- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 8938 how to specify form and line

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

Hi tax experts,

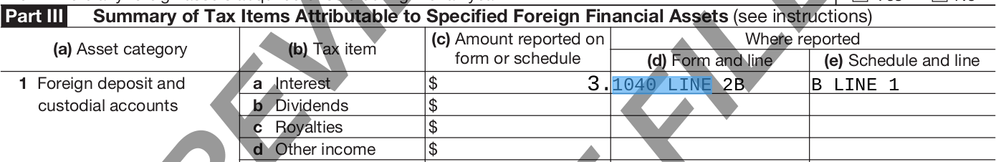

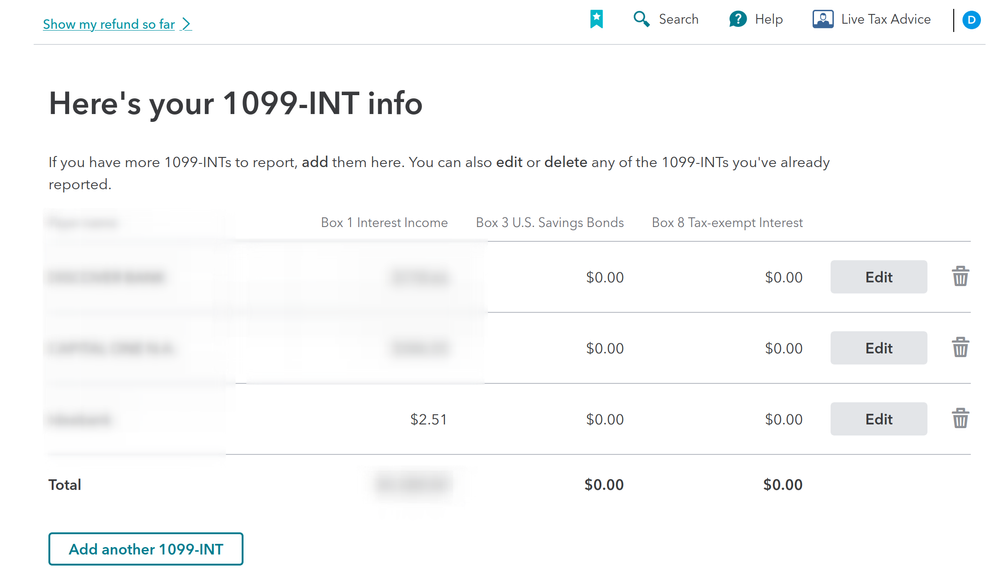

I added 1099-INT manually with 3$ interest from a foreign bank. It appeared in Form 1040 Schedule B.

Now in Form 8938, I need to specify Form and Line or Schedule and line.

On Form 1040 Line 2b I have a total interest I got this year (from foreign and US banks).

On Form 1040 Schedule B Line 1 I have foreign bank (and US banks) interest listed as well.

Should I specify both in Form 8938 Part III Line 1a Column (d) and (e)?

Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

It depends. To clarify, is the only foreign-source income from the 1099-INT? Do you have other foreign assets or accounts that would need to be reported on a 8938? If so, how much and what type? We need to find out first if there is a 8938 FBAR reporting requirement. Here is some more information from IRS in this published link .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

> is the only foreign-source income from the 1099-INT?

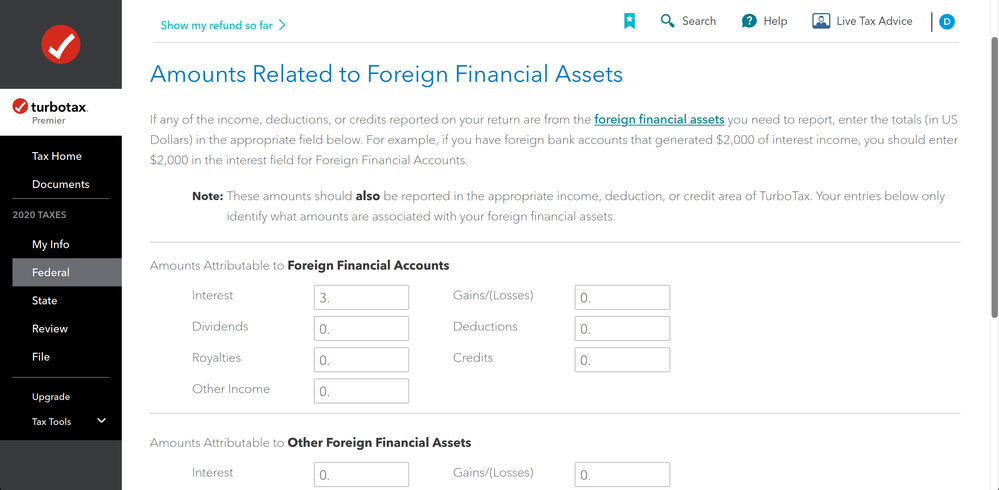

I have a few bank accounts (say A1, A2, A3) in one foreign bank (B1) with a very small APY. It produced interest in EUR and USD each month. I converted this interest using the exchange rate on https://www.fiscal.treasury.gov/. Then summarized it and added it into 1099-INT where is payer's name is B1.

This interest appeared on Form 1040 Line 2b and inside Schedule B Line 1.

> Do you have other foreign assets or accounts that would need to be reported on an 8938?

Yes, I do. I have a few accounts A1, A2, A3 in bank B1 that produced $3 interest. Also, I have bank accounts, say A4, A5, A6 in bank B2 that didn't have APY. I reported them in 8938 and going to report in FinCEN 114.

> We need to find out first if there is an 8938 FBAR reporting requirement.

I checked the requirements and I need to report both. And I did that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

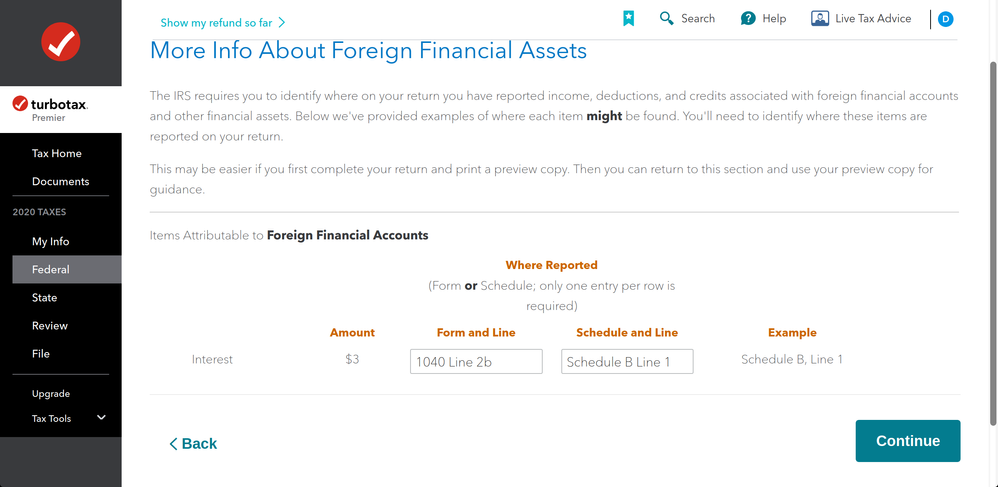

Yes. here is how you will report the $3 on your 8938. You should specify it for all of your $3 transactions, or put them in as a combined total if you have many of them. Now I am going to assume you have a Turbo Tax Software version in front of you and that you also have a 8938 form reading to record.

- First record your information in the 1099-INT and record the $3 interest payment (or combine payments if all from the same broker). Once you have done this, the amounts will appear on line 2b, on the form 1040 and line 4 on Schedule B.

- To report it on the 8938, Go to part 111. In Box 1C hit the plus sign to the left of the box and under reporting details, Type in 1099-INT and the amount of $3. 1D type in 1040 line 2b 1E type in Schedule B Line 4.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

> 1099-INT and the amount of $3

So I need to replace "$3" as on my screenshot above on "1099-INT and the amount of $3"?

But I can't do that, because the field is numeric-only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

No. Here is how to enter.

- Working in the 8938, go to part 111 1C,

- Right click inside the box, you should have a plus arrow to the left of the box, you will hit that plus sign to provide supporting details.

- When you select it, there is a dialogue box where you will enter the description 1099-INT and the amount $3. Here is what that looks like.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

This is not available in Online/Web version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

It depends. In he web version, type in 8938 in he search bar with the magnifying glass. After you type that in, hit continue. When you see the link that says jump to 8938, select that and you can begin working on your 8938.

Sometimes the Turbo online may have limited functionality and if so. You may need to switch to the downloadable software version where you are able to enter directly into the form itself.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

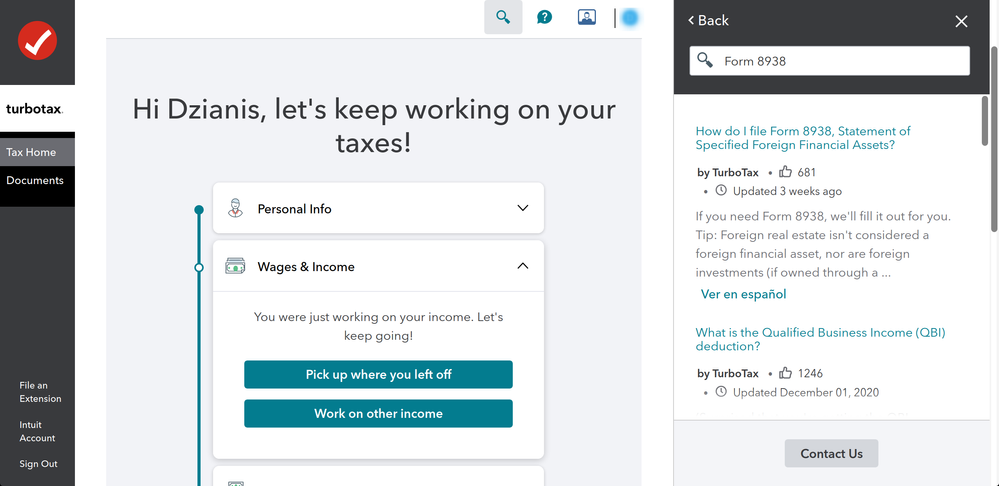

Sorry for that, but if I click on magnifying glass and type "Form 8938" I see only help articles.

It seems that this description is not displayed in Form 8938, it is just for filler convenience, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

Just type in "8938", not "form 8938." See if that helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

The same. Just help articles.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

Did you type in 8938 without the quotation marks?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

Sure, I haven't used it when typed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

It depends. If form 8938 received categorized each income, you may need to enter the income accordingly on your income tax return. If the return wasn't transmitted yet, you may still edit the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 how to specify form and line

How did you enter the 1099-INT manually for a foreign account? Thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nyjerr

New Member

SeaBrat

New Member

mkctt

Level 3

jh73

Level 3

vlebovici

New Member