- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to handle Form 5329-T And CARES Act Rollover?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle Form 5329-T And CARES Act Rollover?

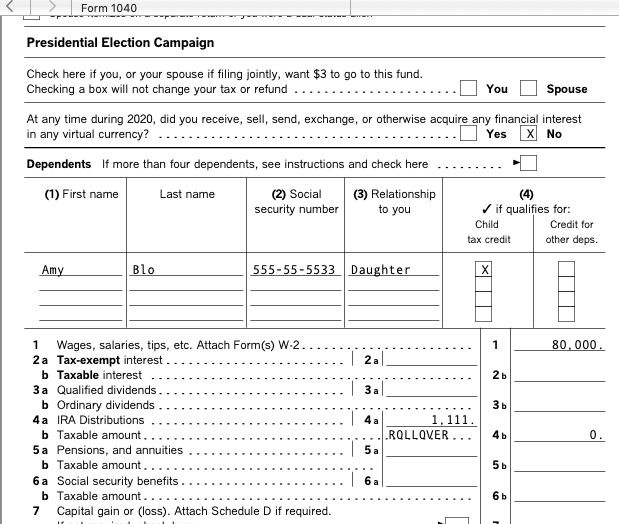

Yes champ. But your screenshots show the returned IRA distribution as coming up as taxable on the 1040. That is problematic in this case because that distribution that was returned is not taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle Form 5329-T And CARES Act Rollover?

@tharais1 wrote:

Yes champ. But your screenshots show the returned IRA distribution as coming up as taxable on the 1040. That is problematic in this case because that distribution that was returned is not taxable income.

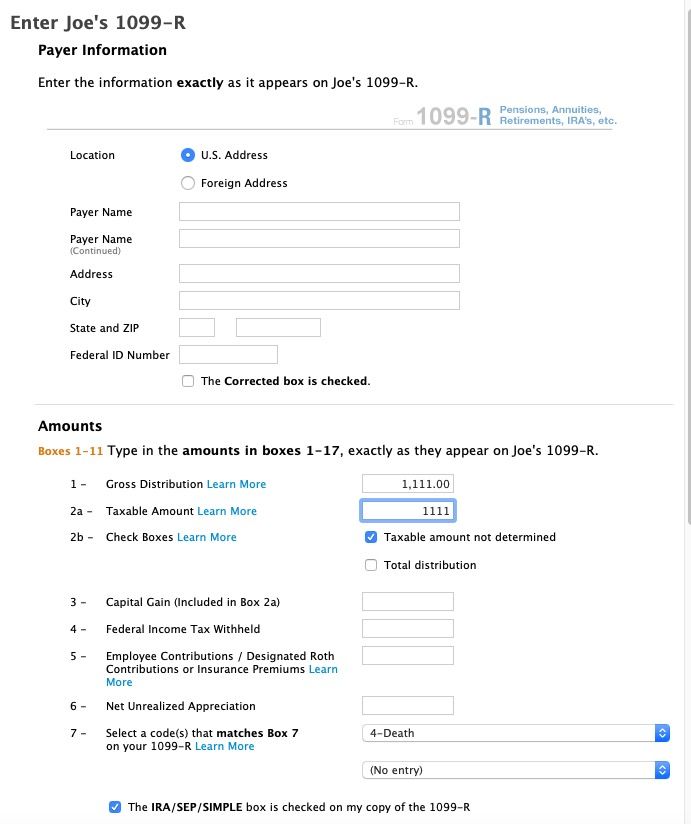

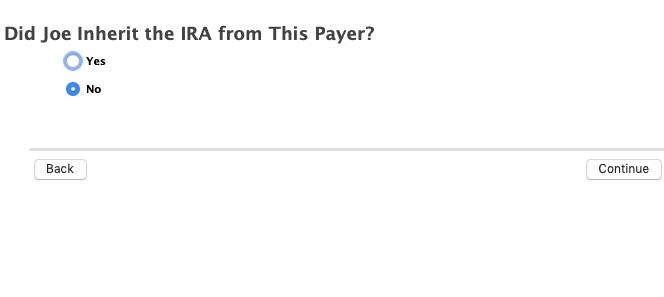

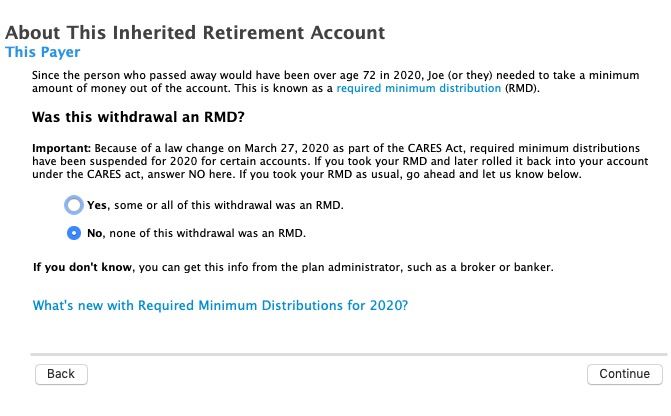

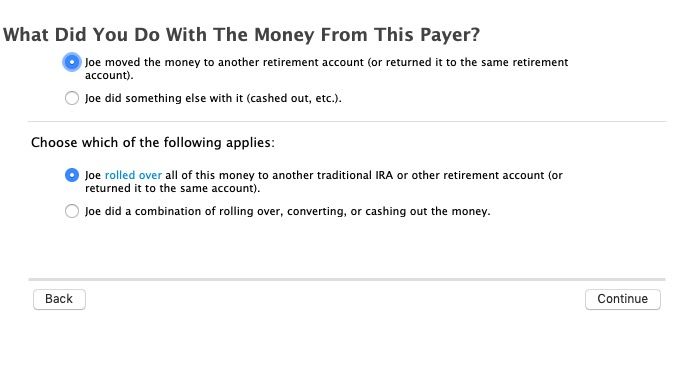

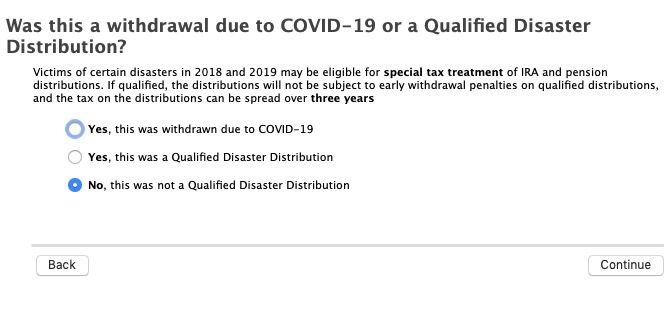

Sorry, the sequence I posted was not for a rollover but was if you kept the money. A rollover looks like this.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sugersam5

Level 3

shelldigity

New Member

davelavelle2000

Level 1

T4Tax

Level 3

kiley-workman

New Member