- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic ...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Since you are not able to claim the Dependent and Care Tax credit on your federal return, you are also not able to claim it on your Hawaii return.

To bypass the error on your Hawaii return, you can elect to forfeit or carry forward any of the dependent care expenses over the amount that was reported on box 10 of your W-2 form for child care benefits.

To do this, log back into TurboTax and proceed to your state interview section.

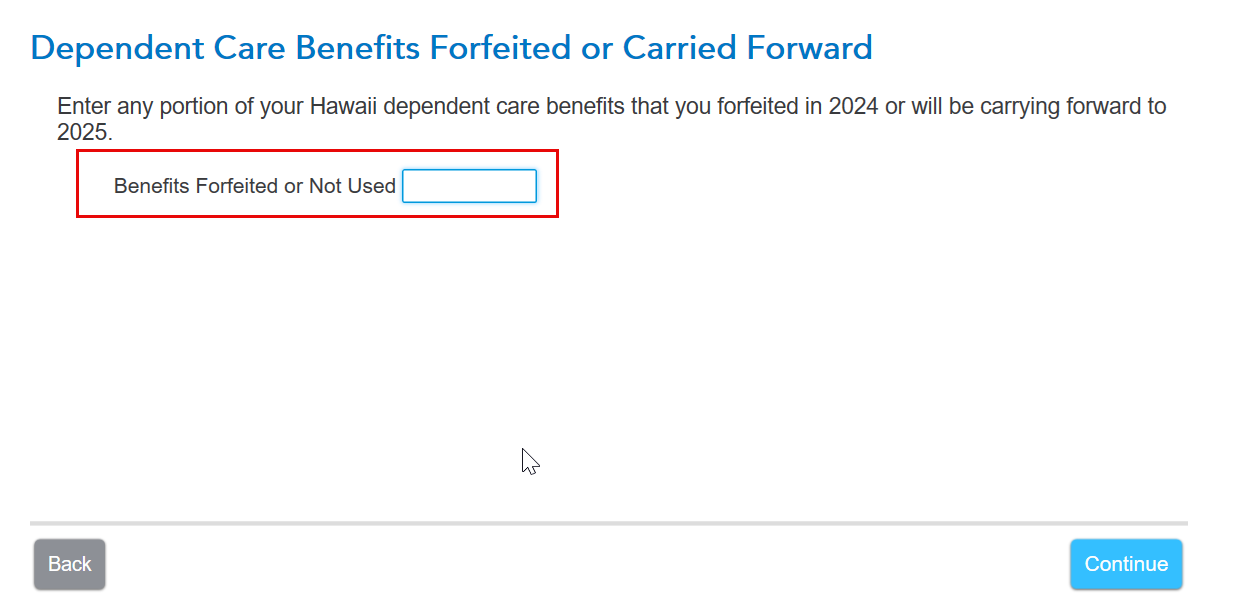

Proceed through the interview screens for Hawaii until you see the screen titled "Dependent Care Benefits Forfeited or Carried Forward." Enter the amount you will not be using on this screen.

After you enter the amount, select Continue. Proceed through the screens and the error message should no longer appear.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

I followed this advice, and it didn't work at first - but then I restarted TurboTax and it installed an update. Then it worked. I hope this patch helps others in Hawaii as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Thank you very much @JotikaT2 this was very helpful and I was able to successfully e file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

I am having this same issue.

I cannot e-file my Hawaii return due to schedule X. When I print all files necessary for filing, it does not print schedule X.

I am not trying to claim a credit. We have only one "working" parent. We had unused money in an employer account that was for preschool. It's not very much so it doesn't really affect anything.

I have created a token: 475 028 895-88843949.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

If you're using TurboTax Online, try clearing your Cache and Cookies. Here's How to Delete Forms in TurboTax Online.

If you're using TurboTax Desktop, go to FORMS and look for Schedule X in your list of Hawaii forms. Open the form and click 'Delete Form' at the bottom.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

I have the desktop version.

Deleting the form does nothing. It is regenerated the next time the program reviews my return. I have the latest updates. Each time I have checked on this over the last couple months a week or two apart TurboTax has downloaded updates and I am hopeful that it will finally work. I tried deleting the state and redoing it as was recommended and the form comes back. I made a post about this over a month ago and it was deleted after a couple of helpers fixes didn't work out. I uploaded my return as someone else instructed to do hoping for some specific fix to the issue. I have been using TurboTax for over a decade and if I can't get this sorted I'll be shopping around for next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

All you need to do is enter 0 during the review. Even if you delete it, it reappears because you have an amount in Box 10 of a w-2. But since you are not taking a credit, it does not get e-filed with your return. The missing zero on Sch X, Part ll Smart Wks line a needs a zero to pass the error check.

When going through the review, enter 0, then scroll down and click on Continue. Then e-file your return. @ScottyB81

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

I have done this many times. Each time I would retry the check would catch this. I would enter zero and it would proceed to tell me I cannot efile. I have deleted the schedule x, deleted the state return as others have said and redone it. Each time the review regenerated schedule x and asked me for that input which I entered zero. Anyway the point is moot. I have filed via the state website on my own.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

drbdvm81

New Member

toddrub46

Level 4

karin.okada

New Member

kip16

Level 1

kip16

Level 1