- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Ebay 1099-K and cancelled (refunded) transactions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

I sold several new items on ebay last year...a printer, laptop & vacuum. I was in between jobs and having cash flow issues. They were new in box (not used) which I had laying around and wasn't using. I plan to file it as Other, because I'm not a regular seller (Self-Employed), but these were new and not used "Personal" used items.

The other half of the story...the laptop & printer sale(s) were both cancelled & refunded by me, as both buyers used unverified / international drop shipping addresses which I did not feel comfortable shipping to. The only successful transaction was the vacuum, which was about $60 +$45 shipping. The laptop was about $400 & the printer about $200. I'm using TurboTax Deluxe. How do I report the 1099-K as "Other", and then enter negative adjustments for both of those items?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

If you choose Personal - it will make you complete the 1099-B section which requires Premier. If you choose Other, it requires using an entry in Other Reportable income which requires Deluxe. If you don't report it and keep the information with your tax records, you can use Free Edition. If there is no gain and it was personal items you can show in case you receive an inquiry, you don't have to report it. It is a tax form the IRS received so they could question you, but if you can show the money was for a vacuum you paid more for than received, you won't have any issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Instructions to enter your cost basis and proceeds in another section for your losses/gains (see instructions below).

We’ve collected your 1099-K information, but you’ll need to add more info about your sale in another section. For TurboTax Online:

- Select Continue on this screen.

- On the Your 1099-K Summary screen, select Done.

- From the Income Landing table, navigate to Investment topics, and select Start or Revisit for "Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

- Go to Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) on the Income & Expenses screen. Select Edit/Add.

- On Your Investments and Savings Summary screen, you’ll see a line item for your 1099-K income. Select Edit or Review and enter the information for the first personal sale item.

- Be sure to select Personal Items under the What type of investment did you sell?

- The Cost or other basis amount should be the amount you originally paid for the item.

- Select Continue when you’re finished to go to the Review your Sales screen.

- If there was more than one personal item sale included in the 1099-K amount, select Add another sale to add each item.

If you sold your personal item(s) for a loss, that loss cannot offset other income on your tax return like capital loss items (stocks).

If you sold your personal item(s) for a gain, then you’ll need to pay short- or long-term gains tax on it, depending on how long you held the item. This is why you should enter each item separately and not net them together.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Personal

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

even if they are new in box, they are still your personal items.

whether they are personal or not is irrelevant because ... ... you did not sell them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Right...but the third item (vacuum) was sold.

Would that also be a Personal Item, even if it is new in box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

They are all personal items, even if they are new - including the vacuum. The last option in the 1099-K section is 'Other'.

You only need to report personal items that you sold if they were sold for more than what you originally paid (gain). If you sold the item for a loss, don't report it and keep the information with your tax records.

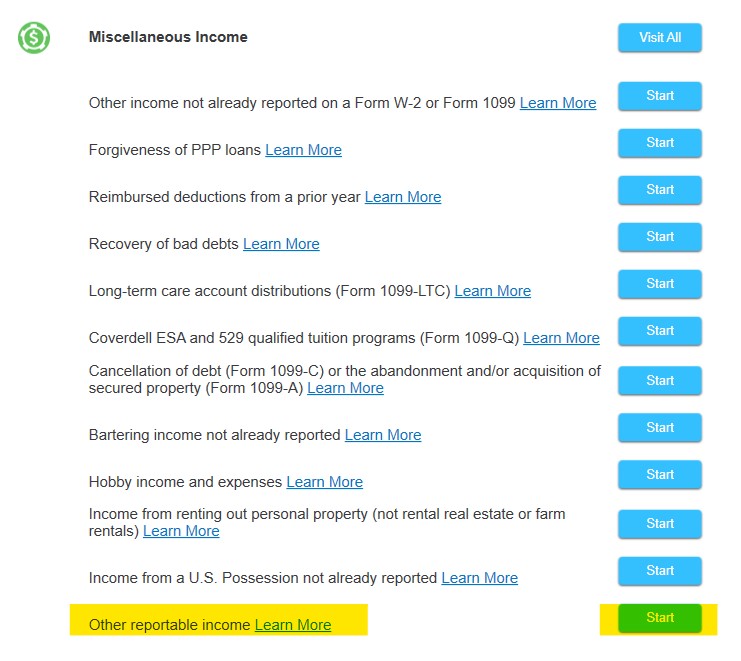

If you have a 1099-K, enter it as a 1099-K (search for 1099-K) and choose the last option, Other. You can enter the negating entry in Less Common Income - Other Reportable Income. See Question #3 in this Fact Sheet.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Thanks Dawn! Do I still have to attach the 1099-K to my taxes & file it as "Personal"? When I do this, TurboTax doesn't deduct anything from my Federal or State refunds. But if I choose "Other", they both go down.

If I choose "Personal", do I have to enter any additional information or declarations about these items? It also seems that TurboTax doesn't like the PDF I attached (from eBay), as there are issues with the State ID and the way it appears on the form. I think I will have to remove it & type it in myself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Even when I remove & type it in (as "Personal"), I still get this before I can finish Federal:

Hit "continue", next:

Then:

Then it says I am getting the full refund (so far) for Federal.

Sorry for being such a n00b, but am I basically done with this then?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

It is now saying I need to upgrade to TurboTax Premier, because I sold Stocks, Bonds or Mutual Funds. WTF?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Guys I'm sorry...I had the ebay 1099-K entered in twice: once as Personal, and another in the 1099-INT type section (which is probably why it was giving me so much trouble).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

If you choose Personal - it will make you complete the 1099-B section which requires Premier. If you choose Other, it requires using an entry in Other Reportable income which requires Deluxe. If you don't report it and keep the information with your tax records, you can use Free Edition. If there is no gain and it was personal items you can show in case you receive an inquiry, you don't have to report it. It is a tax form the IRS received so they could question you, but if you can show the money was for a vacuum you paid more for than received, you won't have any issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Since I received a 1099-K (and the IRS / state also received it), I was under the assumption I had to attach it to my tax return "just because". I'm in a $600 state, which is why I still received it this year.

Last time I received/filed a 1099-K, I did file it under 1040-C "self employed". I was selling alot of stuff on ebay back then. It was in my PayPal account and mixed together with a bunch of Ibotta grocery rebates. I ended up paying income tax on that too, because H&R said I had to. H&R was absolutely horrible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

I have it in there now as Personal, and it is not making me fill out 1099-B. The 1099-B thing was because I accidentally had entered it under the 1099-INT/Other section (under Wages & Income), not just the 1099-K section. In other words: it was in there twice. It was asking weird questions about the way it listed my state but stopped once deleted from "other". But it still made me enter the whole amount of the 1099-K into Box C on my 1040 during verification. This did not increase my taxes. Should I still delete the 1099-K/Personal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

You have to report all of your income, but a loss on a personal sale is not income to you. They certainly can question you later if it is not on your tax return, but if the proceeds are not taxable (and losses on personal items are not), you won't be penalized. See this article about online garage sales - which is what the sale of a vacuum cleaner sounds like. Now, if you sold the vacuum for more than was paid for it, you definitely have to report that gain. But if a loss, it is not taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

Not sure exactly what happened. Do you mean that you reported the 1099-K income in

- Box C, or

- Schedule C Profit or Loss From Business?

Please clarify.

Have you viewed the tax return to see where the 1099-K income has been reported?

You want to report the 1099-K income even if you later reverse the entry. Make sure that you retain any information about the items sold should you be required to demonstrate to the IRS that this is not taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

I haven't purchased TurboTax Deluze yet, so I can't see the return. I currently have my W2's and 1099-R's attached in "Wages & Income". I then hit "Add a 1099-K" and type in the info from eBay. Chose "Personal Item Sales" & typed in the 1099-K info from ebay. It then says, "Personal Item Sales We've added your personal item sales. You’ll need to enter additional information for your sale in another section.". I now have "Income from Form 1099-K" and the amount ($700+) with all my Wages & Income. My Federal / State refund(s) remain the same, as I selected Personal. Once I go through the Review, I get this:

The only field that "works" (i.e., not grayed out) is Schedule C. When I click it, it already has the gross amount from the 1099-k in the drop down list. So I put that in and hit "Continue". This is what I mean about putting it into Schedule C, but I can't see the return because I haven't purchased TurboTax Deluxe yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ebay 1099-K and cancelled (refunded) transactions

You may not have gone through all the necessary steps before starting a review of your entries. Exit out of the screen you are seeing and go back to your 1099-K entries. Then follow these steps.

- On the Your 1099-K Summary screen, select Done.

- From the Income Landing table, navigate to Investment topics, and select Start or Revisit for "Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

- Go to Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) on the Income & Expenses screen. Select Edit/Add.

- On Your Investments and Savings Summary screen, you’ll see a line item for your 1099-K income. Select Edit or Review and enter the information for the first personal sale item.

- Be sure to select Personal Items under the What type of investment did you sell?

- The Cost or other basis amount should be the amount you originally paid for the item.

- Select Continue when you’re finished to go to the Review your Sales screen.

- If there was more than one personal item sale included in the 1099-K amount, select Add another sale to add each item.

- If not, you can Continue.

If you sold your personal item(s) for a loss, that loss cannot offset other income on your tax return like capital loss items (stocks).

If you sold your personal item(s) for a gain, then you’ll need to pay short or long term capital gains tax on it, depending on how long you held the item. This is why you should enter each item separately and not net them together.

@c_man99

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aaron-m-soto1

New Member

haefnerjimmy34

New Member

Shadow104

New Member

sampaulson3218

New Member

bjdmak

New Member