- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 2210

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210

I had Box A marked. My situation that caused the box to be marked was that the previous tax year I had to take out more than my RMD from my IRA. This caused my tax to a lot higher than normal. Then in 2018 I did not need the extra money so I did quarterly payments less than the program recommended but more than I knew my taxes were going to be. That caused the box to be checked so I went and wrote an explanation by clicking the "EXPLAIN" box.

I e-filed and my file was accepted by both Federal and California.

I hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210

It is a bug, but I called Intuit support and was able to get the issued resolved and my 3rd E-file attempt was successful.

The rep explained that while many may be having similar issues - the fix is different based on the individual.

In my case - when we reviewed (via Step by Step) under PERSONAL > OTHER TAX SITUATIONS > ADDITIONAL TAX PAYMENTS > UNDERPAYMENT PENTALTIES...the tax due brought in from the 2017 listed an amount, but since we paid a penalty in 2017, the 2017 liability should have shown as zero. Once we changed that - the need for Form 2210 was removed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210

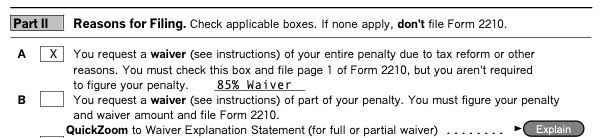

After twice being rejected because of Form 2210 Part II A 85% waiver request. I was able to Override (right click on x) the Part II A box as others have explained in Google search of TT Form 2210 rejections. Did a review of Fed return and resubmitted. IRS accepted by return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210

Do you notice that you can't actually talk to someone at TurboTax, or send them and email? I experienced a similar bug. I’m using TurboTax Deluxe on a Windows 10 desktop. After entering my data, I found that my withholding amounts were about $5,000 shy of my tax obligation. However, because of the estimated tax payments I made I had really paid in about $700 more than I owed. None the less, TurboTax automatically filled out Form 2210, Underpayment of Estimated Tax, and also checked Box A requesting an 85% exception waiver. I tried to uncheck that box but it would not let me do that. I went ahead and submitted my tax filing and it was rejected by IRS with the following error: ”F2210-003 - If Form 2210, Part II, Line A checkbox 'WaiverOfEntirePenaltyInd' is checked, then [WaiverExplanationStatement] must be attached to Form 2210.” So, my next step was to fill out the Waiver Explanation Statement, which I did, then resubmited the tax return. That too was rejected by IRS with the same error message as before. My next step was to see if others had the same issue. They did, and one person suggested right clicking on Box A and selecting “override.” This allows unchecking the box. Then he suggested doing the same with the box saying “Yes. You qualify for the 85% relief Waiver”. I did, and then I deleted the “X” in that box as well. Form 2210 then disappeared with the forms being submitted, and on my third attempt IRS accepted my tax return. TurboTax needs to fix this glitch. It was frustrating and difficult to try to find out why my return was being rejected, all because TurboTax was automatically submitting Form 2210, which I did not need to submit. Perhaps next year I’ll return to H&R Block software!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210

first, just because you have a refund due and you made estimated taxes during the year doesn't mean there isn't a penalty due. The Form 2210 looks at the TIMING of when you made those estimated payments to determine the tax. Look closely at the form

2nd, the IRS changed the form in mid-January creating a 'cluster' for TT to re-program. Agreed a poor customer experience. No excuses. however it appears TT is doing what the IRS ordered, so I wouldn't be so fast to shoot the messenger......

Please review the Turbo Tax post from a week ago (further back in this same thread) by the Moderator..................

[Edited: Link invalid]

FORM 2210 Part II Box A E-file Reject

Rejection code from the IRS: If Part II Box A is checked and you are eligible for the 85% Waiver, your return cannot be electronically filed.

Please review Instructions for Form 2210 from the IRS website.

To e-File with Box A checked in TurboTax Desktop, please look at this instruction per this [Link Invalid].

If you are in TTO, because there is no forms mode option, customers must print and mail their return.

This is the result of tax reform. We understand this is a pain point for customers and we continue to seek more clarification from the IRS.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210

My scenario exactly mimics yours but I use Deluxe on a Mac desktop computer. I could not right click so went with the explanation route and left A checked and y return was accepted. I had money coming back because of an excess of quarterly payments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210

Chris,

I found information on the TurboTax support site how to override an entry. They mention how to do it with a MAC as well.

- Click on the Forms icon in the upper right to switch to forms mode and open the form that contains the line item you want to override.

- Right-click the line item and select Override.

- On the Mac, choose Override from the Edit menu in TurboTax.

- Enter the value, which will turn red.

- Switch back to the interview by clicking Step-by-Step in the upper right corner.

To reverse the override, follow the same directions except choose Cancel Override in Step 2 (on the Mac, uncheck Override in the Edit menu).

When you run the final review, TurboTax will let you know if there are any overridden values in your return. If there are, you'll get an error message if you try to e-file your return.

Source is here: https://ttlc.intuit.com/questions/1899170-how-do-i-override-replace-an-amount-calculated-by-turbotax

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

imaranchkid

New Member

nitramxxx

Returning Member

robs462

Level 3

drbailey25

New Member

alimpich

Returning Member