- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic reb...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

The third stimulus payment is unrelated to the Recovery Rebate credit claimed on your 2020 income tax return.

Information on third stimulus payment

The Recovery Rebate credit is calculated on your 2020 income tax return and is dependent upon what was entered into the program.

If you were eligible for both stimulus payments but did not receive them, you would have been entitled to the credit.

If you noted that you did not receive the stimulus payments on your income tax return when you actually did receive them, the IRS will adjust your overall return and notify you of any corrections accordingly.

Correcting Recovery Rebate Credits on returns already filed

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

@JotikaT2 @So will I have to pay that back for 2021 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

It depends on what was reflected on your 2020 income tax return.

If you had a refund even after applying the credit, you may not owe anything. If however, your credit offset any tax liability, then potentially, yes, you will need to pay the tax due.

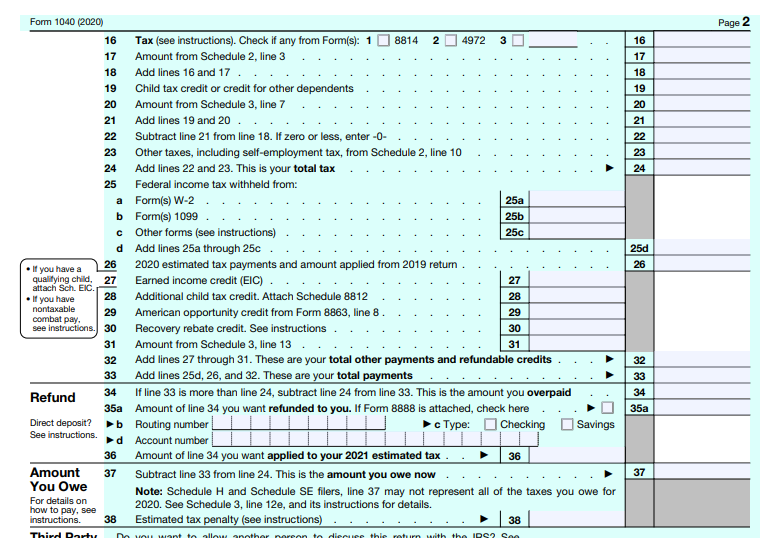

I recommend reviewing your tax return to figure this out. Look at line16 that would show your total tax, and line 30 for the amount of the Recovery Rebate Credit. Deduct the total from line 30 from line 33, total payments. The net amount left would be the actual payment on your 2020 income tax return that would be used to offset the tax liability listed on line 16.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

@JotikaT2 @Ok my line 16 is 0 & line30 is blank I did get 1&2 stimulus already in April & December 2020. But my line 33 has an amount . Now I’m confused & when I go to live tax help on turbo tax they can’t help me even though I paid extra for it . So does this mean they taking it back . Sorry to harass you but u seem like the only one with good answers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

Not a problem at all! Since line 30 is zero on your tax return, it doesn't appear that you have claimed the Recovery Rebate credit. The amount on Line 33 would be any additional credits or withholdings you were entitled to. It appears the IRS is determining your adjustment based upon something else aside from the Recovery Rebate Credit.

If you need additional support, as you have paid for the Live support, I recommend submitting a request for a written response within TurboTax itself. This will allow a tax expert to review your tax return as filed and give you more specific advice as to why your return is being adjusted.

Please see the following link for additional steps on how to do this. If you can include your correspondence from the IRS, this will also assist the expert to assist you as it applies to you specifically.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

Thank you @JotikaT2 😊

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

Thank you @JotikaT2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did anyone get they 3rd stimmy ? & when I called irs they said we had to pay the economic rebate credit back , have anyone heard that ? Ion want it if I have to pay back .

You are welcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hwilliams7

Employee Tax Expert

adou347441

New Member

lmosher

New Member

pechayda

Returning Member

Rufus T Axes

Returning Member