- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Charitable Cash Contributions line 12b glitch?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

That's a good try but there are two problems with that.

(1) line 12b is associated with the standard deduction. I am taking the itemized deduction.

(2) line 12b is limited to the maximum of $600. My actual cash contribution exceeds $600. It is over $2300.

There is bug or glitch in TT but they are sleeping on this one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

correct. BTW the update to TT fixes all the 12b problems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

Ronaldcox3883 (level 3).

My Turbo Tax program has all the updates. Are you indicating there is a forthcoming update?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

My Turbo Tax is up to date as of 3/17/2022 at 10:28 pm as shown in the attached picture below. The problem was not fixed!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

Interesting. I filed my taxes on 3/3, 12b was correct, and we received the (small) refund on 3/11 and the state refund today. I haven't looked for any updates since then. Did you do the manual override?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

What is the manual overide? I have done the following:

(a) deleted my tax file and created a new file and entered all data. - this did not work.

(b) deleted all chartitable contributions and re-entered all the data. - this did not work

(c) made corrections to 1040 sr wks by deleting the $600 - this temporarily works but the error appears later.

(d) the only time I do not get an error is when I take the standard deduction. But I do not want the standard deduction.

So, tell what is the manual overide?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

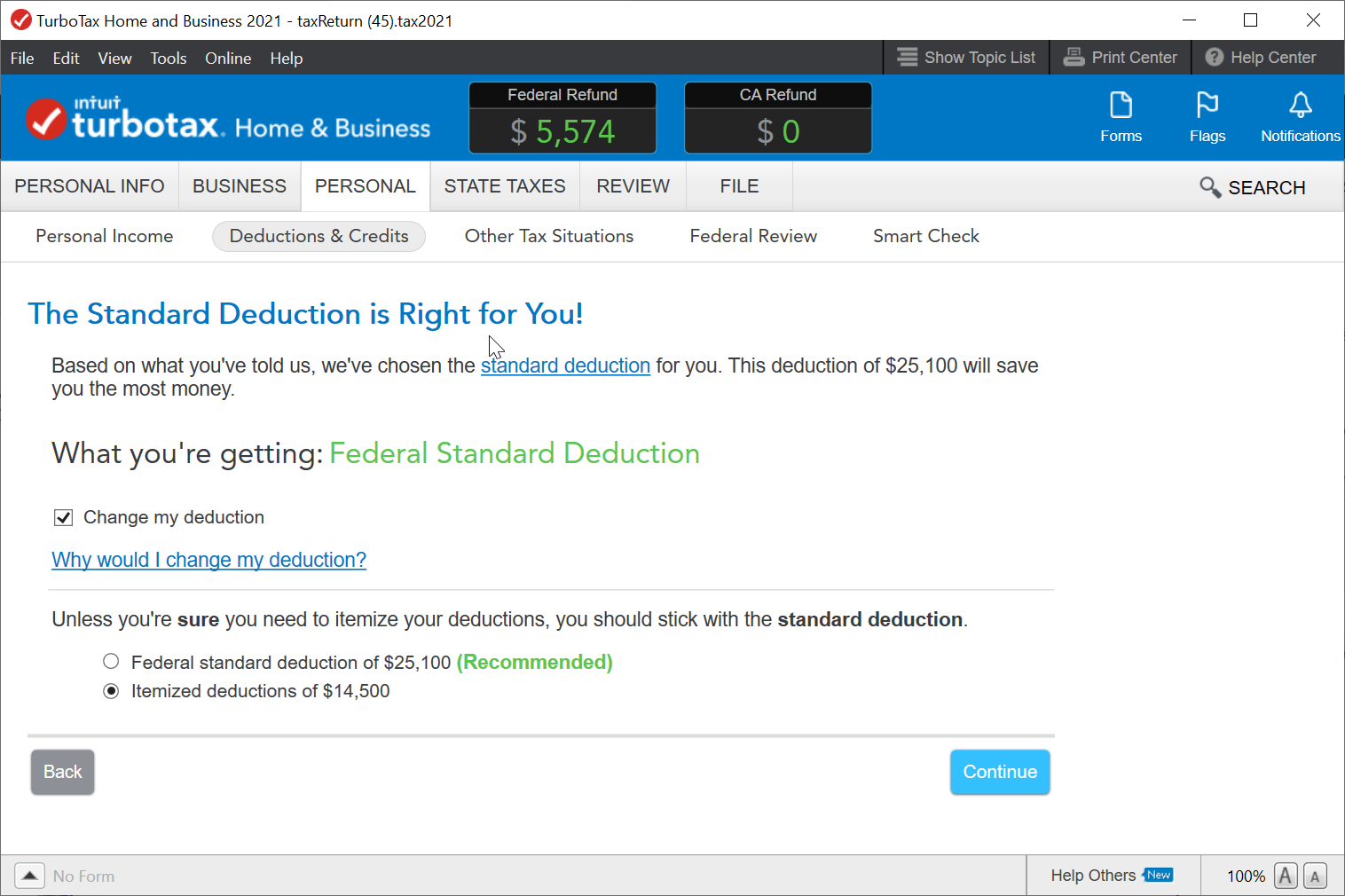

You may have an entry posted at the second area of entry. If so, you may have to temporarily reduce one or more itemized deduction entries to invoke the screen The Standard Deduction is right for you.

In TurboTax Desktop version, follow these steps to enter the Federal 1040 line 12b Charitable Cash Contributions under CARES Act.

- Go to Forms mode and delete the incorrect entry for line 12b on the 1040 Worksheet.

- Return to Step-by-Step and click on Federal Taxes / Deductions & Credits / I'll Choose what I work on but do not enter the charitable donation.

- Scroll to the bottom of the page and click on Done with Deductions.

- You will see the screen The Standard Deduction is right for you! Click Continue.

- At the screen titled Get a tax break for donating cash to charity, enter $0. Click Continue.

- At Other Tax Situations, scroll to the bottom of the page and click on Done with Other.

- Continue through Federal Review and Smart Check.

Go to Forms to view the Federal 1040 line 12b for the charitable deduction.

Under Deductions & Credits, re-instate the deductions that had been temporarily changed and re-qualify for itemized deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

That does not work. There is a just darn glitch in this product.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

I am using Turbo Tax Premier. I’ve been purchasing Turbo Tax (TT) at a store every year since 2005. That is 17 years. I am taking the itemized deduction even though the standard deduction is at a slightly higher amount. I am doing this because my combined federal and state taxes are lower. My state accepts the itemized deductions from schedule A and it lowers my state taxes and effectively both taxes. So I am itemizing for both the federal and state. The TT program would identify an error on the 1040 SR wks line 12b, I would correct the error by deleting the $600 and TT would indicate that the error has been corrected. However, TT would re-populate the $600 in two occasions.

- When I recheck my state return (the line 12b problem occurs and I would have to fix it again, TT temporarily fixes the problem) and

- When I am wrapping everything up all federal and state taxes, this is what the following screen shows

- Done with states, ---- this is ok

- Let’s make sure things are correct ----this is ok

- Give us a minute to look things over ---- this is ok

- Tax Summary for 2021 (at this point it has already re-populate the $600 – because my federal taxes are lowered by $200) ---- the error returns

- Let’s check these entries (this is the error screen showing the S600 on 1040 SR wks on line 12b) --- the same darn error occurs

In other words, Turbo Tax program keeps adding the $600 on the 1040 SR wks line 12b.

My Turbo Tax is up to date as of March 20, 2022 at 3:45pm.

Turbo Tax customer service folks are nice people but they mostly take notes, run through basic computer checks, sends you surveys and then closes the ticket.

Reporting this issue to someone responsible for software issues at Turbo Tax is impossible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

Try this suggestion:

- Make sure that you are itemizing deductions instead of taking the standard deduction.

- Go to federal>deductions and credits.

- Continue through the screens, until you reach a screen that says the standard/itemize deductions are right for you.

- If this screen says the standard deduction is right for you, check the box that says change my deduction. This will change to itemize. Then a popup will appear showing you the difference between the Standard deduction amount and the itemized amount.

- The very next screen will allow you to erase the $600 amount. Here is what the deduction page looks like that I described above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

thgis didn't work. I still can't change my cash contributions under the cares act. please help

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stefaniestiegel

New Member

organdan

Level 1

pv

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

IY

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

CTinHI

Level 1