- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Deductions and Credits Screen - No Explanation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions and Credits Screen - No Explanation

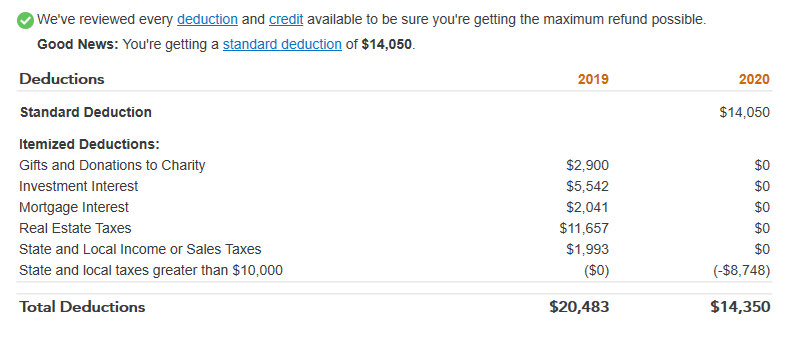

In going through my Deductions section, Turbotax is bragging about reviewing every deduction and credit available - and then shows the following:

How, where did Turbotax come up with the "-$8,748" figure.

And the $14,350 figure looks bigger than the Standard Deduction of $14,050.

Not particularly concerned because the Standard Deduction sounds right for me now (sold house, so no more interest and prop tax deductions) - but I would just like to understand what is going on here.

ron in shawnee

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions and Credits Screen - No Explanation

OK, guess what - the Deductions and Credits screen is correct today (and of course, I claim to have done nothing to fix it). In fact, I Exited and Reloaded Turbotax several times over the weekend, hoping the fictitious entry would go away. But now it is correct in that the totals add up, but it is INCORRECT in figuring the State and Local Tax - which is causing an EVEN MORE SERIOUS PROBLEM.

Turbotax is using my Quarterly payments plus the 2019 State Tax refund being carried forward to calculate my State Tax - and comes up with $14,733 for the State Taxes vs. the $6,000 it calculates on my State Return. This, with my property tax payment pushes me over the 14,000 Standard Deduction (even with the $10,000 limitation for SALT). So Turbotax is now saying it is going to file a Schedule A for me instead of letting me use the Standard Deduction of $14,000.

True, I get a bigger deduction, but it is not right. Depending on how the IRS handled this, I could envision an $8,000 deduction to the Schedule A total, which Turbotax is now claiming to be $16,000.

This isn't right, is it? Why is Turbotax doing this.

ropn in shawnee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions and Credits Screen - No Explanation

Another update. In tracing where Turbotax gets, calculates my State Income tax for the Deductions and Credits (for calculating Line 5 of the Schedule A), I find that Line 2 of the "State and Local Tax Deduction Worksheet" is asking for the "2020 state estimated taxes paid in 2020" - so the question of why the $14,733 calculated for the State Tax is explained.

But I still have the question of WHY is Turbotax using the "estimated taxes paid" to calculate State Tax (for SALT) - this still does not seem right to me.

So is this right or should I override and tell Turbotax to use the Standard Deduction - or does it all wash out in the large refund I would get, which I think would be income in 2021.

OK - STILL NEED HELP HERE.

ron in shawnee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions and Credits Screen - No Explanation

I seem to be carrying on a conversation with myself here. Don't know if the question is too dumb of too complicated.

BUT the more I look into the problem, I am getting a sense that Turbotax does really know what they are doing - although it really makes no sense to me. Now that Turbotax has fixed (don't know what was going on there) my Deductions and Credits screen (which was for informational purposes only) - and re-reading the "Taxes You Paid" section of Schedule A - which says:

"State and local income taxes or general sales taxes. You may include either . . . ., but not both. . . . ."

I note that it doesn't say "taxes you owe" and now I am thinking that it means "taxes you paid" (which is the Heading on this section of Schedule A). So now I am OK with seeing my Estimated Taxes paid here - even though it could be way high as in my case because I made an error in calculating my Capital Gains tax on some farmland that I sold.

That said, I now have another question - which is, Why income tax "OR" general sales tax. There is a big difference here - many thousands of dollars for state income tax vs. hundreds of dollars for general sales taxes - one boosting you into a Schedule A submission and the other not.

It would seem that if you can get a bigger deduction using a Schedule A deduction, that is the way to go - and it seems the Turbotax is thinking along the same line because it is choosing a Schedule A for me. HOWEVER, it also appears that my Charitable deductions can also flow to my 1040, but are limited to $300, which makes this an easy decision on which way to go, depending on the size of your charitable contributions. And of course, there is also that limit on Taxes You Paid of $10,000, which kind of turns out to be the big decision-maker on Schedule A or no Schedule A.

OK, this is hurting my brain. I think I will once again place most of my trust in Turbotax, which I have been doing for the last 15 or 20 years - and go with the philosophy of, if you can get a Schedule A bottom line that is greater than the $14,000 Standard Deductions, take it. This simplifies things a lot.

ron in shawnee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions and Credits Screen - No Explanation

It appears you have addressed most of your concerns, but in regards to the sales tax versus state income taxes, sometimes your sales taxes could be higher than your state income taxes. If that is the case, you could potentially take a deduction for the sales taxes instead of state income taxes.

TurboTax will recommend the deduction that provides the highest tax benefit in your particular situation if you are able to itemize.

Sales taxes versus state income taxes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions and Credits Screen - No Explanation

Jotika-

I have spend a bunch of time on this issue and YES, I did figure out that there is a possibility that sometimes, your sales tax will be higher than your state income tax - particularly if you don't pay any estimated taxes - so I guess it makes sense to have that option.

And yes, I understand that Turbotax will always choose the option that gives me the highest deduction - even though it still seems strange that Turbotax (and the IRS) uses your Estimated tax payments as part of the calculations that get you into the Schedule A. But as I said, I am now comfortable with the way6 everything is handled.

And nonetheless, I really appreciate your confirmation that everything is OK with the way I have worked it out.

ron in shawnee

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g-detzel

New Member

Vultano

New Member

Nancy-Farrar

New Member

skj

Level 3

Abyam

Level 1