- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: DDD thread

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

@austinrome ok.. Well im not sure if its a good thing, but I'm glad to know I'm not alone!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

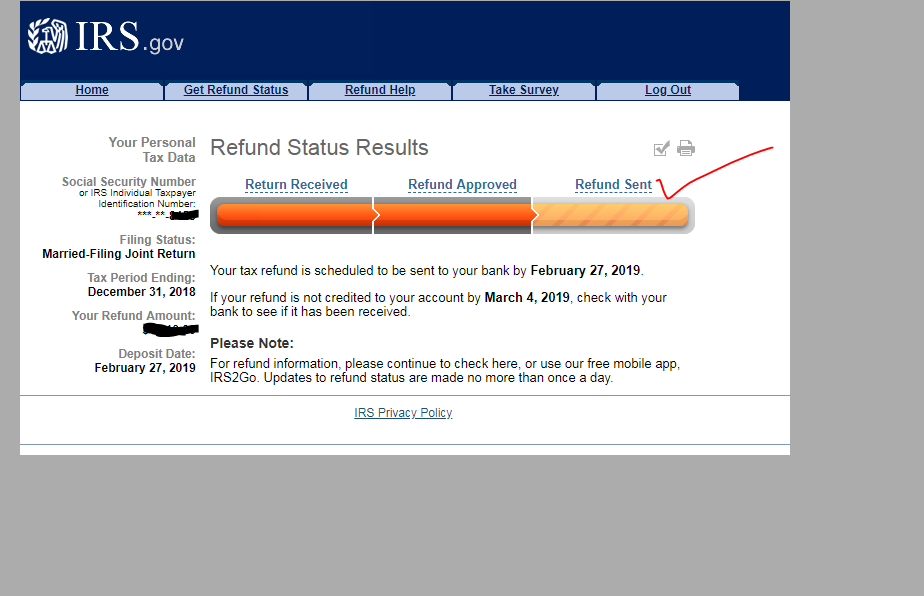

The IRS has only 3 steps ... you will remain in the received (accepted for processing) with or without the bar actually showing ... many will see messages instead which is the same thing. A lot will happen internally at the IRS until step 2 the refund is APPROVED for dispersal. Think of the processing as a pipeline with filters ... some returns will slide straight through quickly and some returns will be caught in one or more filters which will require more time to clear. Processing time may be only a day or as much as several weeks if they send a letter for more information. Once the return passes all the reviews the refund is cleared for payout.

It would be nice if the IRS had a more comprehensive tracking system but for now this is all the IRS has so patience will be needed as the IRS does it's job.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

I was accepted on 1/21- I know that is an early date and I did receive the PATH message but today it changed to

"We have received your tax return and it is being processed

Also on the sidebar, it says the expected refund amount....

Any clue on to when they will actually start DD funds into accounts?

My daughter has two big doctor appointments and I need the funds like now-LOL

If anyone knows I would appreciate info

I am reading so many different things it will make your head spin!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

Mine is doing the same thing no bars an says we are processing your refund but I have eitc an actc so I don't expect to see anything until later next week or the week after.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

Good morning all.. So I think the wmr new message is probably a standardize message for all path ppl.. I say this because they did state that wmr wouldn't update until a few days after Feb 15. So I just checked TT and the bar that was colored blue half way thru is now full.. That's a great sign and hopefully a DD will come shortly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

Hi All

Filed 1/15 Both Credits

Accepted 1/27

PATH UPDATED 2/1

PATH gone 2/16

I am currently on the being processed message, amount on left is there. If your WMR states "STILL BEING PROCESSED" you most likely will have to ID verify and will be receiving a letter in the mail. This is the exact same thing that happened to a lot of people last year. If you have "IS BEING PROCESSED" than you are good to go and just waiting on your 846 refund release code. Hope this help. All we can do is wait..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

Totally IGNORE the TT blue bar ... it is generic and will not reflect your personal return information ... get your information ONLY from the IRS ... https://www.irs.gov/refunds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

@BellaNJakesMom Seriously? I have "is still being processed." It changed to that and no bar this morning.

Why would I have to ID verify? Same address and everything as past two years. Same bank account.

Only change is last year I didnt claim my son. I claimed him the year prior, however. I appreciate the info. But I hope you're wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

That message is normal ... once the PATH message went away the return started processing ... check once a day for the update on the return's current status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

@BellaNJakesMom so mine says “we have received your tax return and it is being processed”... that means I’m ok and just waiting on DDD???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

So what is Mid- Fed considered for people who filed with credits?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

I have no idea... mid February is the 15th which mine updated and went from path message to we have received your tax return and it is being processed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

From the IRS directly :

How quickly will I get my refund?

We issue most refunds in less than 21 calendar days.

I’m counting on my refund for something important. Can I expect to receive it in 21 days?

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, it’s possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

It's been longer than 21 days since the IRS received my return and I haven’t gotten my refund. Why?

Some tax returns take longer to process than others for many reasons, including when a return:

- Includes errors

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q&A below.

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

We will contact you by mail when we need more information to process your return.

I claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) on my tax return. When can I expect my refund?

According to the Protecting Americans from Tax Hikes (PATH) Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Where’s My Refund for your personalized refund date.

Where’s My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC /ACTC filers will not see an update to their refund status for several days after Feb. 15.

Will calling you help me get my refund any faster?

No. Our phone and walk-in representatives can only research the status of your refund 21 days after you filed electronically; 6 weeks after you mailed your paper return; or if Where’s My Refund? directs you to contact us.

What information does Where’s My Refund? have?

It has information on the most recent tax year refund we have on file for you.

When can I start checking Where’s My Refund? for my refund’s status?

24 hours after we’ve received your electronically filed tax return or 4 weeks after you’ve mailed a paper tax return.

Will Where’s My Refund? show me when I’ll receive my refund?

Where’s My Refund? will give you a personalized date after we process your return and approve your refund.

Will ordering a transcript help me find out when I’ll get my refund?

A tax transcript will not help you find out when you’ll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

@MsLadee thank you for saying about the blue bar on TT. I just checked and mine is full as well and wmr days the same as yours

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DDD thread

Mine got accepted on 1/28 also. I do have a income credit. IRS did send me this ( we have received your tax return and it is being processed). Hoping mine will come soon.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Boodlesg

New Member

G8g

Level 1

Cumbie

Returning Member

RachelBaker414

New Member

user17717286405

New Member