- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Hi there, I am unable to file my tax return because I cannot delete Form 2441. I use the desktop version and have followed the advice of other posts on here. As soon as I delete the form from the forms section, it IMMEDIATELY reappears. I have tried entering the information but since my husband did not have an income and was not disabled or a full time student, we are not eligible for the credit. I just want to submit my taxes but Turbo Tax will not let me delete the form. I actually even tried re-doing my entire tax return from the beginning again and I still got the same error. What do I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Go to dependent care questions and find

Did you pay for child and dependent care in 2022?

Mark it Yes and it will take you to the questions that you need to change to get rid of the form. Sometimes in TurboTax you have to put the wrong answer in order to get to the part that will correct an error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

If you are using the TurboTax software installed on your personal computer -

Click on Federal Taxes (Personal using Home & Business)

Click on Deductions & Credits

Click on I'll choose what I work on

Scroll down to You and Your Family

On Child and Dependent Care Benefits, click on start or update

Click on No for Did you pay for child and dependent care in 2022?

Now click on Forms in the upper right of the desktop program screen (Windows)

In Forms mode locate the Form 2441 on the left side of the program screen. Click on the Form 2441 to open the form. Click on Delete Form at the bottom of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Do you have an amount in box 10 of your W-2 for dependent care benefits? If so, this is going to prevent you from deleting the form 2441.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Yes, I do, and so since you are probably right as to why this won't let me delete the form, how do I correct the part of that form that is missing the amount of qualified expense I spent, even though I'm not eligible to claim that tax credit? The line is blank and I can't figure out how to fix it. I can't do an override because it tell me I can't. It does have the $ that is listed it box 10 of my W2 on the part of the 1040 that is income. So I am being taxed appropriately, but I can't get rid of the error on form 2441. Any clue on how to fix that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Complete the 2441 section completely ... if you had a day care provider the year before you need to remove them if that information was forwarded.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

I have honestly tried fill out thr required parts of form 2441 and it lets me add the preschool provider name, address, etc, but it does not populate a $ about for the amount of qualified expense in Part 2d, where it says "Qualified expenses you incurred and paid in 2022 for the person listed in column (a)", and nothing is populated in that part either like name, social, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Contact TurboTax support and speak directly with a TurboTax support agent concerning this situation.

See this TurboTax support FAQ for a contact link and hours of operation -https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

I do not see where this exact question is being asked. When I go back to Deductions and Credits and look at the "You and your family" section, I click on "visit all" and this question is not listed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

@volleybeck24 wrote:

I do not see where this exact question is being asked. When I go back to Deductions and Credits and look at the "You and your family" section, I click on "visit all" and this question is not listed.

Delete answer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

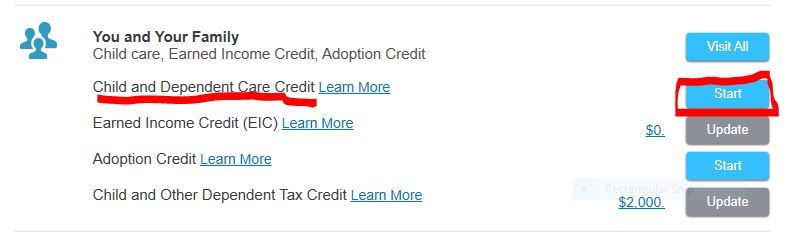

@volleybeck24 I posted an incorrect answer and screenshot. Please ignore the first answer.

Under You and Your Family click on the start or update button on Child and Dependent Care Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Thanks, but I have gone here about 50 times and it always does the same thing: it tells me we cannot claim the credit and moves on. I am not sure if you have followed my other replies to other comments and suggestions but I now realize I do need to keep this form but Turbo Tax will not let me fill in the fields of the form it says I am missing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Since you have information that is creating the form, you need to remove that information before deleting it. The only way to do that is to answer Yes to the question about paying for child care and that will bring up questions that you will answer to remove the form. You don't need to edit the form, just to eliminate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I delete unnecessary Form 2441 in TurboTax Desktop? It immediately reappears!

Okay, I'm posting this result in case anyone else has had this problem. I finally figured it out. I went to the Dependent worksheet and it allowed me to enter the amount paid for childcare expenses to be entered on that worksheet, and once I did that, the information flowed to form 2441 and now I CAN FINALLY FILE MY TAXES!! HALLELUJAH! Thanks for everyone who tried to offer me advice.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aousuome

New Member

volleybeck24

Returning Member

jakewho1

Level 2