- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: ESPP Tax Question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ESPP Tax Question

Hello,

I've 5 different ESPP lots that I've sold this year. Both had 15% discount (lookback) -

- Lots 1 through 4 - Qualifying disposition (they were acquired over 5 years ago)

- Lot 5 - Disqualifying disposition (acquired early 2023 and sold late 2023)

For #2, "ordinary" income was included in Box1 W2 as compensation income. Box 14 (DISQD) has this compensation income as well.

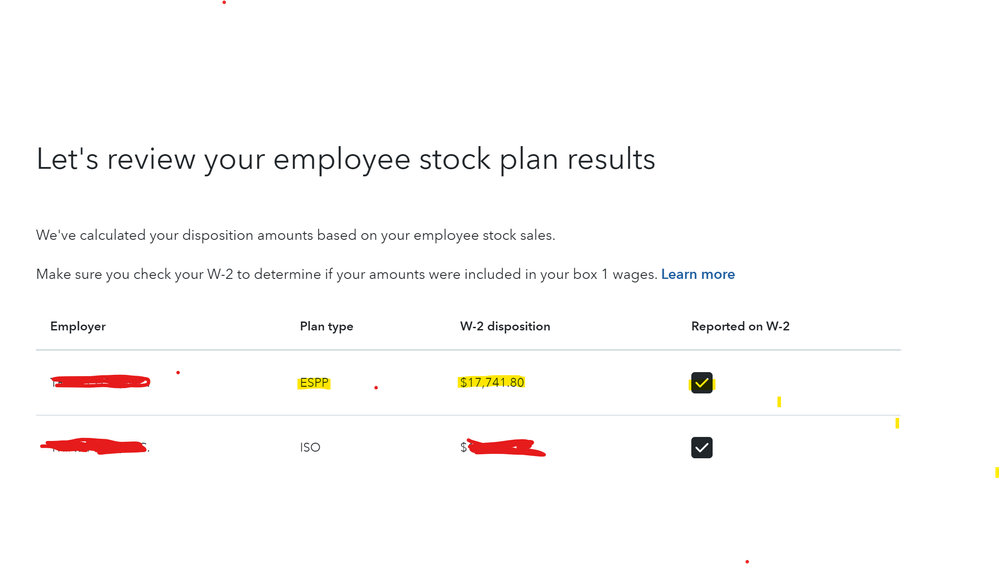

For #1, "ordinary" income was NOT included in Box 1 W2. After I go through the ESPP interview questions ( Wages & Income > Investments and Savings), TT is treating both 1 and 2 together to include the "total ordinary income" from both under "W-2 disposition" for ESPP plan type. If I check the "Reported on W-2" box here, it would be incorrect as the portion of ordinary income for #1 above (Lots 1 through 4) was never reported on my W2.

How do I fix this in TT?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ESPP Tax Question

I suggest you only enter lots 1 - 4 as Employee Stock Purchase Plan sales. For lot 5 report it without indicating it was employer stock/ESPP shares. Your cost basis in lot five is the discounted amount you paid, plus the amount of your discount that was included in your W-2 as wages. Entering like that will prevent the program from treating all five lots the same.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ovillanos

Level 1

alexco20

New Member

robadele

New Member

elijahrberry

New Member

Raytam

Level 2