- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@PatriciaV Thanks for the reply though I'm still confused. Perhaps some sections differ in name (I'm using Home & Biz - CD."

I entered the 1099-Misc under Personal Income and selected Rental Income (Schedule E) which prompted me to enter information on my property. This led me to the Business section Rental Properties and Royalties. Is this correct? It's not really business income I thought?

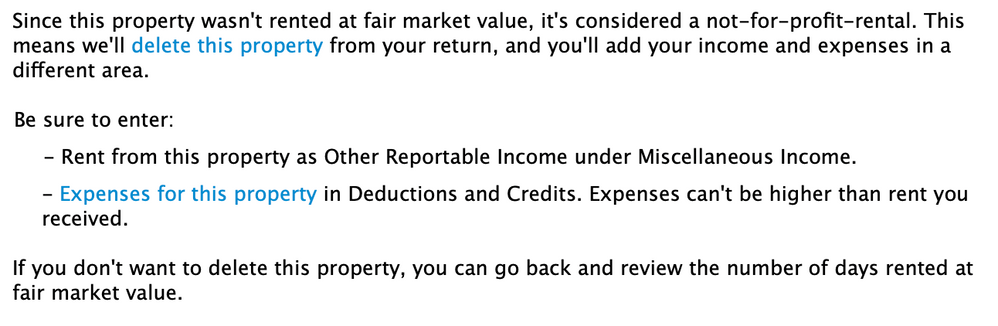

Under the Property Profile section I selected "Land" as property type, checked the boxes for "First year rented" (as my home is not part of the easement in question). On the next page I input Days Rented as "0 days", Personal Use as "365 days". The following page showed me what is attached below.

What am I doing wrong? If I modify my answers it also asks me for home expenses etc. It seems TT is under the assumption that this is all related to my home itself, instead of just the partial and temporary land easement. Surely there is a better way?