- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

I owned a rental property for 10+ years and it had been rental property throughout the years.

I started the selling process from the end of 2018 and it got sold in Spring 2019. There was no rent collected since 1/1/2019 as it's in the sale process.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

- Open up your program for this year.

- Go to your rental

- Edit/Revisit/Update

- Rental and Royalty Summary screen

- Click Edit next to your property

- In property profile, continue through to Do Any of These Situations Apply to This Property?

- Mark that you sold the property and click continue until you get back to Review your Rental Summary

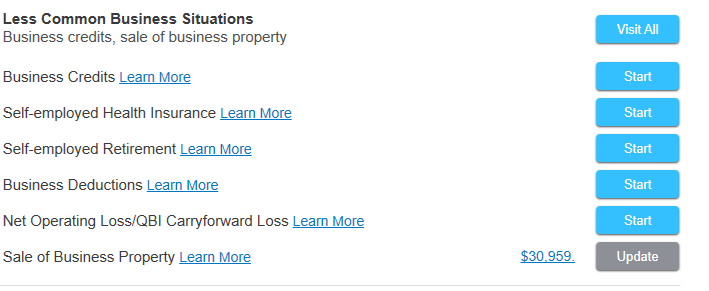

- Look down to Sale of Property/Depreciation, select Update

- Do you want to go directly to your asset summary?

- Select yes

- Your property assets screen

- you may have several things listed here, each needs to be disposed of. Let's work on the house. Select Edit

- Describe - rental real estate property, continue

- Tell us more - residential rental real estate, continue

- Tell us about this rental asset:

- description - whatever you have had in there for years, continue

- Tell Us More About This Rental Asset

- Mark that the item was sold and the date

- Then mark if it was always business and the date

- continue

- Confirm prior year depreciation and continue

- Special Handling Required? If it was your main home that was converted to a rental, you have all of the depreciation correct, enter NO. If it was always a rental, enter NO. Otherwise, when you answer yes, you go to different areas of the program depending on your situation and you will need to respond with your special situation.

- Home Sale, answer NO

- Enter Sales Information- Split 1099S between house and land sales price

- Enter sales expenses plus any costs while up for sale not on sch E

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

Thanks for the instruction. For step 13 "you may have several things listed here, each needs to be disposed of. Let's work on the house. Select Edit ":

How to dispose other items? say, I have loan points there, and what's the step to dispose it? I tried to mark it as "stop use in 2019", but the depreciation/deduction result showed no difference from the previous years.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

Yes, each item needs to be disposed of. If the points were already fully depreciated, there would not be a change. Items still being depreciated, should show some difference.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

How to select and input to dispose them (say, the points)?

Do you have the similar step by step instruction towards the main house asset item?

The loan points were amortized for 30 years, and so definitely they are not fully depreciated yet.

but not sure if I select/input anything wrong, so that it's not disposed, but continued being depreciated annually as usual... Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

For the points which are not fully amortized, and any other asset that is not fully depreciated or amortized (e.g. the land) and allocate a portion of the sales proceeds equal to the remaining un-amortized value of the asset, and dispose of it for that amount. This will result in no gain or loss or loss on those assets, and will reduce your proceeds allocated to the building.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

Understood the result impact as you explained. My question is HOW to dispose it and make the un-depreciated portion to be deducted at one time as disposal?

Could you please help with the step by step operation instruction, better with screenshot showing the selection/input, to show how the loan points should be disposed for the property sale year in 2019?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

If you assigned a price to the assets that you sold, you would enter that as the sale price of the assets. Otherwise, it would be allowable to enter the sale amount as an amount equal to the basis of the assets (cost less depreciation.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

where can I found this information to send to cx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

Amy

Navigated successfully thru step 8, but can't seem to find step 9 of your last guidance as fols:

- Look down to Sale of Property/Depreciation, select Update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

below step don't appear/isn't an option on my Intuit Screen: Pls help me

- Do you want to go directly to your asset summary?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

Hi Amy,

I'm trying to follow these steps for my 2021 return but when I get to your last step - "Sales Information" - I don't have those 4 entry boxes where you can break out Asset Sales Price and Expenses and Land Sales Price and Expenses separately. I only have 2 entry boxes, one for Sale Price and one for Sale Expenses. Is that because I am using TT Premier and not TT Home and Office?

In any event, for Sales Price do I enter the full sales price which included the land ($485,000) or can I apply the same percentage breakdown for the house (i.e. "Structural Improvements") as is listed on the county property tax bill which is .634, making the Sales Price $307,567? ($485,000 X .634)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

I have the same issue. I'm not sure how to get the numbers to enter in these 4 boxes. Can someone advise?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

I am having similar problems entering original cost of rental house and land purchased 40 years ago and improvements made and depreciated at different lives.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report rental property sale by TurboTax At Rental Property->Depreciation - Is there a step-by-step instruction ?

I am having the same issue. Can't find where to list land value separate from structure value. it only offers total sales price minus sale expenses.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

deborahhuff753

New Member

joel_black_sr1

New Member

mjtax20

Returning Member

tucow

Returning Member

pusafla7

New Member