- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to input undetermined term transactions for noncovered tax lots on 1099-B

Hi,

Can you clarify on how to enter undetermined term transactions for noncovered tax lots on 1099-B?

I'm using TurboTax Premier.

On the 1099-B that I have from my brokerage, it says the following:

Sales transactions are grouped by their term (long, short or undetermined) and covered status (covered or noncovered). For tax lots whose term is undetermined, use your historical documents to establish the cost basis and date of purchase. Tax lots with an additional notation of “Ordinary” represent neither short- nor long-term capital transactions. You may wish to consult with your tax advisor, the IRS or your state tax authority regarding the proper treatment.

Report on Form 8949, Part I with Box B checked or Part II with Box E checked. Basis is NOT provided to the IRS. (Line 12)

“Date acquired,” “Cost or other basis,” "Accrued market discount," "Wash sale loss disallowed" and “Gain or loss (-)” are NOT reported to the IRS.

I see the cost basis as ... on the 1099-B and I don't have date in 1B for these transactions.

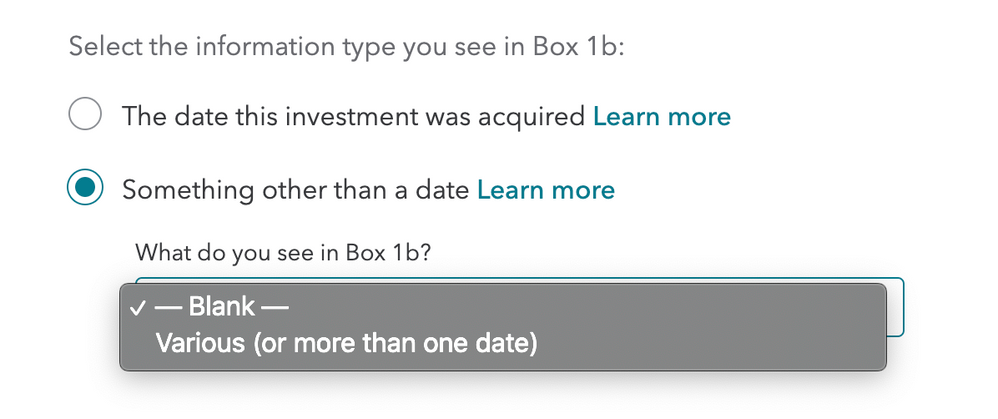

However, when I try to add these records on TurboTax Premier, the system is not allowing me to proceed with a blank date. Can you help on how to input these transactions?