- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: file extension

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

file extension

Sorry for the basic question since I never do it before.

How easy to file extension with Turbo Tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

file extension

To apply for an extension in your TurboTax program you can do the following:

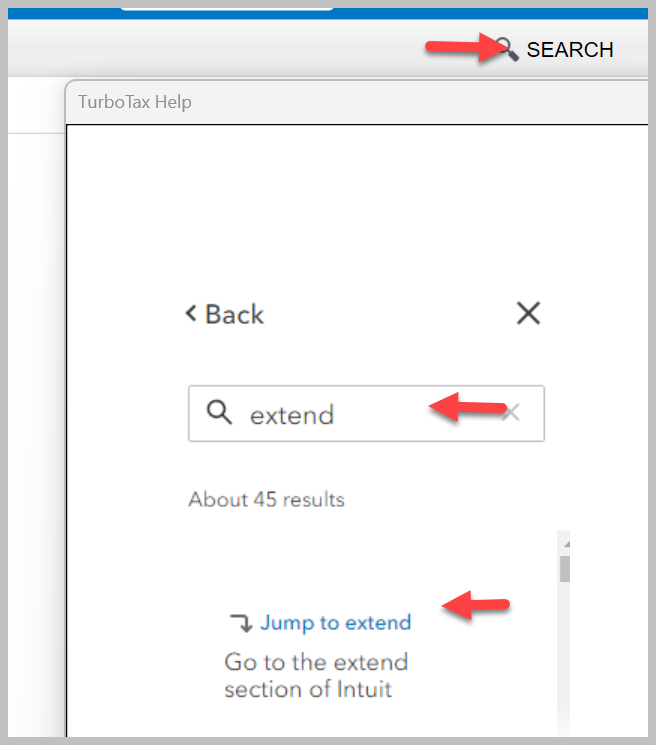

- Click on the search icon in the upper right of your TurboTax screen

- Type "extend" in your search box

- Click on the link "Jump to extend"

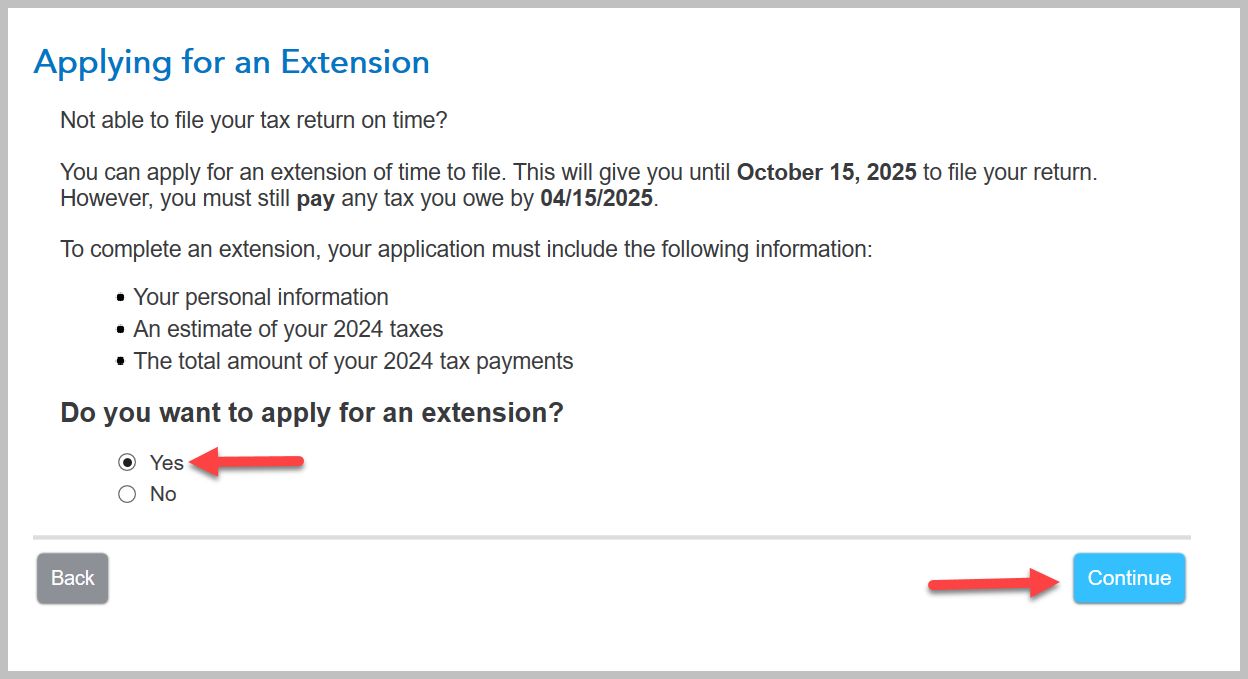

- Your screen will say "Applying for an Extension"

- Answer "Yes" to the question "program,"

- Select "Continue"

- Follow the TurboTax screens and answer all of the follow-up questions

Your screens will look something like this:

You can click this link federal tax extension to start an extension.

Click here for How to File a Tax Extension: A Step-By-Step Guide.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

file extension

2 follow-up questions:

I have multiple states (CT, NC, NY, NJ, CA). From what I understand, the federal extension is easy using the method you outlined below. But for state extensions, it looks like I need to handle them one by one, and in some cases, file directly through each state’s website. Is that correct — that TurboTax doesn’t automatically file state extensions when you extend the federal?

I’m expecting refunds from the federal and some states, but I owe taxes in other states. I know I need to pay what I owe by the April deadline, but for the states where I’m getting a refund, I’m assuming I have to wait until I file (likely in October) to receive those refunds — is that right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

file extension

1. Yes, individual states have their own rules for filing an extension. See this TurboTax help article for information regarding the different state rules.

2. Yes, you would need to file your state return before you could get your refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

file extension

That does not work. No "Jump to Link" offered

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

file extension

@AlreadyTaken wrote:

That does not work. No "Jump to Link" offered

For a federal extension

Click on Federal Taxes (Personal using Home & Business)

Click on Other Tax Situations

Under Other Tax Forms

On File an extension, click on the start button

For future reference - You can get an automatic extension from the IRS if you make an extension payment on the IRS website for Direct Pay on or before the due date of the federal tax return - https://directpay.irs.gov/directpay/payment?execution=e1s1

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17712095505

New Member

Keyairaphillips310

New Member

user17712053492

New Member

user17712064671

New Member

bobsentell

New Member