- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Estate Tax Final Return - Business 2022 will not create K1 forms

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

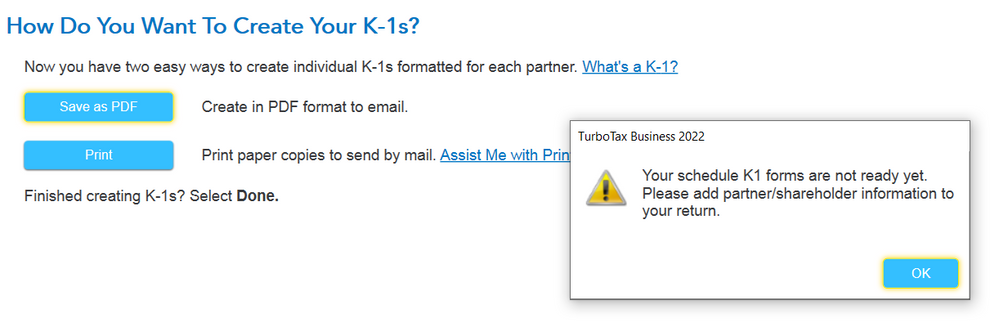

I have completed 1041 estate taxes. Since this is the final year for filing and beneficiary distributions were made, I believe there are K1 forms to be created. The beneficiaries are included on other information, including the amount of distribution. But when I attempt to create K1, I get the message shown below.

What am I missing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

Are the figures on the K-1s not appearing?

If that is the case, enter Forms Mode and look for the Beneficiary's Allocation Smart Worksheet (see screenshot) and input each beneficiary's percentage of their share of the distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

If I go to forms exactly as you suggest, there are K1 forms for each beneficiary and the worksheet for them is filled out, complete with percentages. Can I simply print the forms from there, instead of having the program do it?

I checked them, saved them, and am still getting the partner/shareholder information. It's a simple return otherwise.

I've made sure the program is fully updated. I've run the error check with no errors. This is the only thing holding me back from completing and filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

You did start a 1041 return, correct? Make sure you didn't inadvertently start another type of return, such as a 1065 or 1120-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

Yes. Definitely 1041.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

You can absolutely print your K-1s in Forms Mode, but you might want to contact Support for this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

It would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

At the top menu in the black line at the top of the page go to Online.

- From the menu, select Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

Token Number: 1055737

Thank you. I'm sure it's something I'm doing, but I appreciate someone taking a look.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

You can manually enter a K-1 by doing the following:

TurboTax CD/Download

- Click on Federal Taxes > Wages & Income [In TT Self-Employed: Personal > Personal Income > I'll choose what I work on.

- Under Other Business Situations, click on the box next to Schedules K-1, Q.

- Click Yes on the next screen, Schedules K-1 or Q.

- On the Tell Us About Your Schedules K-1 screen. Click on the Start/Update box next to Partnership.

- If you have already entered K-1 information, you will see the Partnership/LLC K-1 Summary screen. Click Add Another K-1 to enter your information (or click on Edit to continue with the existing form entry).

- If you haven't started entering K-1 information, continue through the screens, entering the requested information.

TurboTax Online

- Click Wages & Income.

- In the S-corps, Partnerships, and Trusts section, click the Start/Update box next to Schedule K-1.

- Continue with step 4 above

You can reach out to Turbo Tax for support. Click here for information on contacting Turbo Tax Support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

@LindaS5247 wrote:You can manually enter a K-1........

@lkhightower is in the process of preparing a 1041 for an estate with TurboTax Business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

There is an issue in TurboTax Business 2022 with creating the K-1s on the Distribute K-1s page on the File tab. To work around this and issue your complete K-1s you can follow these steps:

- Within your tax return use the Forms icon in the upper right to switch to forms mode.

- Scroll down on the left to the Schedule K-1 (XXX) you want to issue first and click on it.

- Click Print at the bottom of the preview window after you have ensured all appropriate fields are populated on the Schedule K-1.

- Here you can either print the form to paper or print the form to a pdf in order to email the Schedule K-1 if you wish.

- Repeat the process for the remaining Schedule K-1s you need to issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

I am having exactly the same problem. Frustrating.

Jim Hoge

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

It is frustrating. While I appreciate the assistance here and have managed to print out my K1 forms via the FORMS area, I have to say that for a program that's far from being cheap, this issue should have been fixed by now. It was not addressed in updates to the program.

I shouldn't have to pay for a tax program and then have to come here to find a workaround in 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

Whoever worked on this for Turbo Tax doesn't understand how Estate distributions work.

Assets are accumulated in an Estate Account and then distributed. The Turbo Tax program appears to be thinking the distribution is only related to the activity which occurred in 2022. Actually, most of my assets were accumulated in 2021 and not all of them were taxable. Turbo Tax FAILED!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estate Tax Final Return - Business 2022 will not create K1 forms

It would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

At the top menu in the black line at the top of the page go to Online.

- From the menu, select Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17557136899

New Member

c0ach269

New Member

Newby1116

Returning Member

bpscorp

New Member

stays

New Member