- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I file 7023 form with my taxes on turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Are you referring to IRS form 7203, S Corporation Shareholder Stock and Debt Basis Limitations?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Yes.

I know I need to complete a separate form I just want to know how I unlcude that in my online turbotax submission when I file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

S corporation shareholders use Form 7203 to figure the potential limitations of their share of the S corporation’s deductions, credits, and other items that can be deducted on their individual returns.

Form 7203 appears in the S-corps, Partnerships, and Trusts Income from partnerships, S-corps, LLCs and REMICs near the end where you entered Schedule K-1.

If you’re an S corporation shareholder and you:

- are deducting an S-Corp loss (including a prior year loss disallowed due to basis limitations)

- received a non-dividend distribution from an S-Corp

- disposed of S-Corp stock (regardless of whether a gain was recognized)

- received a loan repayment from an S-Corp

TurboTax will create Form 7203 on your personal return and perform limited calculations based on your entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Thanks but my question is, at what point (or in what section) am I able to request that the 7203 form be generated. I completed my taxes (though I have not filed them) and I did not see any prompt to create this form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

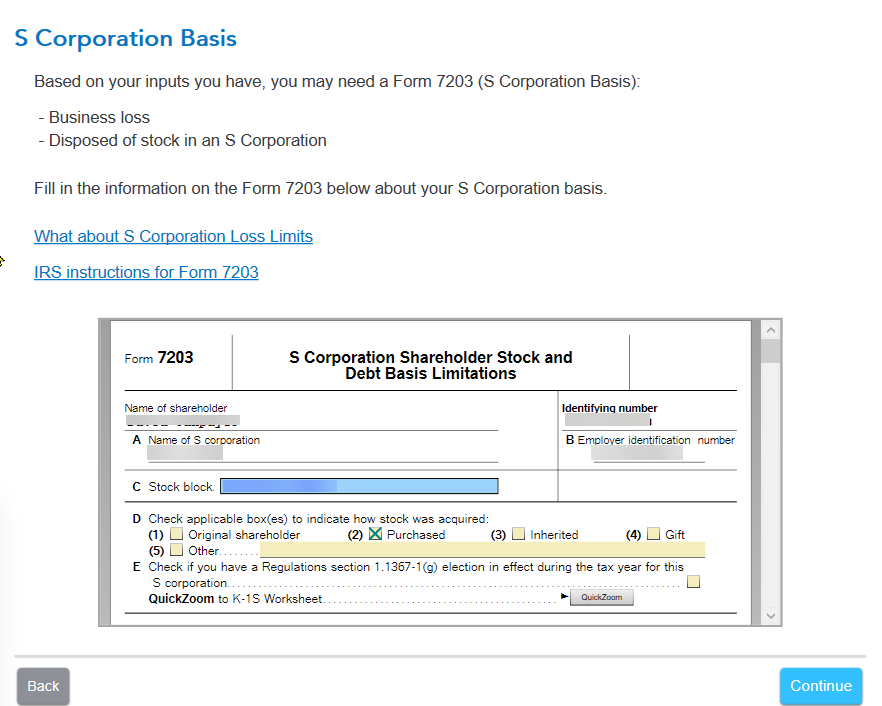

You may wish to return to the K-1 topic and review your entries for Form 1120S Schedule K-1. At the end of the entries for the K-1 boxes is a page "S Corporation Basis" that presents a sub-form with Form 7203 for you to complete.

If you're using TurboTax Desktop, you can complete this form using Forms Mode (Ctrl+2 or Forms>>Open Form).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hjw77

Level 2

RMenschel

Level 3

maceafricanstorellc

New Member

ekendallcalvert

New Member

bischoffjared

New Member