- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to input undetermined term transactions for noncovered tax lots on 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

Hi,

Can you clarify on how to enter undetermined term transactions for noncovered tax lots on 1099-B?

I'm using TurboTax Premier.

On the 1099-B that I have from my brokerage, it says the following:

Sales transactions are grouped by their term (long, short or undetermined) and covered status (covered or noncovered). For tax lots whose term is undetermined, use your historical documents to establish the cost basis and date of purchase. Tax lots with an additional notation of “Ordinary” represent neither short- nor long-term capital transactions. You may wish to consult with your tax advisor, the IRS or your state tax authority regarding the proper treatment.

Report on Form 8949, Part I with Box B checked or Part II with Box E checked. Basis is NOT provided to the IRS. (Line 12)

“Date acquired,” “Cost or other basis,” "Accrued market discount," "Wash sale loss disallowed" and “Gain or loss (-)” are NOT reported to the IRS.

I see the cost basis as ... on the 1099-B and I don't have date in 1B for these transactions.

However, when I try to add these records on TurboTax Premier, the system is not allowing me to proceed with a blank date. Can you help on how to input these transactions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

You can't report the term as undetermined on your tax return. "Undetermined" on the 1099-B means that the brokerage doesn't know whether it's short-term or long-term. You have to determine that from your own records of when and how you acquired the investments. Determine the acquisition date as accurately as you reasonably can, but the exact date is not critical as long as you correctly determine whether each lot is short-term or long-term. Then, in TurboTax, you will select the sale category as either "Box B - Short term noncovered" or "Box E - Long term noncovered." You can enter "Various" as the acquisition date as long as you correctly categorize the sale as short-term or long-term.

If you inherited the investment you can enter "Inherited" as the acquisition date. An inherited investment is always considered long-term, regardless of how long you or the deceased actually owned it. If you received the investment as a gift, your acquisition date is the date that the donor acquired it.

You also have to provide the basis from your own records. If you purchased the investment yourself the basis is what you paid for it. If you inherited it, the basis is the market value on the date of death of the person you inherited it from. If you received it as a gift, your basis is the donor's basis.

For investments that you purchased, if you have a reasonable estimate of the purchase date, there are web sites where you can look up historical prices of stocks and mutual funds.

Ask the broker if they have any information about the acquisition date and purchase price. Sometimes they have the information, even though they don't put it on the 1099-B. But they are not likely to have any information about investments that you inherited or received as a gift.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

Hi,

Thanks so much for the advice!

In this case, I didn't make any sale.

I purchased gold ETF "WORLD GOLD TRUST SPDR GLD MINIS ETF" through a brokerage. So, it's not inherited.

From the ETF's website, I found this info:

"Because the Trust sold only a de minimis amount of gold for payment of Trust expenses during the year and made no distributions of sale proceeds to its Shareholders, under Treasury Regulations Section 1.671-5(c)(2)(iv)(B) neither the Trust nor brokers are required to report the gross proceeds of Trust sales to Shareholders on Form 1099B. Certain brokers may nevertheless elect to report these proceeds to their customers on a composite Form 1099B"

So, these proceeds are reflecting those trust expenses.

I'm still not clear on what cost basis to use for these records. On the 1099-B I received from my brokerage, I see cost basis as ....

Can you advise on what cost basis, I should be using while filling it on Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

You will use the purchase price of the gold ETF when you purchased it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

Hi,

Thanks for the advice!

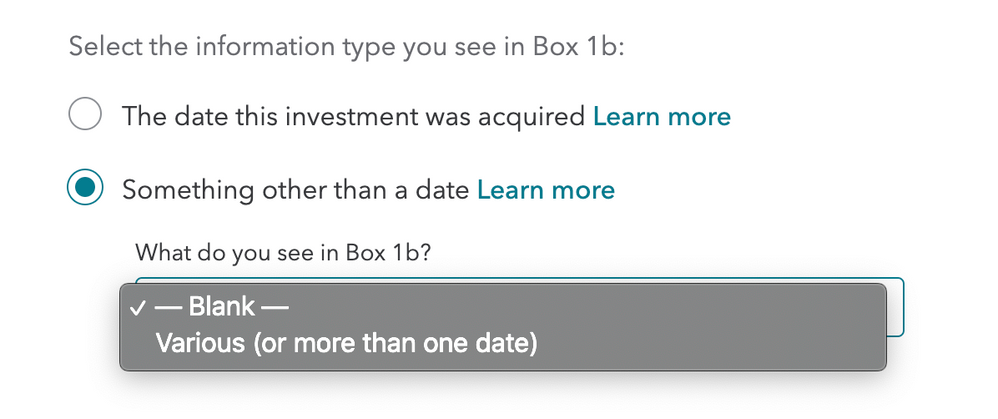

Can you advise what should I input for the value of box 1b?

- On the 1099-B I have, there is no box 1b for undetermined term transactions

- Should I input the date of my gold ETF Purchase? Or the date of the proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

I am using turbo tax deluxe and have a similiar question. Ten years ago, I was given stock options that resulted in 100 shares of company stock. Two years later, I received and 250 shares of common stock. I let the company stock dividends get reinvested for the past 10 years. In July of 2021, it was announced that the company stock would be splitting off a portion of their business into another company and I would receive one stock for every 2 stocks that I owned. So now, with all of the reinvestments, I have 456 shares in company A and 227 shares in Company B. Recently, I received a 1099-B statement from the shareholders investment group. In box 5, it states a $30.91 amount for cash for a fractional amount of the new company B stock. Back in the summer of 2021, I cashed a check for this amount $30.91 and it was for cash in lieu of fractional shares. The 1099-B form has Boxes 1B, 1c, 1d, 1e,1g, and box 4 are all blank. Box 5 has description stating "Non covered securities transactions for which basis is not reported to the IRS and for which short term or long term determination is unknown by EQ shareholder services" and I must determine short term or long term basis on form 8949. Should I just complete form 8949 stating long term basis and zero cost basis? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

Well, it's definitely long term so that's out of the way.

Your cost basis is up to you. Cash in lieu of shares is a purchase - they bought fractional amounts of your investment and that reduced what you own. You have the option to put zero and then the basis that you have (the amount that you have spent over the years) remains the same on the investment still in the company. If you would rather you can reduce your basis in the company and use some of it here to reduce gain on the sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

I too have this issue with an SPDR GOLD ETF, my broker told me this regarding the $136.51 that is showing up as a basis not reported to the IRS:

There was no external distribution. You never received the $136.51. The internal sales were placed by the ETF to cover the .40% of expenses.

TurboTax is asking me to explain these proceeds and I have no Cost Basis, no Market discount, no Wash sale loss, and no Net Gain or Loss. The 1099B only shows proceeds of $136.51.

Any suggestions?

Thanks

Jeff

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

According to the SPDR Gold Trust Reporting Statement, the Trust sold only a de minimis amount of gold for payment of Trust expenses during the year and made no distributions of sale proceeds to its Shareholders. Under certain Treasury Regulations neither the Trust nor brokers are required to report the gross proceeds of Trust sales to Shareholders on Form 1099B. However, certain brokers may nevertheless elect to report these proceeds to their customers on a composite Form 1099B, and it appears your broker elected to report such proceeds.

Included below is a link to the 2021 Reporting Statement for the SPDR Gold Trust ETF. On page 11 of the Reporting Statement is an example of how a hypothetical customer can calculate gain or loss in connection with the Gold Trust's sale of gold to pay Trust expenses. You may find this information helpful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

GeorgeM777,

Thanks for the information - my 1099B listed an expense each month and based on the Pg 11 it appears as a total amount which think makes more sense. I wonder if I could only list one event as a total/summary to explain to the IRS? I tried calling them and got nowhere.

Thanks for your help and advice.

Jeff

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

Reporting the item as one entry appears reasonable. The monthly expenses are not the same as purchases and sales information that would appear on a Form 8949, Sales and Other Dispositions of Capital Assets. Moreover, the 2021 Reporting Statement , which you mention, presents an example to Shareholders which includes aggregating all monthly expenses for the year. Thus, reporting the item as you suggest appears reasonable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

I also have this SPDR GOLD TRUST GOLD ETF and have never sold any. I read a post in here that said the ETF sells some of it to take care of fees. Under "proceeds & reported" I have about 12 transactions listed averaging about 0.35, which equal to a "security total" of $4.10. I connected my brokerage account and it populated all that info, except for cost basis and date acquired.

If I use my cost basis of $123.45 for all these transactions, I get a "gain/loss" in turbotax of -$1442.55, which doesn't seem right at all.

Can anyone provide any additional insight about this and what I should enter in for cost basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

The SPDR Gold Trust recommends using the Gross Proceeds file (obtained from the 2021 Grantor Trust Tax Reporting Statement) to calculate your gain or loss on the sale of gold to pay trust expenses. It is a multi-step process and it has to be done outside of TurboTax, and then the numbers can be entered into TurboTax. If you made multiple purchases over a period of time, they also recommend calculating gain, loss and adjusted basis separately for each purchased lot and then sum up the results of each lot to arrive at the net reportable gain or loss and the total investment expenses.

If you purchased shares prior to 2021, and made no other purchases, then you should calculate your adjusted cost basis, using the gross proceeds information for the relevant years. The SPDR Gold Trust recommends that shareholders follow these steps (provided here in summary fashion) to calculate their gain/loss on the sale of gold to pay trust expenses:

- Identify the shareholder’s pro rata ownership of gold (in ounces).

- Calculate the gold (in ounces) sold from Shareholder XYZ’s account during 2021 to pay expenses.

- Calculate cost of gold sold from Shareholder’s account.

- Calculate Shareholder’s gain or loss on gold sales for each lot purchased.

- Calculate Shareholder’s investment expenses.

- Calculate Shareholder’s Adjusted Gold held and Cost Basis.

The above steps were obtained from the 2021 Grantor Trust Tax Reporting Statement. At page 11 and 12, the Reporting Statement provides further detail on how a Shareholder should apply the above steps when calculating their gain or loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

I am having a similar issue with my 1099-B which is a result of the acquisition of a private company for which I had some shares, by another private company. This is "noncovered" sale and they would not determine what the cost basis is. I know what the cost basis is and I can enter that (hopefully TT let me enter that manually) to the screen corresponding to the form 8949.

But the 1099-B entry screen keep telling me it "NEEDS REVIEW". TT isn't happy that the box 1e (Cost or other basis) is left blank because it is blank on the paper form, even though I checked the checkbox "The cost basis is incorrect or missing on my 1099‑B".

Isn't this simply a bug? If I ignore "NEED REVIEW" warning, will TT proceed further? Or will it insist that I fix this "error" ? Is TT requiring us to enter inaccurate information here in order to proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

If there's a bug at all, the bug may be that the description of the checkbox is wrong, or maybe you misread it. In my TurboTax Premier CD/Download software for Windows it does not say "or missing." It just says the cost basis is incorrect.

In any case, when you enter the sale, if there is no cost basis on the 1099-B, enter the correct cost basis in box 1e, even though it's not on the 1099-B. Do not check the box saying that the basis is missing or incorrect on the 1099-B. That checkbox is only for an incorrect cost basis on the 1099-B, not for a missing cost basis.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Juliaxyw

Level 2

Juliaxyw

Level 2

b_benson1

New Member

icefyre123

Returning Member

fuelnow

Level 2