- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I file 7023 form with my taxes on turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Are you referring to IRS form 7203, S Corporation Shareholder Stock and Debt Basis Limitations?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Yes.

I know I need to complete a separate form I just want to know how I unlcude that in my online turbotax submission when I file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

S corporation shareholders use Form 7203 to figure the potential limitations of their share of the S corporation’s deductions, credits, and other items that can be deducted on their individual returns.

Form 7203 appears in the S-corps, Partnerships, and Trusts Income from partnerships, S-corps, LLCs and REMICs near the end where you entered Schedule K-1.

If you’re an S corporation shareholder and you:

- are deducting an S-Corp loss (including a prior year loss disallowed due to basis limitations)

- received a non-dividend distribution from an S-Corp

- disposed of S-Corp stock (regardless of whether a gain was recognized)

- received a loan repayment from an S-Corp

TurboTax will create Form 7203 on your personal return and perform limited calculations based on your entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

Thanks but my question is, at what point (or in what section) am I able to request that the 7203 form be generated. I completed my taxes (though I have not filed them) and I did not see any prompt to create this form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file 7023 form with my taxes on turbotax?

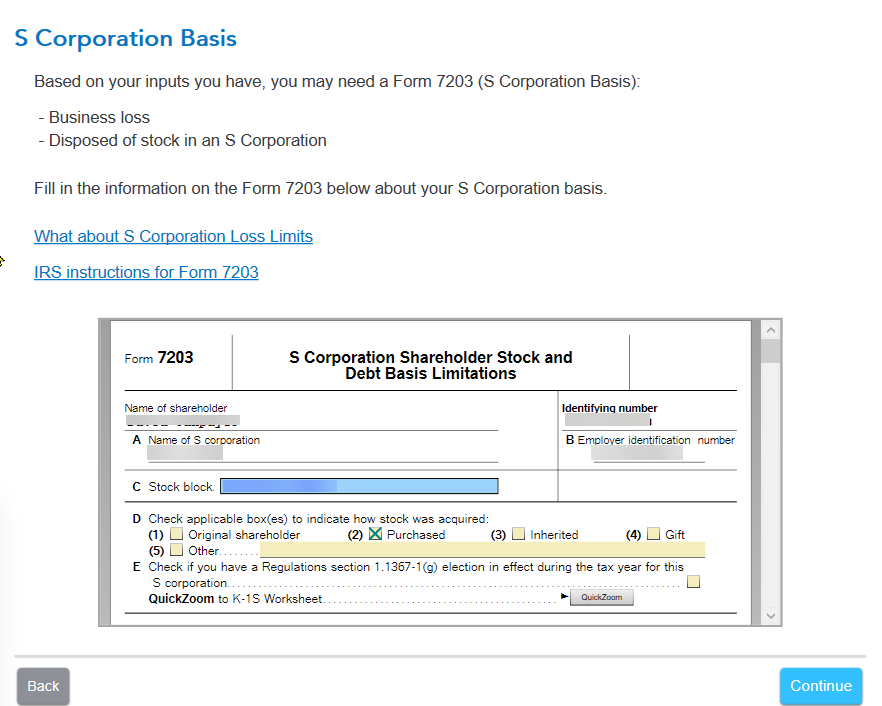

You may wish to return to the K-1 topic and review your entries for Form 1120S Schedule K-1. At the end of the entries for the K-1 boxes is a page "S Corporation Basis" that presents a sub-form with Form 7203 for you to complete.

If you're using TurboTax Desktop, you can complete this form using Forms Mode (Ctrl+2 or Forms>>Open Form).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17621839383

New Member

crevitch

Level 2

chris-rains

New Member

TarHeelAlan

Level 1

michael_dunne

New Member