to depreciate it over 7 years. No matter what I do, it is only sh

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my schedule f, specifically my listing of assets. I purchased a used tractor this year, and I believe I should be able to depreciate it over 7 years. No matter what I do, it is only sh

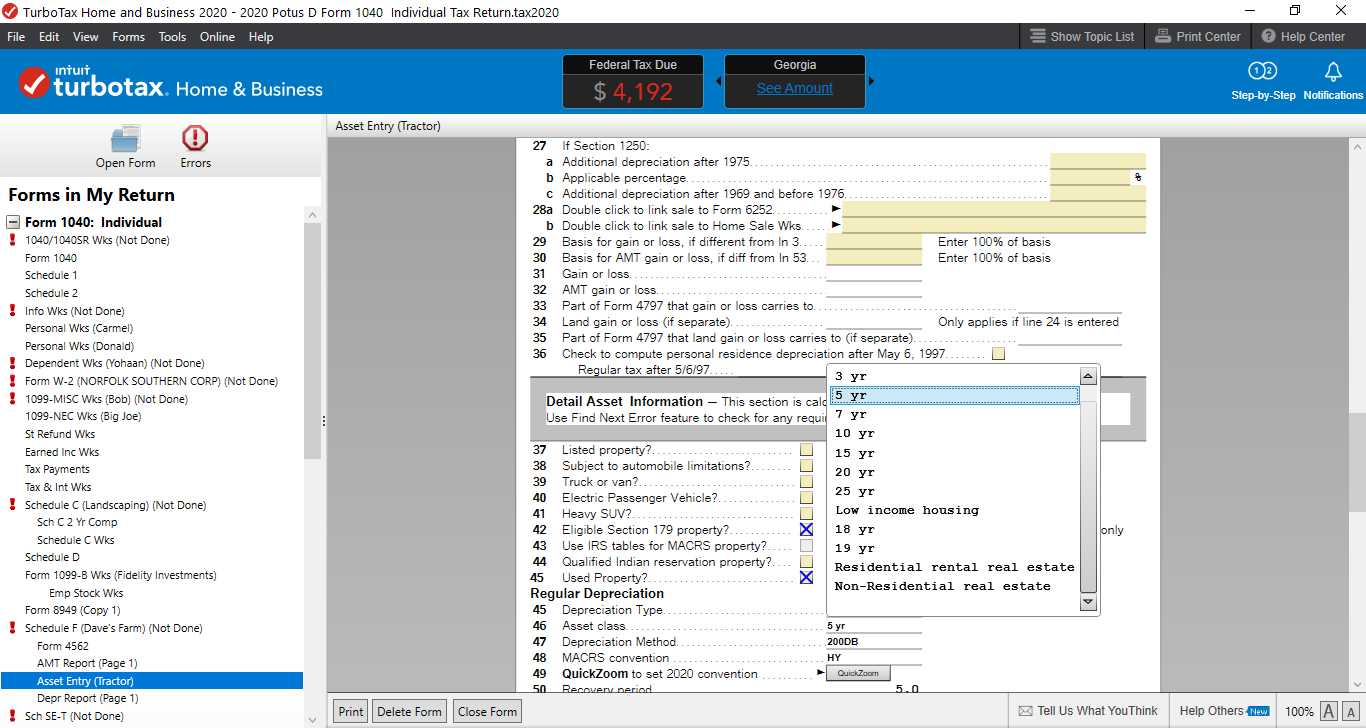

The Tax Cuts and Jobs Act made changes to how farmers and ranchers depreciate their farming business property. New farming equipment and machinery is now five-year property. This means that for property placed in service after Dec. 31, 2017, the recovery period is shortened from seven to five years for machinery and equipment. Used equipment remains seven-year property. If you are using TurboTax Online, you may want to switch to TurboTax Desktop. Desktop give you the ability to enter directly on Forms, Schedule, and worksheets using the "Forms" mode (as opposed to the step-by step. This gives you more flexibility when it comes to things like selecting depreciation methods and periods. See the attached screenshot showing how you can select the type of depreciation you want. For information on switching from Online to Desktop, see the following:

How do I switch from TurboTax Online to the TurboTax software?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

swick

Returning Member

kms369

Level 2

nstuhr

Returning Member

tpgrogan

Level 1