- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: HSA overfunded

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA overfunded

TurboTax is telling me I overfunded my HSA by the exact amount I contributed... Has to be a mistake but I don't know how to fix it.

I contributed $3800 which is well below the limit for married filing jointly

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA overfunded

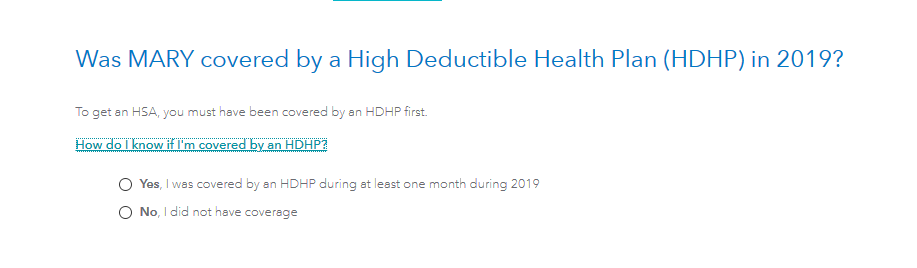

Go back to the HSA section and make sure you answered all the questions- in particular, the HDHP must be answered to qualify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA overfunded

I have same problem. My wife has an HSA, she contributed $7k (family) to. We have checked off she was covered by HDCP Family plan every month, not inherited, no Medicare. It keeps telling me over funded by $6k. This worked fine last few years.

Can't delete, please disregard. For others with same problem, Page asking for contributions which per-populates amount from W-2 (box 12-W) has an additional box below for contributions made through other means, not on W-2. Kept coming back with an Additional $7k. Every time I deleted kept putting it back in. Finally put "0" in box, and it saved it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA overfunded

That is a good lesson - the difference between a delete and a zero.

It won't always work - to delete an entry - because, as you saw, TurboTax didn't realize that you meant to delete the number, until you entered zero.

For others reading this, note that sometimes there is no way to get back to the screen where you had entered a number in the HSA interview that you want to change. In this case, it will be faster to simply delete all the HSA data and start over.

To delete all HSA data, please do:

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form. Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, and 8889-S (if one)

5. go back and re-add your W-2(s), preferably adding them manually

6. go back and redo the entire HSA interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA overfunded

I was banging my head for a couple of hours until I see I was adding extra HSA unnecessarily. That box should state more clearly that W2 HSA contribution already accounted for. Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

parachem

Level 2

mtnspokes

New Member

lvervynckt

New Member

anonymouse1

Level 5

jimshane

Level 2