- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

You must have an AMT carryover to claim the credit for AMT paid in a prior year. Please review your return from last year and your entries for this year. See Instructions for Form 6251 page 1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

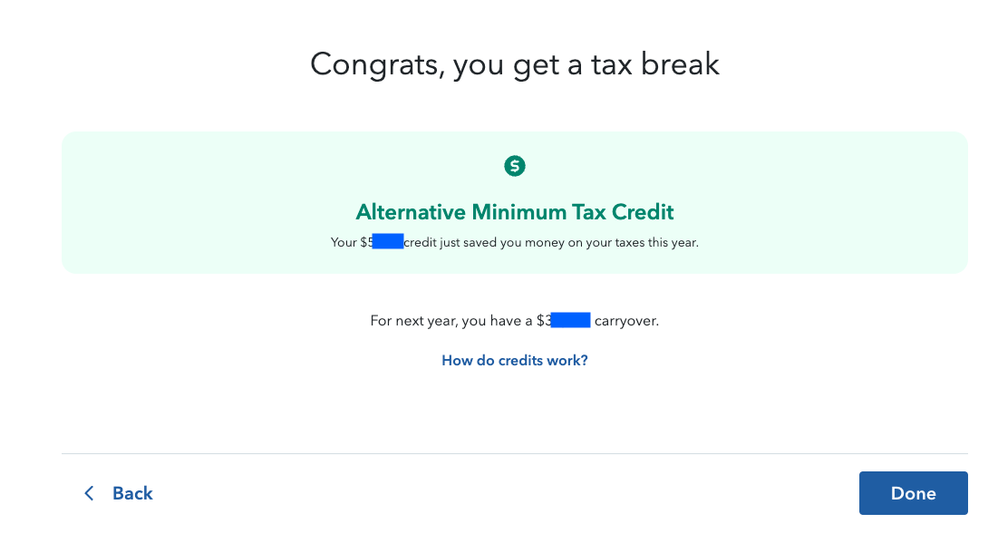

I'm having the same problem. I have carryover from last year. The review screen says "Congrats, you get a tax break!" I click "Done", and the previous screen continues to say "NEEDS REVIEW".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

I don't think this is an issue of having carryover. It appears to be a bug in the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

To look into this further and submit it to the appropriate team for possible correction, it would be beneficial to have a diagnostic copy of an actual user's tax return in order for the change to be considered. You can help by providing that diagnostic tax file.

The diagnostic file will not contain personally identifiable information, only numbers related to your tax forms. If you would like to provide us with the diagnostic file, follow the instructions below and post the token number along with which version of TurboTax you are using and what state you are filing in a follow-up thread.

Use these steps if you are using TurboTax Online:

- Sign in to your account and be sure you are in your tax return.

- Select Tax Tools in the menu to the left.

- Select Tools.

- Select Share my file with agent.

- A pop-up message will appear, select OK to send the sanitized diagnostic copy to us.

- Post the token number here.

If you are using a CD/downloaded version of TurboTax, use these steps:

- Select Online at the top of the screen.

- Select Send Tax File to Agent.

- Click OK.

- Post the token number here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

Same issue here. Is there a solution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

@AnnetteB6 , is this still being looked into? I am happy to share my diagnostic code: 1226735. This definitely seems to be a bug. I am using TurboTax Premier Online and experiencing the exact same "Needs Review". And it seems to be causing Part I of Form 8801 to be left entirely blank by TurboTax. I've tried deleting forms via Tools, but that doesn't work (it says successful, but the form is still there). Is it possible for this be escalated? I contacted support by phone and received essentially no help. Cannot e-file taxes as things currently stand, as I'm assuming it will be rejected if I leave all of Part I on Form 8801 blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

Using the desktop version will allow you to switch over to Forms mode and force open the form 8801. Most of the form accepts entries without an override so there is no issue with data accuracy or efiling. The top right has a toggle between the program and forms mode. The arrow back to the program is shown below along with where you open forms. Once you open the search box, type in 8801 and open the form.

If you have already paid for the online version, there is no charge to switch to the desktop product. See How do I switch from TurboTax Online to the TurboTax software?

Once you are in Forms mode, select Open Form, then type in 8801 and select US Form 1040, select open

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

@AmyC Thank you. However, I don't have TurboTax desktop. I paid for the online version. Am I understanding correctly that the only option is to now pay for the desktop version because of a bug in TurboTax online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

Here is an FAQ: How do I switch from TurboTax Online to TurboTax Desktop?

If you have already paid for the online version, please call TurboTax Customer service. Here is a link: Turbo Tax Customer Service

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

I am having this exact same issue. Is there a solution to this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit for AMT Paid in Prior Year says that it needs review. But after reviewing my deduction is not added, it just goes back to saying that it needs review. Why?

I was ultimately able to get past this message by switching to TurboTax Desktop.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jenekane28

New Member

jtrains3

New Member

mjperez0500

New Member

stephanie-furrier

New Member

cellsmore

New Member