- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 1116 3e - "Gross Income from all sources" is EMPTY not calculated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 3e - "Gross Income from all sources" is EMPTY not calculated

Loaded return from 2020, into TT H&B 2021, loaded OK, entered and imported all information from financial institutions, however, on the final CHECK return, it complains that

Form 1116 3e "Gross Income from all sources" is EMPTY, no value at all, the error is "Must be entered", however, not sure WHAT to enter 🙂

The return is for US citizen living abroad.. getting paid in local currency and trying to exclude some of that income using Form 1116... any way to cause TT to calculate/populate that field?

Thanks.

Nova.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 3e - "Gross Income from all sources" is EMPTY not calculated

The amount in form 1116 line A inside the "gross income from all sources smart worksheet" is inserted by TT. It appears that it is corrupted. I suggest that you delete the form and re-do the foreign tax credit interview. During the interview when you reach the screen with the header "choose the income type", at the bottom click on the "show relevant form" button and the form 1116 should appear. Scroll down to smart worksheet and you should see the gross income from all sources display an amount. If you do, then you can click on the button to close the form and continue from there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 3e - "Gross Income from all sources" is EMPTY not calculated

In Forms Mode, bring up f1116. Scroll down to the "Gross Income from all Sources worksheet." Put the pointer on the cell and right click. A box will appear. Click on " Data Source". Another box will appear listing the sources TT uses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 3e - "Gross Income from all sources" is EMPTY not calculated

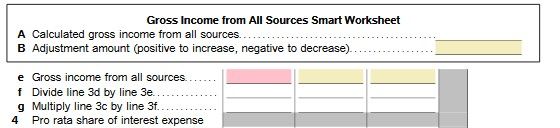

Thanks, the field is marked RED and is EMPTY, data source says:

Form 1116 (COPY 1) Line 3ea

Form 1116 (COPY 1) Gross Inc Adjustment

This is how it looks:

clicking on first link highlights row "A" in the small worksheet above, and right-clicking Data Source on it, shows a very long list of items to Sum, as you can see, the value is ZERO, but these rows definitely have values in them, not sure why it does not do the math, is the expectation for user to add up all these fields?

For reference this is the list:

~~

Line 3ea

Calculated Gross income from all sources:

This is total income before deductions and is the sum of:

Form 1040, lines 1, 2b, 3b, 4b, 5b and 6b plus

Schedule 1 (Form 1040), line 1 plus

Schedule 1 (Form 1040), line 2a plus

Schedule C, line 7 (all copies) plus

All gains reported on Schedule D minus Schedule D, line 11, Subtotal Line A(Form 4797, Gain from Part I) plus

All gains reported on Form 4797 plus

Schedule E, line 3 total plus line 4 total plus

Schedule K-1 Worksheet - Partnerships Box 16, Code B (if it has a value); otherwise income reported on line 1, 2, OR 3 plus any amount on line 4 plus

Schedule K-1 - Partnership Additional Information page 1, Box 11 section,Code A, line 1 (if positive) and line 3 and line 4 and Code I, line 5

Schedule K-1 Worksheet - S Corporations Box 14, Code B (if it has a value); otherwise income reported on line 1, 2 or 3 plus

Schedule K-1 - S Corporation Additional Information page 1, Box 10 section, Code A, line 1 (if positive) and line 3 and line 4 and Code H, line 5

Schedule K-1 Worksheet - Estates and Trusts, Box 14 Code B : Foreign Tax Information section, line 7 (if it has a value); otherwise income reported in Part III lines 5, 6, 7 and 8 plus

Schedule F, line 11 (all copies) plus

Form 4835, line 7 ( all copies) plus

Schedule 1 (Form 1040), line 7 plus

All positive income amounts on the Other Income Statement

~~

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 3e - "Gross Income from all sources" is EMPTY not calculated

The amount in form 1116 line A inside the "gross income from all sources smart worksheet" is inserted by TT. It appears that it is corrupted. I suggest that you delete the form and re-do the foreign tax credit interview. During the interview when you reach the screen with the header "choose the income type", at the bottom click on the "show relevant form" button and the form 1116 should appear. Scroll down to smart worksheet and you should see the gross income from all sources display an amount. If you do, then you can click on the button to close the form and continue from there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 3e - "Gross Income from all sources" is EMPTY not calculated

Indeed deleting the 1116 form "fixes" the issue after doing the interview again, HOWEVER, all HISTORICAL data is WIPED from prior years, so all carryover charts, are all EMPTY, one has to enter them from prior years but then it shows as "entered/override" data rather than "carried over" from prior tax files/prep...

Thanks anyways!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CalcGuarantee

New Member

tianwaifeixian

Level 4

gabbydean8

New Member

kat2015-

New Member

Dliotta

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill