- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 2555 self-employed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 self-employed

Hi,

For form 2555, foreign income exclusion, if I am self employed, where do I put my income, and do I report my gross receipts or net income?

The instruction for form 2555 is confusing too. It is not helpful for self-employed. I have seen calculation examples for gross receipts over the foreign income threshold but cannot find any for below the threshold.

I know that your expenses and the 1/2 self employed exclusion has to be added on, as you cannot claim for them twice.

For example, if my gross receipts are $95K, and $27K expenses, then my net income is 63K. So do I report 68K as my income on form 2555, and which section, because there only appears to be one section for wages and salaries, which I thought was for employed individuals only.

Or do I report 95K as my income and then on line 44 report my expenses (27K+4,8040.47 Self employed 1/2 tax)? This would give a exclusion of 631959.53.

Since my net income on form 1040 shows as 68000, I would deduct the 631050.53 and the 1/2 self employed tax on the next section to give 0 income tax.

Is this correct or did I do this wrong?

I know that self-employed tax is due at then end, its just the form 2555 for self-employed that is confusing me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 self-employed

@Workbank , assuming

(a) that you are US person ( citizen/ Green Card ),

(b) that you are residing in a country which has tax treaty with the US

(c) that you meet the general requirements of Physical Presence Test;

(d) that your test period for the Physical Presence Test is the calendar year 2020 (i.e. 01/01/2020 thtough 12/31/2020 )

(e) that you wish to exclude foreign earned income

(f) that you are self employed ( or a wage earner and employed by a local entity )

Then you report your gross self-employment ( and/or sole proprietor ) on Schedule C as if you were operating in the USA. Thus you report your gross of 95K ( your example ) and expenses of 27K ( your example ). This will allow TurboTax to fill out the Schedule C with a net income of 68K and a Schedule-SE for SECA taxes approx 10K. This will now flow to form 1040 showing an income of 68K ( net income ) as business earnings and also an adjustment of 5K ( 50% of the SECA taxes ) i.e. your AGI would be 63K ( 68K less 5K ). Your taxable income would be 68K less your standard deduction ( if that is what you choose to use ).

Thereafter you choose "foreign income and exclusion " under "less common incomes" category. Here you say that you have foreign income you want to exclude -- the income is 68K ( the net foreign self-employed income ) -- this will lead to form 2555. Make sure that the form 2555 shows the gross income for exclusion as 68K ( per your example ).

More I can do for you ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 self-employed

If I show 68K as the income, when it comes to the calculations at the end, it will ask me to deduct my business expenses and the 1/2 SE tax deduction to reduce my foreign earned income.

So line 44 would be the 1/2 SE deduction + expenses which is roughly 37K, thus I would only be allowed to claim 31K as foreign income exclusion, leaving a balance of 37K income on form 2555, minus the 1/2 SE tax deduction which leaves me at 32K income, which would then be taxed?

This means even though my gross income is less than 100K, I would still be taxed on my net income because I have high expenses?

I am confused.

The examples seem to say you are supposed to show gross income and then on line 44 is when you deduct the expenses and the 1/2 SE tax to get your foreign income exclusion.

I don't know what line the SE income goes on as well, since the first line says wages and salaries. The second line is for businesses that have capital investment, which doesn't apply to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 self-employed

@Workbank , I do not understand your logic -- please read again my response and let TurboTax do the work -- it will do as I said i.e. Schedule-C, Schedule-SE, form 1040 business income and adjustment to gross income ( of half of SE tax ). If you are trying to do this a different way --I humbly suggest you seek the help of tax professional. Please trust my advice --- I have been a tax professional for many many years.

If you need more help -- (a) see a tax professional familiar with foreign self-employment or (b) send me a private mail with gory details of your situation

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 self-employed

I have some questions for foreign income in Schedule C. There is no 1099-K in foreign country obviously. All revenue is through foreign currency credit card.

My question is if most of the transactions are through credit card transactions and with no 1099-K, how do you enter those credit card payments as income in schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 self-employed

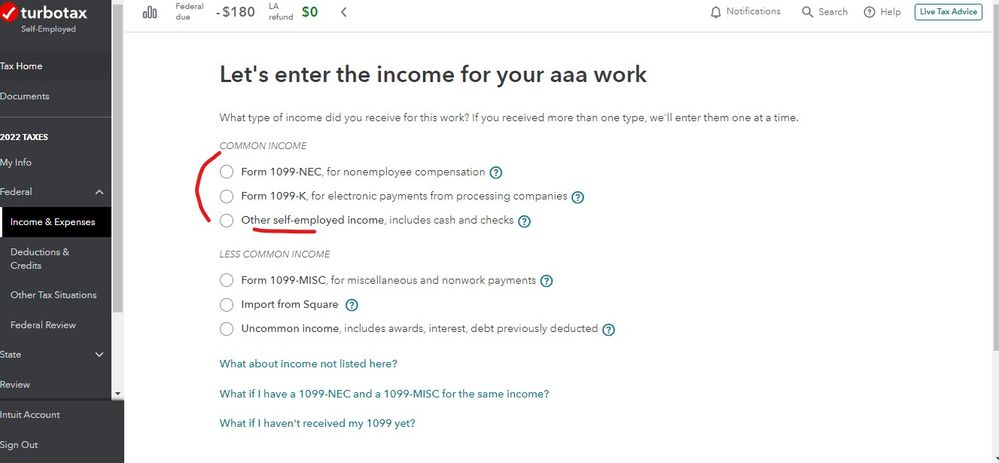

Simply enter the income as OTHER SE :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 self-employed

Thanks. I wanted to confirm 👍.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taxation13371337

New Member

capelani2020

New Member

shifi-reif

New Member

WillieD

Level 1

crash-1996

New Member