- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turb...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

IRS form 8960 Net Investment Income Tax can apply to modified adjust gross incomes that exceed a threshold amount:

- Married Filing Jointly or Qualifying Widow(er) is $250,000.

- Married Filing Separately is $125,000.

- Single or Head of Household is $200,000.

and apply to a variety of incomes detailed under Net investment income under the Instructions for Form 8960.

Have you reviewed this information to see whether you qualify to for this form? What does the message from TurboTax state? Please clarify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

I received a similar error. Below are the full details. Previous posts I searched (2020 chat) said I had to use the CD/downloaded version. I am using the online version. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

Form 8960 is under active investigation for receiving Error code: F8960-019-04. If this is what you are seeing, I recommend patience since mailing in your return would take months. They just finished the 2020 returns. You are filing 2022.

If not that code, address the reasons you listed. Your code statement above looks like you are MFS from an alien, and have NIIT due to your income.

If that is not your code and you would like to respond with more information for help, we would be glad to assist.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

Yes, that is the error code I am receiving. So I should go ahead and wait for a couple weeks and refile? I wanted to make sure there wasn't anything on my end that I was doing incorrectly. Sounds like it out of my control, and I just need to wait?

If I am still having the issue after 2-4 weeks, is there any other option besides mailing it?

Thanks again for the help and quick response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

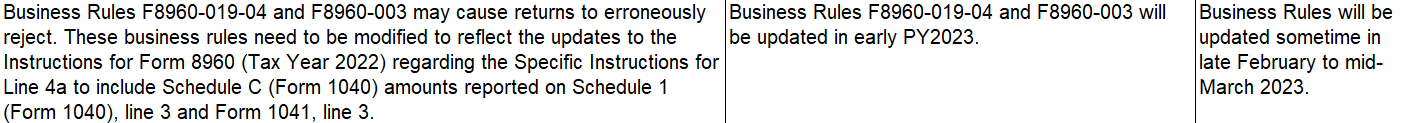

In late February to mid-March, it will be corrected by the IRS, this is a known issue to them rejecting returns, see list of IRS KNOWN ISSUES. Please wait for IRS to update, this is across the board with the IRS.

@ptplayer

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

I received the same error; however, I do need to use form 8960 and it appears that TurboTax software is pulling the wrong amount into Form 8960 Line 4a. So is this something Intuit intends to fix in the application?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

There's no known issue with line 4a of Form 8960.

However, it's important to realize that line 4 is populated with information from several sources.

According to Line 4a—Income From Passive Trades/Businesses, Rental Real Estate, Royalties, Partnerships, S Corporations, and Trusts in the Instructions for Form 8960:

Enter the following amount from your properly completed return.

- Schedule 1 (Form 1040), line 3.

- Schedule 1 (Form 1040), line 5.

- Form 1041, line 3.

- Form 1041, line 5.

- Form 1041-QFT, the portion of line 4 that’s income and loss that properly would be reported by a trust filing Form 1041 on Form 1041, line 5.

- Form 1040-NR, the amount properly reported on the attachment to your Form 1040-NR representing the amount that you would properly include on Schedule 1 (Form 1040), line 5, if you were filing Form 1040 or 1040‐SR and including income and loss only for your period of U.S. residency.

Please see the instructions linked above for more details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

Thanks for the added info. I just compared the Form 8960 instructions for 2022 vs 2021 and they changed which seems strange as it is in effect treating my Schedule C activity as "passive" income which is not accurate. Anyway, I saw the change in treatment from 2021 and thought it may be something with the software, so appreciate you calling out the instructions as I should have looked there first. Guess I get to wait on the IRS to fix the issue 😕 thanks for your help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

I am in the same situation and it will NOT let me delete the form. So frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

If you are being rejected for the 8960 and you do not need to include it then you need to go back through the interview and change your answers to the questions involving the 1095-A.

The IRS has a known error where they are rejecting returns for this when the form does not need to be included. If you're being effected by that then you should be patient. They are working on it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

😔Same situation. First year to exceed $250 and now there's this form that mistakenly inserts 'active income' in "Rental real estate, royalties, partnerships, S Corporations, trusts, etc". Argh. I really hope they fix whatever this is and get the ball rolling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

Since the last update, the TT desktop app displays a message related to this error which says we’ll be able to e-file on or after Feb. 19 (tomorrow).

Do you know if that is still true or not? Your reply says “they are working on it” which doesn’t sound like “tomorrow.”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

I just successfully filed my federal return- It appears the 8960xx error has been fixed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

File rejected due to form 8960 error, but I don't have a 8960 form as part of my filing. Turbotax says cannot fix, what do I do to correct this?

My return was accepted on 2/19 after previous rejection. I had the same issues as everyone here. I have a Schedule C basically business contractor profit that was not passive income. That amount was placed by Turbo tax on line 4a of 8960. (even though I have no real estate profits). Then on 4b is the exact same amount but a negative value canceling it out and it shows a "0" on 4c. There is also a negative amount on line 5a "net loss of disposition of property" but I had no property, the amount listed is my total capital gains loss from stocks this year. Line 5 of schedule 1 is blank. Line 17 on 8960 does have a positive amount which is 3.8% of my dividends and interest minus my capital gains losses which is the correct amount. That was auto placed correctly on my 1040. On my 8960 works form it listed the total amount of business income(profit) on the line "adjustment for business or trade income not subject to net investment tax". I did notice that a schedule E was autogenerated at some point, so I just deleted that form. What is interesting is that turbo tax showed no errors, and I filed, and it was rejected. On the rejection explanation it said try again on 2/19. So basically, I did not have to change anything other than deleted schedule E. This time it was just accepted. Everything looks the same as it did when it was rejected. So the IRS must have changed something. But wanted to update people that it did go through today for me. I still think it is unusual the way lines 4a and 4b are worded that a small self business income is listed there. Other advice to delete form 8960 is wrong. if you make over 250,000 married filing jointly and have investment or dividend income you have to do this form. I am not a tax professional at all. Just a TurboTax user. But it went through today for me with pretty much changing nothing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stephanie-dotson

New Member

cdtucker629

New Member

kragby

New Member

Vickiez1121

New Member

Vickiez1121

New Member