- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Estimate 2024 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimate 2024 taxes

I will be winding down my self employment this year and rely primarily on Social Security (self and spouse) and rental property income for 2024.

How do I estimate my tax liability (married filing jointly)and begin quarterly estimated payments?

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimate 2024 taxes

You can use TurboTax to estimate next year's taxes. You'll answer the questions about things like your 2024 filing status, income, and deductions, and TurboTax will prepare vouchers for you to print.

Estimate next year's federal taxes

Estimate next year's state taxes

Mail your payment along with the corresponding 1040-ES voucher to the IRS address listed on the voucher. Quarterly payment due dates are printed on each voucher.

Additional estimated tax payment options, including direct debit, credit card, cash, and wire transfer, are available at the IRS Payment website. You also have the option when you file your return to apply some or all of your refund to your estimated tax payments for the coming tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimate 2024 taxes

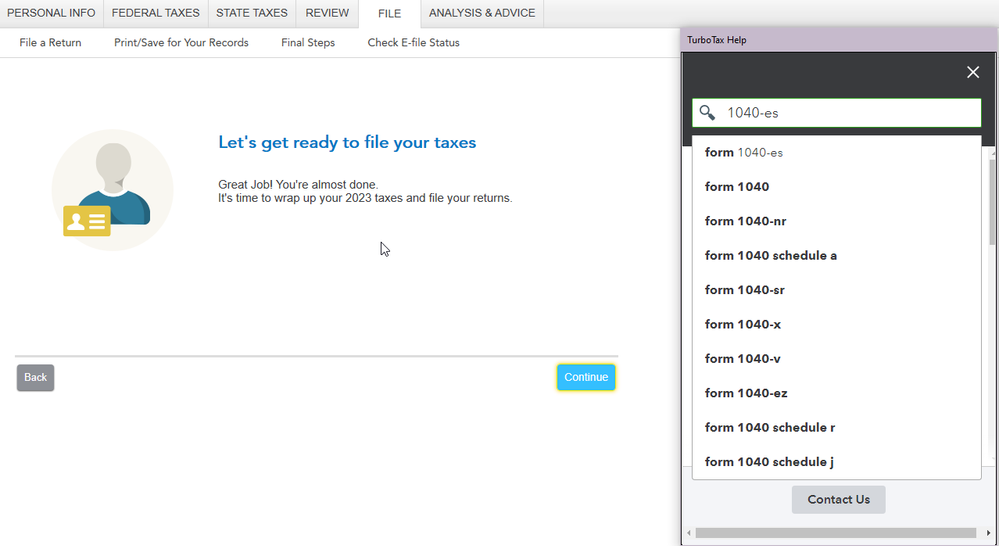

TT Premier 2023 does not respond as you have outlined in the reply. Searching for 1040-es opens a plethora of questions not related to the actual 1040-es form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimate 2024 taxes

Make sure you are all the way in your return BEFORE you search. Search the term 1040-es and hit enter - do not choose an item from the menu.

For TurboTax Online users: You should see the Federal Taxes and State Taxes menu on the left-hand side. If you are on the Tax Home page, you should click on Pick up where you left off. If you already filed your return, you will need to click on Add A State at the bottom of the Tax Home page to access your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimate 2024 taxes

I am as fully into the return as is possible - at the File tab. See image

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimate 2024 taxes

Ahh got it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimate 2024 taxes

Search the term 1040-es and hit enter - do not choose an item from the menu.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

danielle

New Member

bk1999

Level 1

42Chunga

New Member

joel_black_sr1

New Member

weafrique

Level 2