- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Ebay sales started last year, the revenue $2000, the cost $3000, Can I report this loss? no b...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay sales started last year, the revenue $2000, the cost $3000, Can I report this loss? no business registered,no any forms received.

I’m a college student, I’ve some ebay sales last year, the revenue around $2000, the cost and expenses around $3000, Can I report this loss? I didn’t register a business,neither received any forms.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay sales started last year, the revenue $2000, the cost $3000, Can I report this loss? no business registered,no any forms received.

It depends. If you were selling personal goods, then the cost can be included only up to the amount of the sale.

If you were in the business to make a profit, even though there was a loss, report this income as business income & expenses. It is not necessary to register a business to report it on your personal return. TurboTax will use Schedule C to report this business activity.

To do this in TurboTax, follow these steps:

- From inside TurboTax, enter schedule c in the search box.

- Select the Jump to link in the search results.

For more information, see: How do I enter a 1099-K in TurboTax Online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay sales started last year, the revenue $2000, the cost $3000, Can I report this loss? no business registered,no any forms received.

Thank you for such a quick and kind answer! I really appreciate it!

If you are able to answer, there're more questions I was hoping to ask about:

1. It's not personal goods selling, kind of business sales, but I didn't received 1099-k from eBay, how to report it?

2. What kind of TurboTax product should I choose? Self-employed or Small business?

3. My parents has filed me as their dependent, am I still able to report this loss?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay sales started last year, the revenue $2000, the cost $3000, Can I report this loss? no business registered,no any forms received.

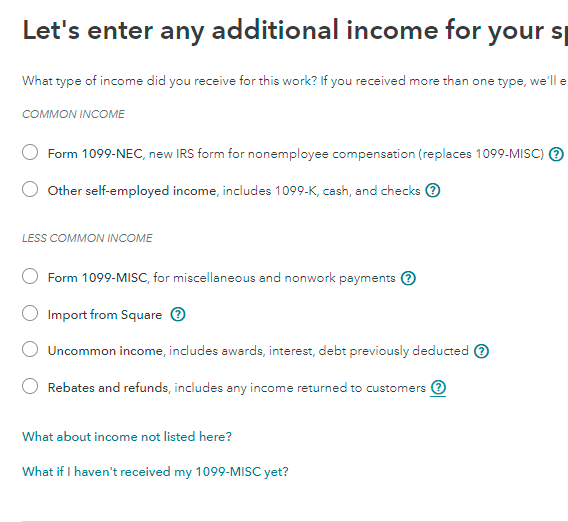

1. It's not personal goods selling, kind of business sales, but I didn't received 1099-k from eBay, how to report it? You can report it as cash on Schedule C.

2. What kind of TurboTax product should I choose? Self-employed or Small business? You have the choice of doing it online in Self-employed or on desktop with Home and Business. It is just personal preference. With H&B, you pay up front and can see your forms at any time.

3. My parents has filed me as their dependent, am I still able to report this loss? Yes, just make sure you indicate that you are a dependent in the Personal Info section.

We'll automatically complete Schedule C when you set up your self-employment work in TurboTax or when you enter what the IRS considers self-employment income, which is usually reported on Form 1099-NEC or 1099-MISC.

Schedule C is supported in TurboTax Self-Employed (both online and in the mobile app) and in all personal 1040 versions of the TurboTax CD/Download software.

To set up your business:

- Open or continue your return.

- Search for schedule c and click the Jump to link in the search results.

- Answer Yes to Did you have any self-employment income or expenses?

- If you've already entered self-employment work and need to enter more, select Add another line of work.

- Follow the onscreen instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay sales started last year, the revenue $2000, the cost $3000, Can I report this loss? no business registered,no any forms received.

I tried to fill up the schedule C, the questionnaires are quite complicated, since I didn't get the forms 1099-K,if those are hobby sales, I won't be able to report my loss, could I just ignore this income and expenses? because it will be a zero income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay sales started last year, the revenue $2000, the cost $3000, Can I report this loss? no business registered,no any forms received.

You can't just omit income because it is too difficult to figure out how to include it. Enter the income as cash on Schedule C.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

meltonyus

Level 1

michelleroett

New Member

swayzedavid22

New Member

jmeza52

New Member

Questioner23

Level 1