- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I am unable to file my tax return and there is no such rejection code it shows that there is ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to file my tax return and there is no such rejection code it shows that there is a difficulty in recognizing the data in the return you are sending.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to file my tax return and there is no such rejection code it shows that there is a difficulty in recognizing the data in the return you are sending.

This Turbo Tax FAQ will provide a solution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to file my tax return and there is no such rejection code it shows that there is a difficulty in recognizing the data in the return you are sending.

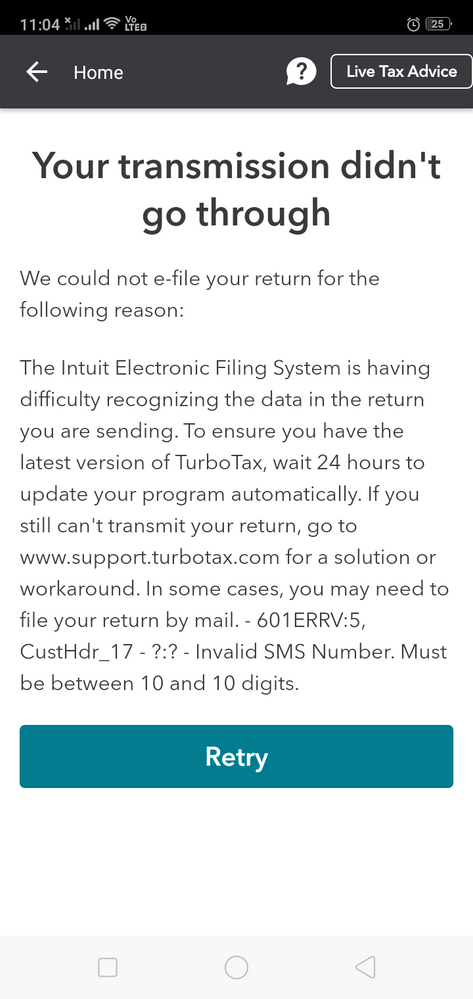

Hello Mam the solution you gave me it's still not working for me this is the message I am still getting. Please help me with this. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to file my tax return and there is no such rejection code it shows that there is a difficulty in recognizing the data in the return you are sending.

601ERRV:5, CustHdr_17 - ?:? - Invalid SMS Number. Must be between 10 and 10 digits.

If you have a phone number listed in your Intuit Account settings, then you must make sure you use a valid 10-digit domestic USA phone number in both your Intuit Account settings and in your return. Or you can try removing the phone number in the Intuit Account.

See if this FAQ helps:

FAQ: 601ERRV:5 Invalid SMS Number

See if this answer by TurboTax CatinaT1 helps:

Also see this answer by TurboTax DawnC in the thread linked below. She also says it may be possible to leave the phone number blank in the Intuit Account settings.

Also see this other thread with other out-of-country users with the same problem who were able to correct the error. Several have posted anecdotes there about how they solved it. If you continue to have trouble, post there, and they may be able to help you.

NOTE:

A couple of users have said that even after making changes to (or removing) the phone in the Intuit Account, the efile problem still happened, until they logged out of TurboTax then logged back in. Apparently that reset something.

So if you make any changes to the phone number listed in your Intuit Account settings, after you save the settings, log out of TurboTax and close the browser. Then reopen it and log back in and try to efile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to file my tax return and there is no such rejection code it shows that there is a difficulty in recognizing the data in the return you are sending.

Thank you Soo much.your solution has really helped me a lot and I was able to fill my tax properly. Very good job guys you guys are very helpful thank you once again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to file my tax return and there is no such rejection code it shows that there is a difficulty in recognizing the data in the return you are sending.

@wasim_sayed wrote:Thank you Soo much.your solution has really helped me a lot and I was able to fill my tax properly. Very good job guys you guys are very helpful thank you once again.

You're welcome. Good luck.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ckabele

New Member

chrisdanna

New Member

brunomaiacreates

New Member

manningmonique03

New Member

nasha320

New Member