- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Gross Proceeds Not Matching

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross Proceeds Not Matching

TurboTax Premier 2022

I've imported all my 1099B information from multiple accounts. When I add up the gross proceeds shown on Schedule D it is well below what I have entered. Adding the gross proceeds from the 1099-B Worksheets has it right. So I'm thinking I can't just add the numbers in column D of the schedule D? I thought I used to be able to do that. What am I overlooking? Or is this a big problem?

Thanks for any help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross Proceeds Not Matching

If the numbers from the worksheets do not transfer correctly, to Schedule D, clearly that is a problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross Proceeds Not Matching

Any suggestion as to how to resolve the problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross Proceeds Not Matching

You should be able to verify that the numbers downloaded have transferred to the Schedule D Capital Gains and Losses.

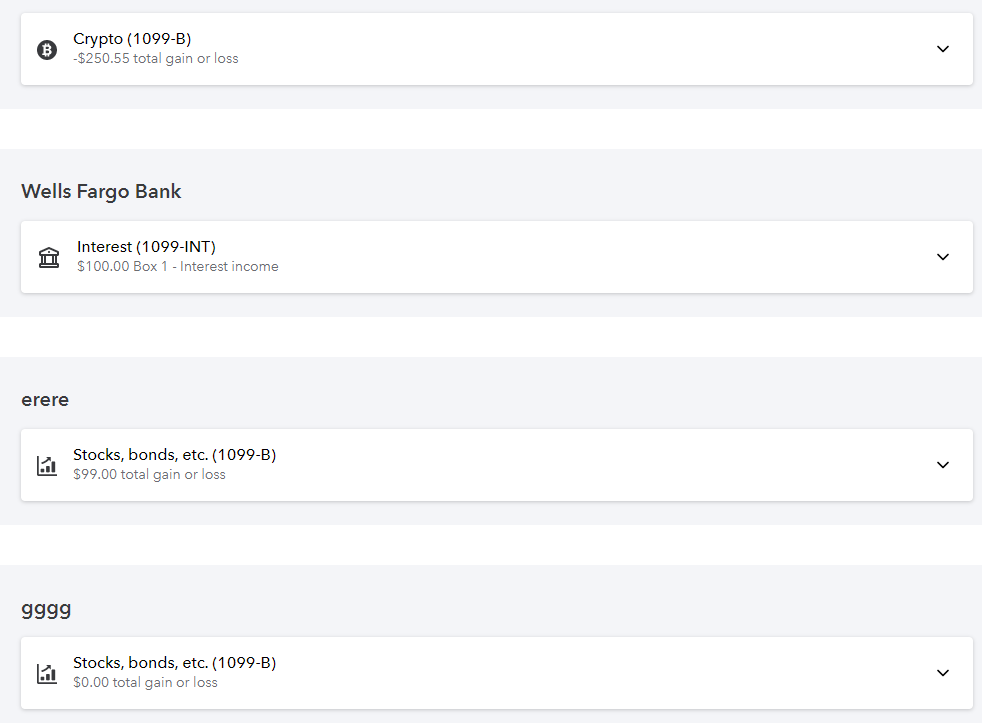

Each 1099-B import creates an individual entry that may be reviewed.

Click the down arrow to view the Proceeds imported and the number of line entries. You are able to compare these to the paper copy received or the copy viewed online.

Review and view the tax return at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets after you have paid for the software.

In the Desktop versions, you can look at the tax return by clicking FORMS, or by viewing the PDF through the Print Center.

Those same numbers should transfer to the two (d) Proceeds (sales price) entries on Schedule D.

Post here if you see something different.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17715173406

New Member

bkgrant10

Level 3

jcakes09

Level 1

john_cross

New Member

dmcniff2

New Member