- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

The county paid me last year for a temporary easement of part of my yard. It is my primary residence. I received a 1099-Misc with payment amount under "Rents". I have read I should file this under Schedule E, but looking through the Property Profile section, there is much that doesn't seem to pertain to me or is very confusing. Should I be looking somewhere else?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

They should not have reported it as Rental Income, they should have reported it as an Easement Payment.

You can still enter the 1099-MISC and then "back-out" the income. This way the IRS sees you reported the 1099-MISC, but you also report that it is not taxable.

As stated earlier, the amount MIGHT be considered when you sell. Whatever the amount is would need to be subtracted from your basis, so if you paid 200,000 for the property and the easement was 5,000, your new basis would be 195,000 plus any other applicable adjustments.

To enter in Home and Business, first delete whatever you entered for the 1099-MISC.

In "Step by Step" entry, Click "Personal Income"

Click "I'll choose what I work on"

Scroll down to "Other Common Income"

Click START or UPDATE next to "Income from Form 1099-MISC"

Enter the 1099- MISC on the next screen and click Continue

Select the last option "Nonbusiness income from the rental of personal property or equipment "

Continue

"Do either of you have another 1099-MISC?" select "No" and Continue

Click Done

This will put the amount on Schedule 1 Line 8k, and included on the amount on the 1040 Line 8

Now we need to show that it isn't taxable.

Go back to the "Personal Income" section

Scroll down to the VERY LAST option "Less Common Income"

Click START or UPDATE next to the last option on that list "Miscellaneous Income, 1099-A, 1099-C"

Now scroll down to the VERY LAST option "Other reportable income" and click Start or Update

Select YES on the "Any Other Taxable Income?" screen

Type "Reduction in basis for easement payment" for the description and the same amount you entered before but as a NEGATIVE (put - in front of the number)

Click Continue and Done

This NEGATIVE number should negate the income on the 1099-MISC

Schedule 1 will show both transactions so the IRS will understand what happened.

There will be no impact to your 1040 Line 9 (Total Income)

Keep copies with your tax file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

Per DavidD66

Payments for utility easement sales are not considered income. Instead, the payment lowers your basis in the property. It does create a capital gain if the payment exceeds the basis in your land. You wouldn't have to report the payment on your tax return, except for the fact that you received Form 1099-MISC, and the IRS is expecting that amount to be reported. For more information on property easements, see: IRS Publication 544

Since you received Form 1099-MISC you will have to report the "Rental Income". When you enter Form 1099-MISC, it will trigger TurboTax to create a Schedule E. Report (as Other Expenses) the same amount as the rental income reported on the 1099. Give it a description of "Reduction in basis for easement". The 1099-MISC will be reported on your tax return, so it will match with the IRS records. Leave days rented blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

@PatriciaV Thanks for the reply though I'm still confused. Perhaps some sections differ in name (I'm using Home & Biz - CD."

I entered the 1099-Misc under Personal Income and selected Rental Income (Schedule E) which prompted me to enter information on my property. This led me to the Business section Rental Properties and Royalties. Is this correct? It's not really business income I thought?

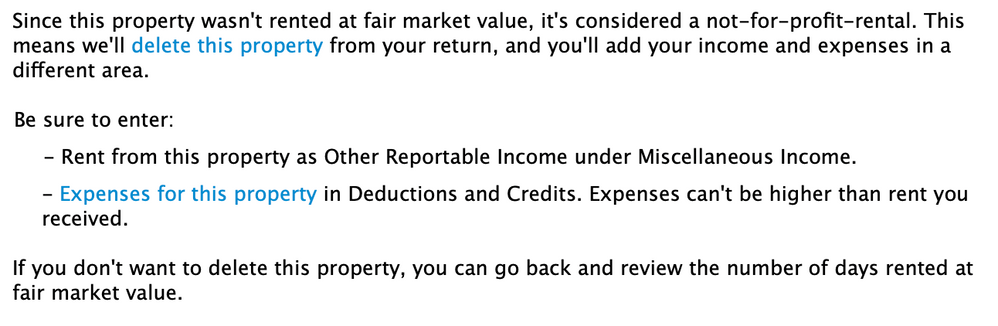

Under the Property Profile section I selected "Land" as property type, checked the boxes for "First year rented" (as my home is not part of the easement in question). On the next page I input Days Rented as "0 days", Personal Use as "365 days". The following page showed me what is attached below.

What am I doing wrong? If I modify my answers it also asks me for home expenses etc. It seems TT is under the assumption that this is all related to my home itself, instead of just the partial and temporary land easement. Surely there is a better way?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

They should not have reported it as Rental Income, they should have reported it as an Easement Payment.

You can still enter the 1099-MISC and then "back-out" the income. This way the IRS sees you reported the 1099-MISC, but you also report that it is not taxable.

As stated earlier, the amount MIGHT be considered when you sell. Whatever the amount is would need to be subtracted from your basis, so if you paid 200,000 for the property and the easement was 5,000, your new basis would be 195,000 plus any other applicable adjustments.

To enter in Home and Business, first delete whatever you entered for the 1099-MISC.

In "Step by Step" entry, Click "Personal Income"

Click "I'll choose what I work on"

Scroll down to "Other Common Income"

Click START or UPDATE next to "Income from Form 1099-MISC"

Enter the 1099- MISC on the next screen and click Continue

Select the last option "Nonbusiness income from the rental of personal property or equipment "

Continue

"Do either of you have another 1099-MISC?" select "No" and Continue

Click Done

This will put the amount on Schedule 1 Line 8k, and included on the amount on the 1040 Line 8

Now we need to show that it isn't taxable.

Go back to the "Personal Income" section

Scroll down to the VERY LAST option "Less Common Income"

Click START or UPDATE next to the last option on that list "Miscellaneous Income, 1099-A, 1099-C"

Now scroll down to the VERY LAST option "Other reportable income" and click Start or Update

Select YES on the "Any Other Taxable Income?" screen

Type "Reduction in basis for easement payment" for the description and the same amount you entered before but as a NEGATIVE (put - in front of the number)

Click Continue and Done

This NEGATIVE number should negate the income on the 1099-MISC

Schedule 1 will show both transactions so the IRS will understand what happened.

There will be no impact to your 1040 Line 9 (Total Income)

Keep copies with your tax file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

@KrisD15 Thank you for the quick and detailed post! This makes more sense to me, much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

I have the same issue with a 1099-MISC that I received for a utility temporary construction easement on land that is part of my primary residence. I first started entering in the information as a 1099-MISC which led me down the Schedule E route which seemed the wrong path as this is not a rental property. I was going to try the method suggested by KrisD15, but was not sure how to do that in TT Premier. Where is the "step by step" entry such that I can follow this method in Premier?

I have backed out and deleted the 1099-MISC entry. Does that negate the Schedule E creation, or should I start over to make sure there is no confusion?

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

@KrisD015 's answer and step-by-step guide is just fine for TurboTax Premiere as well. Just follow the steps and enter the income and negative offset amount and you should be set.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

Robert,

I apologize if I'm missing something obvious, but where is "step-by-step" entry and "personal income"? I normally sue the "Guide Me" path and walk through all the topics individually.

Thanks again for your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

If you still own the land, the general treatment is that the payment is not income but reduces the basis in the land that you own. So, if you paid $10,000 for the land and received a right of way payment for $1,000, your new basis in the property is $9,000.

You still have to deal with the 1099 that was reported to the IRS. Report the income, then immediately report a minus entry for the same amount. Reference both entries as 'right of way sold - basis adjustment'.

Follow the steps below to report this income that is not reported as self-employment income.

- Select Federal from the left side of the screen.

- Select Wages & Income on the left side of the screen.

- Scroll down to Less Common Income. Click Show more.

- Click Start / Revisit to the right of Miscellaneous income….

- Click Start / Revisit to the right of Other reportable income.

- At the screen Other Taxable Income enter the description of the income.

- Click Add another Miscellaneous income Item.

View the entries at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets.

The income will be listed on line 8z of the Schedule 1 Additional Income and Adjustments to Income and line 8 of the Federal 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

I just want to clarify as I have a similar situation.

My mother received a temporary easement for some land for road construction and she also "sold" some land for the new right away. Can both of these be entered as layed out above or does the "sold" portion of land (non homestead ag land) need to be entered as a sale and if a sale it would only be taxable above the basis, correct?

The temp. easement was a 1099-misc (about 3 years)

the sold land for the right away was a 1099-S

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Rents from 1099-Misc for temporary construction easement on land of primary (non-farm) residence?

Yes, below is a link with the detailed directions, similar to the posts above but referring to a 1099-S.

If the 1099-S reduces the basis to less than zero, there would be gain to report this year, otherwise the basis is reduced which is later addressed when the property is eventually sold.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rejected Federal

Returning Member

sunnyx0r

Level 2

Jack3520

Level 1

mmmkcook

Level 2

Zapit

Level 2