- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 5695 processing error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

I did this as well and am awaiting acceptance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

Hi, thanks. And I tend to agree, and I'm not sure why Turbotax does not provide a better description of the error and where it is occurring when it is rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

What an excellent description of the ambiguity! Thanks for sharing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

Another option...I efiled WITH half the energy credit just said sole property owner after redoing form 5695. Accepted. Now doing a paper amended return correcting form 5695 and added a statement. No change in tax liability and manageable paper to mail to go on record.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

do you still need to file an amended return when your first return was rejected in the first place?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

Thank you all for your inputs.

I reviewed the section on energy credits, changed the joint occupancy question, then line 32 on the form became unchecked. Resubmitted the return and was accepted within an hour!

This community is awesome!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

Amending is always an option.

But I don't see where indicating the filer is the only owner in the TT input form translates into the exact same on form 5695 since this form uses the term occupancy for box 32a which is checked or unchecked depending on response to said owner question in TT.

There is another part of form 5695 that does specifically use the term owner. But that is under Part II Section B ("Joint Ownership of Qualified Property") where expenditures on qualified property are shared with a neighbor to benefit each of their main homes. But in this case owner relates to neighbor's ownership of shared energy property expenditure and not actual home ownership.

So it seems there are two situations where apportioning credit is needed. 1. Where neighbors in separate homes that expend money on a shared qualified energy property. 2. Where multiple occupants in the same home have expenditures and need to apportion credit accordingly. But #2 does not specifically say anything about ownership that I can see.

It seems like for TT to guide a taxpayer through this form requires more questions and sub-questions before box 32a should be checked or not.

Everyone should check this out for themselves. I am just pointing out what I see and think.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

No rejected return alone requires amended return. I did one to correct the single occupany to joint with no change in tax liability. I included the missing statement explaining that and how the energy credit money was split and with whom (including SSN) since it could not be corrected or provided electronically, I'm mailing the amended return that Turbotax can generate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

I suppose one can follow this route or do not select joint occupancy so the efile successfully completes and be ready to provide an explanation with any needed receipts backup should if the IRS contact you with any questions later on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

"Line 32a

Joint occupants of a home who are claiming the energy efficient home improvement credit must check the box on line 32c and attach a statement explaining how they allocated the credit among each occupant".

As the instruction state, only who are claiming the energy efficient home improvement credit must check the box. Therefore, the other energy credit does not have to check the box? Why do we have to explain to them if you only file for other energy credit?

I am very confused!!!

Anyway, thanks for all the inputs related to form 5695

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

As of April 1, Form 5695 box 32. a comes pre-checked. It cannot be unchecked. I looked at a blank form and it is checked as well. I don't have joint occupancy and because I can't uncheck the box it's not accepted by the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

How did you override. I cannot uncheck it. I tried deleting the existing form and redoing, but even the blank form shows that it's checked and unchecking doesn't work there either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

Mine worked after deleting the form and starting over saying I was sole owner. That's why I did an amended return w a statement after getting accepted. I did it with the step by step and not the form view.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

The frustrating thing is when you call. Intuit they can't tell you that Form 5695 is going to be fixed April 4 meaning that box 32a permanently checked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 processing error

Both credits use the same form @HaiQ

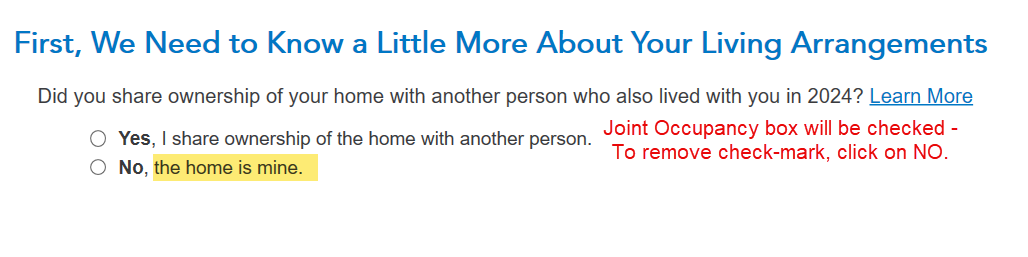

At the beginning of the Home Energy Credits section, you are asked about the home the credits pertain to. If you do not indicate that you are the sole owner of the home in question, the box will be checked. To remove the checkmark, you need to delete Form 5695 from your return and go back through the step by step interview in the Deductions & Credits section.

On returns, other than Married Filing Jointly, the first question is:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17721267754

New Member

PCUTTS11315

New Member

user17719627076

New Member

F51TT

New Member

terrafogorn

Level 1